A Retail Investor’s Playbook for the Stock Market

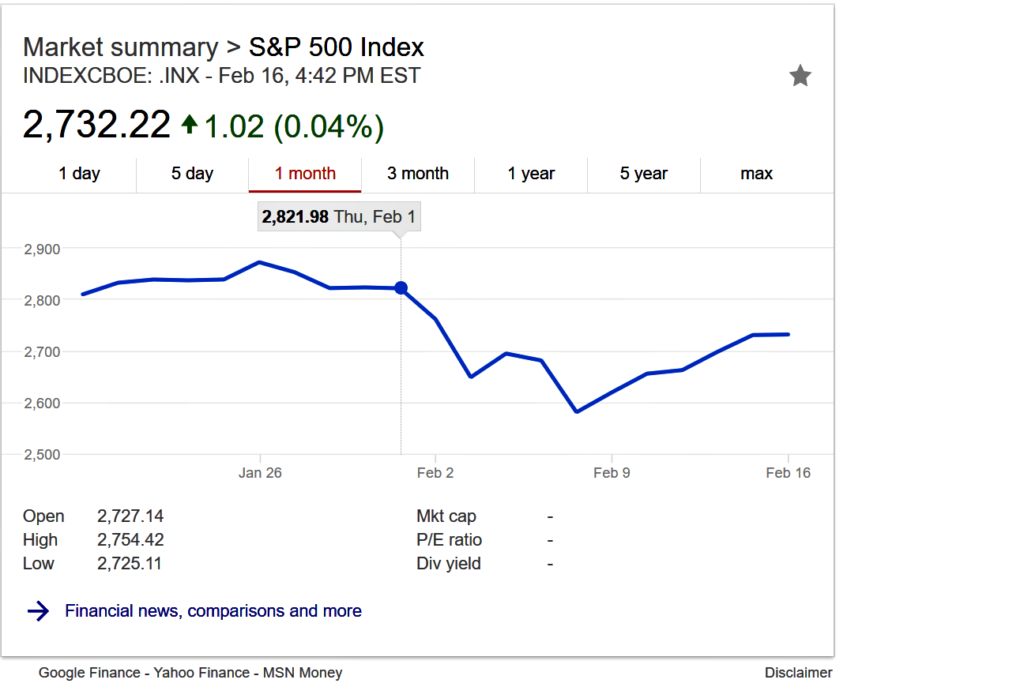

Its been approximately 2 weeks since the more than 10% correction in the US stock market. Volatility spiked from around $11 on the VIX to $30 after being essentially flat below $16 the whole of 2017. The S&P 500 and Dow Jones sold off rather unexpectedly despite recent tax cuts and solid earnings being reported by companies. Supposedly, the reasons for the sell-off was the quick rise in the 10-year yield to 2.80%, wage growth, inflation concerns, and leveraged bets against the VIX imploded. Thus, some panic selling took place.  This event woke people again to the reality that the stock market doesn’t go up in perpetuity without volatility. Since the stock market hasn’t really sold off since the 2009 Financial Crisis, perhaps complacency set in. On Feb 1st 2018, the S&P 500 was at 2821, if you sold because you thought, “I’m going lose all my money”, what you really did was lock in the loss for very brief downturn. As of Feb 16th 2018, the S&P 500 is back to 2732.

This event woke people again to the reality that the stock market doesn’t go up in perpetuity without volatility. Since the stock market hasn’t really sold off since the 2009 Financial Crisis, perhaps complacency set in. On Feb 1st 2018, the S&P 500 was at 2821, if you sold because you thought, “I’m going lose all my money”, what you really did was lock in the loss for very brief downturn. As of Feb 16th 2018, the S&P 500 is back to 2732.

Who’s A Retail Investor?

I wasn’t selling! I think I’m what Wall Street would classify as a retail investor because I manage the money I’ve invested in the stock market myself. Due to the recent pickup in volatility, I thought that I would discuss my retail investor’s playbook for the stock market.

Although I’m a retail investor, it doesn’t mean I’m el’ Dumbo when compared to professional money managers. I’ve gotten my education from some of the best to do it. Benjamin Graham, Warren Buffet, Peter Lynch, David Swensen, William J. O’Neil, and John (Jack) Bogle to name a few. I’ve learned to invest in stock market by studying their philosophies on the subject. I then went slowly, putting my money to work with the philosophy I assimilated from them. Through time and experience you kind of develop you’re own style but mine’s has its roots in these successful investors philosophies as its bedrock. Today, I see myself as a bit of a blend, value and growth investor.

Judge My Performance

You may question how well I’ve done doing it myself? I’d have to say pretty well. I measure my performance by S&P 500 much like professional money managers. As retail investor, I don’t have to overcome the fees money managers charge to outperform the index. Thus, I keep more of my money for investing. Mr. Bogle taught me the value of that.

- 401K performance

- Motif performance (see below charts for Os Own What Your Love and Os ETF 87/13 Allocation)

- FolioFirst performance

My Playbook for the Stock Market

Play#1

First, you have to find out what is your real temperament towards the stock market when your money is a risk in it. When you read the books of aforementioned investors, especially as it pertains to psychology, for what you should do, how close in reality is your temperament or actions to that? Reading it in a book is one thing, but doing it in practice is a whole nother thing.

You need the stock market to test your resolve, more so, during volatility to flesh out if you are the type of investor you think you are!

Play#2

Second, you have to invest for the long term with that implying a horizon of 5 years or more. My first play will let you know if you are truly equipped for that. There is nothing wrong with you if you’re not, but you will at least know that and know maybe you shouldn’t be investing in the stock market.

Play#3

Third, invest early and often. I really started seriously investing in the stock market in my late twenties, early thirties. I’m 40 now. If I would have known what I know now and been doing what I’m doing now, I’d have been a millionaire or close to it already! Investing in the stock market was just not common conversation or behavior for people in my circle. Observe if that is the case in your circle of friends and family. Now, I just try to consistently invest every available dollar no matter how small. On TheWorldOfOs.com, I encourage my readers to do likewise.

Play#4

Fourth, I’m a middle class person and I didn’t and don’t have large lump sums of money to put into the stock market. So, I often dollar cost average into the stock market. I bring a different level to this because I do it in fractional shares. You never know when the stock market will surge, but whatever you have invested, you want to be a part of it. Also, if there is a pullback, you want to be a part of it because you can buy more at a low point. I use trading platforms like Motif Investing, FolioFirst, Acorns, and Stash to build small positions which grow and compound over time. I liked that they were low cost for commissions or fees.

Play#5

Fifth, broad based trades in ETF and Index Funds which track some major performance benchmark indexes. That way you are broadly diversified across a broad range of stocks and minimize single stock risk. I think it’s more typical for the retail investor to fear losing their money, but what is the probability of say an investment in the S&P 500 Index going to zero? I’ll tell you the answer is low to nil, unless these idiots in Washington start a nuclear war! Then, we all might not be here and that won’t matter.

Play#6

Sixth, a well balanced allocation across asset classes. For me that is characterized as foreign and domestic ETFs, stocks, bonds, real estate, precious metals, and commodities. David Swensen portfolio can serve as a model, but as I mentioned developing your own style, I’ve add a few more than he has in precious metals and commodities.

There are other models in fact, I’ve created some of my own available to the public for selection under Motif Investing. They are listed below and you can start by clicking the INVEST button:

Finally, any investing starts with savings, so I use the philosophy from another book found on my financial journey named, “The Richest Man In Babylon”. I pay myself no less than 10% first. You can of course do more, but it’s a good baseline and reminder that while you should invest, you should live a enriched life as well.

In Closing

This is the playbook for the stock market that has helped me ride out weeks like what has recently happened. Also, the performance I’ve had over that time while following my playbook has encouraged me not to turn these duties over to a professional money manager which would mean a reduction of my overall return. Can you be a good retail investor too?

March 4, 2018 @ 10:07 pm

Very energetic article, I enjoyed that bit. Will there be a

part 2? http://www.erioshop.com/UserProfile/tabid/64/UserID/43593/language/de-DE/Default.aspx

March 10, 2018 @ 9:26 pm

A part 2, I’m not sure. However, I can assure you there will be more in future post on similar topics. Please be sure to subscribe for future post.

March 12, 2018 @ 10:58 pm

Hi, yes this article is actually pleasant and I have learned lot of things from it about blogging.

thanks. https://remote.com/griffin-jim

March 13, 2018 @ 7:54 am

You are welcome. I’m glad you found it pleasant. Please be sure to subscribe to my blog and you’ll get the latest post directly to your email.