Ways To Reduce Credit Card Annual Fee?

Ways To Reduce Credit Card Annual Fee?

Award travel has become a part of my lifestyle, but sometimes along with that comes credit card annual fee(s). How do I pay for them? If you have 1 credit card you use, this might not be much of a problem. However, if you look to maximize award travel, there’s a chance you have 5 or more credit cards with annual fees. The annual fees can be as low as $75 or as high as $550 for each credit card. The cost can add up quickly. You may be forced to decide is a cards benefits worth keeping and paying the fee or close it. Sometimes, you may also have an option to do a product change to a no annual fee card. So, if you don’t close it, are there ways to reduce credit card annual fee?

Banking Promotional Offers

Yes, I’ve used 2 ways to pay credit card annual fees. First and foremost, opening checking and/or savings accounts that has a promo bonus. Doctor of Credit is a good resource that aggregates a list each month of “Best Bank Account” offers. That makes it easy to scan the list and see which ones I can do. I view the offers and terms and signup if the bonus is worthwhile.

Depending on the offer and terms, I might sign up for a few of them and a couple can also do the same independently. This also is easier for those who’s job offers direct deposit. It’s quite flexible to change from month to month at my employer. I can do myself with up to 3 different banks. This isn’t ideal to do with a lot of different banks at one time. I prefer not to have my money dispersed to many places at once.

Annual Fee Waived The First Year

Initially, some credit cards might waive the annual fee the first year. In the 2nd year, you might be faced with to pay the fee or not pay the fee dilemma. However, why not take advantage, if a bonus received from one of these banking offers enables you to keep a card open for another year. Especially if the credit card comes with fire ass benefits. Take for example the Chase Sapphire Preferred, its annual fee is waived the first year and $95 per/yr thereafter. It has the following benefits:

- 50K Ultimate Rewards(UR) points after 4K spend in 3 months + an additional 5K UR points for adding an authorized user. That 50K is worth $600 or more in travel depending on the redemption

- 2x points per dollar spent on travel and dining

- No foreign transactions fees

- 1:1 point transfer to partner airline and hotel loyalty programs

- Primary auto rental collusion damage

- Trip cancellation/Trip Interruption Insurance

- Points worth 25% more if redeemed on Chase Ultimate Rewards

- Points don’t expire as long as the card remains open. They can also be transferred to no fee card that earns UR points. However, points then cannot be transferred to loyalty programs

If you travel frequently, Chase Sapphire Preferred could be a good card to keep long term. So, a $95 fee shouldn’t be a deterrent possibly after only a year. For example, signing up for a checking account with a $300 bonus from Chase could prolong it’s life.

Example Bank Offers

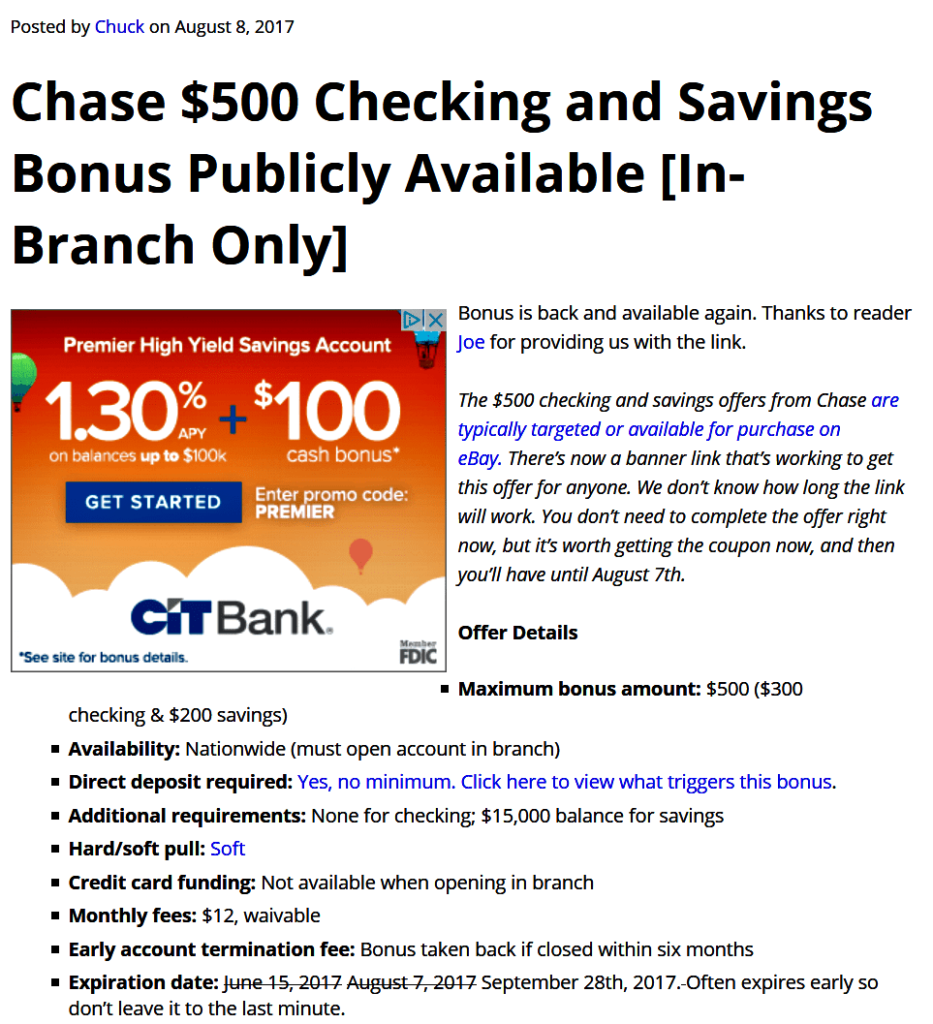

If you haven’t checked out the Doctor of Credit, as of writing this, below is an example of one current offer from Chase. You can determine if you qualify and can meet the terms for the reward. This reward could reduce the credit card annual fee out of your own pocket.

Sometimes an offer requires a bit more cash, if you have some lying around, why not use it to this end. You don’t have to stay with any of these banks long term and can often close the account(s) in as little as 6 months. Be sure to thoroughly read all the terms prior to signing up.

These little tips and tricks help to alleviate or remove the cost burden of credit card annual fees being used for award travel.

Personally, I have used the following banking promo offers so far:

- HSBC Checking Account Promo – $350

- Chase Checking Account Promo – $500

- Chase Checking Account Promo – $300

- Capital One Money Market Account Promo – $200

- Discover Savings Promo – $100

- BMO Harris Checking Account Promo – $200

- Citi Checking Account Promo – $300

Note: Treated as Interest Income and reported by bank on Form 1099-INT

This tallies to $1,950 in banking bonuses I have used to reduce credit card annual fee.

Cashback Credit Cards

Finally, the other potential way to reduce credit card annual fee is to apply for and use cashback credit card which have no annual fee. Either points can be converted to cashback or it’s simply cashback on all purchases. You can strategically spend on these card with target of spending enough to gain cashback to offset the annual fees on other credit cards.

There are several good cards listed here that are good for this purpose in order of best to worse.

When you can get 2% cashback on purchases that can add up pretty quickly to an $95 annual fee. Well worth helping to keep a valuable card like the Chase Sapphire Preferred. I often wind up with one of the cards above after I’ve downgraded from a premium card which I didn’t want to keep because of the annual fee. Chances are I initially signed up for the card for a huge signup bonus offer. I then downgrade to avoid paying the annual fee. Sometimes, downgrading also allows for me to keep points alive until I have better alternative.

2% Over Some Loyalty Program Points

When there isn’t a big credit card sign-up bonus to be had, a 2% cash back card beats the slow process of building up a point stash in some loyalty programs. This is particularly the case if you have a loyalty program with non-transferable points. For example, Hilton Honors, the points are not even worth ¢0.01, so the 2%, 1.5%, or 1% cashback are all better options.

Transferable currencies like Chase Ultimate Rewards, American Express Membership Rewards, Citi Thank You, and Starwood Preferred Guest Starpoint can be converted to cashback, but often with lower potential redemption rates that could be had otherwise. This is particularly the case, when you have the premium cards associated to each of these transferable currencies like:

- Chase Sapphire Preferred

- American Express Premier Gold

- Citi Prestige

- American Express SPG

It definitely is a trade-off if you use cashback cards over bank accounts bonus because the money spent getting cashback to pay annual fees could be diverted towards points reward accumulation for award travel.

In Closing

Everything in life isn’t always perfect, so you have to pick your spots when it makes sense to use a bank offer bonus over cashback credit card. In either case, the effective use of both ways can help you to reduce credit card annual fee. You then will not be pressured to close a credit card needlessly. This will allow you to keep credit cards essential to your maximizing award travel.

What's In My Wallet? - The World Of Os

September 19, 2017 @ 6:15 am

[…] want cashback. I might as well get the 2% cashback on these items/purchases. In my blog post, “2 Ways To Reduce Credit Card Annual Fee”, I speak about uses of cashback card. Of all the card providers with transferable currencies, […]

AAdvantage Aviator Red Limited Time Credit Card Offer - The World Of Os

September 23, 2017 @ 6:16 am

[…] 177,628 miles and my wife’s to 60,000. If the $95 annual fee is of concern, my blog post, “2 Ways To Reduce Credit Card Annual Fee”, gives some suggestion how to get around […]