Motif Investing The Os Way

Motif Investing trading platform allows you the ability to construct a motif of up to 30 securities at one cost. You can then buy that motif for a trade commission of $9.95. There are 2 motif’s I would like you to consider for your investment:

I customized these motif’s with individual stocks or Exchange Trading Funds (ETF) designed to be long term investments. I explained in a previous post, “Motif Investing”, just what it is and why I use it. You can click the link at the right for more information. I am simply suggesting that if your are looking to start investing or are already experienced investor, do consider investing in these 2 motifs. I’ll make further case of to why later in the post.

Sound Financial Advice

First and foremost, good sound financial advice would say to ask when considering securities to buy to consider the performance compared to the S&P 500 benchmark. How close are they either aligned and/or beating the benchmark? What are the fees and cost associated? Can they be purchased in retirement vehicles offered like an IRA (Roth or Traditional). What is your risk tolerance and investment horizon?

There are wide swath of people who want to learn simply what’s a good allocation of securities they can invest in without having too much knowledge and do well by their money. I provide a simple solution for that here. I will provide proof that I am not merely suggesting these to you. The investments I made below lately demonstrate, I eat my own cooking.

![]()

![]()

![]()

I have started focusing more on allocating money here to max out the Roth IRA amount of $5500 before moving into taxable accounts.

401K First

Before considering investing here, if you have a 401K with employer match, invest up to the match first in your 401K before considering other places like this to invest. Get the match because that betters your chances to get double the return on your contributions if the market does well and/or cushions the impact if it doesn’t. Perhaps the money in your 401K is manged by financial advisor, but this money you want to invest without their guidance in a reasonable allocation.

Personally, I don’t have a financial advisor that I depend on for my investment decisions in my 401K nor outside investments. I have done OK. Nonetheless, I preach a lot of what they teach and the path I follow myself is to get the match of my employer. I then aim to max out a Roth IRA for my wife and I, if additional money, I personally would chose to invest in a taxable account instead of a 401K. This is due largely to the inflexibility of a lot of 401K plans and lack of control. Take for instance, in brokerage accounts outside 401K, you can set up a stop loss.

Mutual Fund vs Motif

So, why these two motif’s over some other investment like a mutual fund for example? The upfront money you have can make a difference in this decision. A trade on Motif Investing you can do for $9.95 with as little as $250. Some mutual funds require as much as $500 – $3000 for an initial minimum investment. In addition, the expense ratio to manage the fund can be considerably higher than the $9.95 commission paid to purchase the entirety of these motifs. You are paying for the expertise of the fund(s) managers. When you buy my motif, I get a royalty from Motif for the purchase of my motifs. This helps to support this blog.

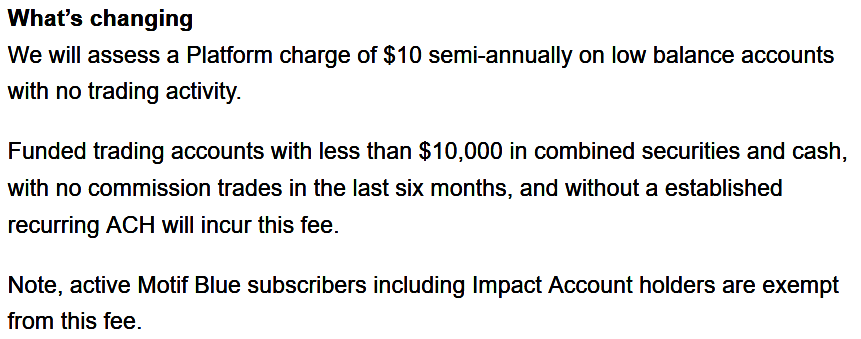

Depending on your trading frequency you should consider if this is right platform for you as well. Motif charges a fee of $10 semi-annually if you make no trades during that time. So consider for yourself if you believe you will make fairly frequent trades. Currently, I have setup automatic monthly transfers of $270.

Os Own What Your Love

Initially, at it’s core, this smaller set of 10 stocks I originally owned on Loyal3 grew to an additional 20 stocks I also really felt strongly would outperform over time. They are a collection of individual stocks in select companies. I have written about on my blog, “Loyal3 10 Stock Plan” and “Loyal3 10 Stock Plan Addendum” to show the performance charts of 10 of those stocks over a 10 year period. The portfolio of stocks contains a combination of growth, value, and blend with 14 of the 30 providing a dividend yield greater than 1.5% (this is subject to change over time). In addition the cumulative valuation is quite reasonable. In consideration what I mentioned earlier about evaluating against a benchmark, since it’s inception it has been outperforming the S&P 500. This may or may not always be the case, but it is definitely worth considering as investment if going forward it continues this out-performance of the benchmark.

Os ETF 87/13 Allocation

This allocation is classic scholarly well diversified portfolio in Exchange Traded Funds (ETF) across several asset classes. This is fundamentally a solid mix of asset classes. The percentage is my judgement of the mix of equities to bonds I was comfortable risk wise taking. You might buy this and re-balance to more bonds as you see fit over time and it’s totally in your power to do so on this platform. This portfolio reaches across the world, and for long term investment, it’s for any category of investor. Also it spans to be useful in any market time-frame. The chart for the motif is also showing out-performance since it’s inception; however, the same implies that this isn’t a guarantee of future performance. It’s valuation as determined by Motif is currently higher than former motif.

This valuation may fluctuate over time, but personally I assess the value when I buy either one or both of these motifs. No matter what you buy you make your money on the buy, not the sell. Therefore, if one is cheaper than the other, I allocate my initial dollars to it. If it switches or evens, I’ll interchange buying between both in order to balance out approaches. This is my approach and yours may be different.

Strong Case For The Motif

So, here are two fantastic investments provided on great platform for those smaller incremental investments that can be made. You have the potential to grow your money if they continue in this fashion greater than the benchmark returns. Also you do so at a pretty cheap cost if you factor in not having to pay financial management fees out of your returns.

The horizon and the consistency of investment also makes a difference, so start and stick too it. If you don’t like these 2 options, check out others motif themes on the Motif Investing platform. Remember you can also customize and create your own if you are really adventurous. But remember to stick to reasonably diversified allocation that outperform or match the S&P 500 benchmark. If not, you should be investing in ETF or index fund that indexes to the S&P 500.

Motif Investing Tips

If there is considerable divergence from the S&P 500 benchmark, it could either be a buying opportunity or a chance to stop to evaluate shifting funds to an investment that better tracks to that benchmark. However, the Os ETF 87/13 Allocation is likely to be stellar and closely akin to benchmark during all market outlooks. It may lag a little. I would personally consider investments in it to be ideal. Exercise patience during investing because markets can be fickle. In addition, remember these investments are dollar cost averaging into positions anyway. We may catch high and lows in this process, but it averages out over time. Consistent investment and a long time horizon is what I encourage more than attention to short term market moves. These stocks and ETF are themes I think will do well in the next 5 – 10 years. If you are convinced of this as well, use the links below to signup and start investing.

In Closing

Start investing if you haven’t already whether you choose to invest in these 2 motifs I created or not. This is simple easy way to do so on Motif Investing platform and commissions are low. Hopefully what I have shared gives you food for thought as you continue or start your investment career.

Disclaimer: Financial investments using this and other financial services are subject to risk in that you could lose your entire investment due to the nature of investment exposure to the stock market.