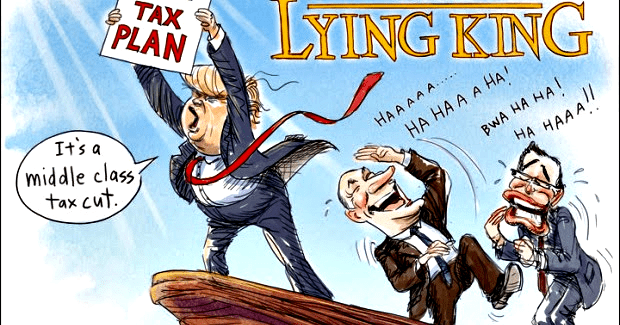

Are Tax Cuts Going to Benefit You?

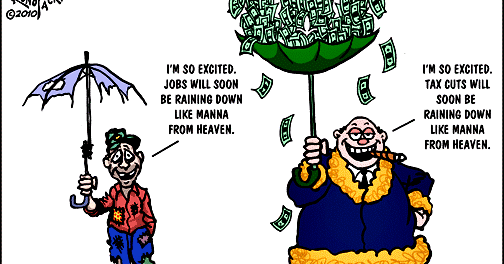

Recently, our US Congress and President passed and signed into law a tax reform bill that cuts taxes for corporations and individuals. The latter tax cuts will sunset after 10 years all while the former is permanent. The Washington Post reports 45 as saying, “This bill means more take-home pay,” Trump told reporters earlier. “It will be an incredible Christmas gift for hard-working Americans.” So, are the tax cuts going to benefit us, I mean really really benefit us hard working Americans? I would like to add some measure to see. Supposedly, do you sense my skepticism, corporations will have more money to raise wages for its workers. In addition, you will see more take home pay due to the tax cuts. I have a simple suggestion below for you to gauge whether this is just political speak or is it a real benefit to you/us(the not so rich)?

Half Truth?

I’m not trying to be political necessarily, because both of these parties are full of sh!# when it comes to acting in the best interest of all American people. I personally have no doubt that the assertion is true that you will see more money in your paycheck; however, in my opinion, it’s a half truth. It is what they are not saying that concerns me. They hope to keep the American public in the dark about that. It is this that I want to bring attention to and ask each reader to be sure to take stock of your current financial situation. Then judge whether this tax cut really benefits you. Is the tax cut going to go to increase your discretionary income over the next 10 years?

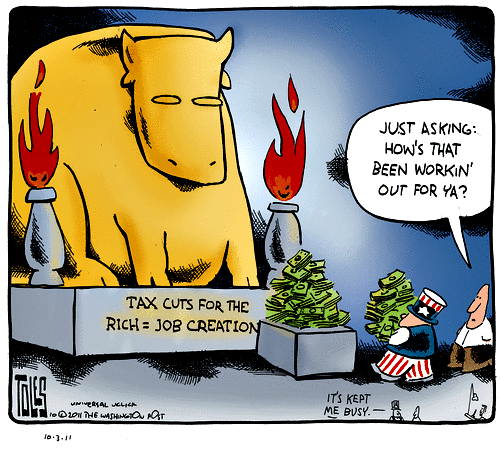

If the answer to that question is no, then it just is a band-aid for hard working families falling further behind or into poverty and over the next 10 years the GOP plans to slowly yank it off. The Washington Post reports, “In the bill’s later years, however, many of the individual tax cuts are set to expire, leaving a broad swath of Americans paying more than they do right now. Republicans promise that a future Congress will intervene to prevent that tax hike from happening, while Democrats have questioned why the GOP procured a permanent cut for corporations while subjecting the middle class to years of uncertainty.”

Direction of Discretionary Income ↑ or ↓ or Unchanged

If you have more discretionary income, it can be used for investment, savings, and leisure or it can help in paying down excess debt(s). On the other hand, if you wind up just paying more for good and services you used to have access to from the government that will be cut as result of these tax cuts, then its an illusion for some of us, but not for our already wealthy countrymen. They (the rich) don’t really need this tax cut and they will be just fine.

They (the rich) don’t really need this tax cut and they will be just fine.

How to Measure Your Benefit

I have and use a budget for my household using Mint.com, but you can do something so simple as to take down your current income and expenses. Sum your income and expenses and then subtract your income from expenses (Total Income – Total Expenses = +/- Discretionary Income). This is your baseline number and a measurement you can use to compare if you benefited. During the year and at the end of the year, do the same exercise and if the number improves (either more positive or less negative) and tends to stay constant or trend up over the coming years then I would say it was a real benefit to you/us(the not so rich) just like the politicians said. Otherwise, it was nothing more than a half truth meant, in my opinion, to placate a vast majority of voters while the real intended beneficiaries capitalize.

In Closing

You can used aforementioned to measure and see if you benefit from tax cuts like our political leadership says you will. I tend to think what will happen is insurance costs will go up (for both health and home), housing, childcare, interest rates, food, and internet to name a few. Those cost will eat up any supposed benefit and leave us no better off than before. However, our good ol’ politicians will continue to say, “look at the those extra dollars we helped put in your pocket”. Not false, but definitely not all true!

I’ll end by telling you a good joke I heard.

How do you tell if a politician is lying? When their lips are moving! LMAO!