Price To Earnings Ratio

As an investor that got my tilt first as a value investor, the metric Price to Earnings ratio, P/E ratio for short, was one of the first concepts I was introduced to as a way to value how attractively a company was selling at price wise compared to its earnings. If you could identify companies selling at an attractive valuation which the market hasn’t yet acknowledged, and you invested in them before the masses take notice, you stood a chance to see your initial investment appreciate in value because investors could revalue the earnings and as a result the stock price higher. Early on this metric has driven my investment mindset more so than it does now; however, I always seem to return to the roots of this metric and keep sight of it in evaluating the value at which I am getting a stock in a company.

P/E Definition

I found the definition by Money Chimp as the easiest for my mind to understand as they say the P/E ratio represents the number of year’s of a company’s earnings it will take to add up to the original price you paid for the stock. Contrast that by Investopedia’s definition of P/E ratio, which is the dollar amount an investor can expect to invest in a company in order to get one dollar of that company’s earnings. I just understood Money Chimp’s definition of that concept more intuitively and as you might can imagine, of course I wanted to invest in companies where I got paid back sooner.

P/E Ratio Comparisons for Extreme Contrast

So, say you were to contrast Apple’s (AAPL) P/E of 16.90 and its stock price at $144.02 per share, as of writing this, vs Netflix’s(NFLX) P/E of 193.29 and its stock price at $149.41 per share. Using the definition from the above, Apple clearly has the more attractive valuation as it will take approximately 17 years as opposed to 193 years to pay you back the price you paid of $144.02 if Apple’s earnings stayed constant. In this case, the earnings are about approximately $8.54($144.02/16.90) annually either by solving for E in P/E or seeing the quarterly earnings data of the last trailing twelve months

for Apple and $0.77($149.02/193.29)

for Netflix.

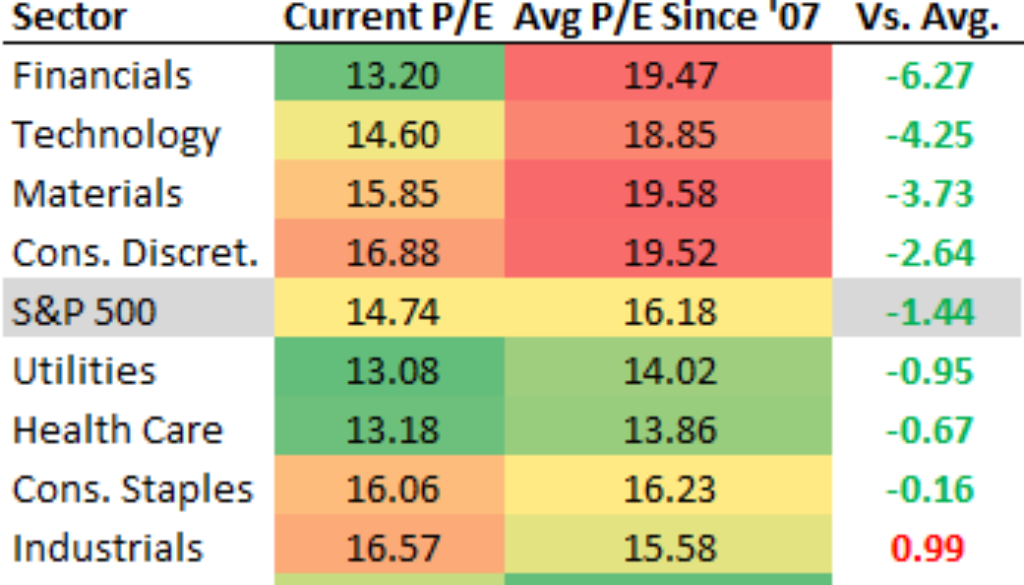

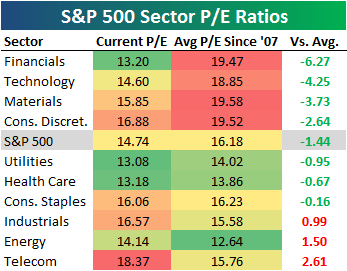

P/E Ratio Comparison By Sector

However, to be fair, it is often stated when comparing P/E ratios of companies it should be to other companies in similar industry, size, and sector. So if we compared Apple to HP Inc(HPQ), we see HP’s P/E is 12.36 and its stock price is $17.48 per share, as of writing this, has a lower a slightly lower P/E than Apple. Investors tend to pay a higher P/E multiple if they believe that earnings will be higher for a company in the future. Perhaps that is the case for Apple as these company’s are in the same industry with similar size and the same sector. If you do similar with Netflix and Activision Blizzard(ATVI), we see Activision Blizzard’s P/E is 42.24 and its stock price is $57.57 per share, as of writing this, and it has a dramatically lower P/E than Netflix. In the above, I personally would still tilt my investment dollars in a greater amount to Apple over HP, but HP is great value here and should be considered. Moreover, I would select Activision Blizzard in a greater portion size if choosing between it an Netflix.

Valuation Classifications

Stocks like Netflix and Activision Blizzard get classified as growth stocks as opposed to value stocks which Apple and HP are more akin to at this point in their history. As investors, when we look at metrics like this it doesn’t mean we should not invest in a Netflix or Activision Blizzard, but we should do so with great caution, as growth stocks usually help boost capital appreciation when they really take off, which we like as investors too, but these are the ones we should prune and invest in some of the slow movers that are more solid in their fundamentals like an Apple or HP. I usually dollar cost average into growth stock positions and take some profits when they get really high like Netflix is now. My Loyal3 10 Stock Plan(now FolioFirst) has Netflix in it along with combination of growth and value stocks.

Company Earnings Check Up

Companies report earnings each quarter, so assume you have taken a position in Apple of 5 shares at $144.02. You know that the earnings as of taking that position is $8.54 per share on an annual basis. If from here the price where to drop to $135 on investor sentiment sinking on Apple and it’s earnings hadn’t been reported for the year, should you sell? I would say people buy and sell for different reasons, but if you sell before earnings, and Apple reports earnings that are $8.54 or higher, you lost you original position and might have to pay a higher price now to get back in to Apple stock. Had you held your position, you would still be on track to get back the $144.02 you spent on each share. As long term investors we have to think in terms of years in the stock market and endure price fluctuations and evaluate the numbers for ourselves to see has anything fundamentally changed. Having a metric like P/E and others I listed in, “Stock Basics 101 – Evaluating Stocks”, helps us put in perspective the long term prospects of a stock we decide to invest in. Be careful not to be shaken out of your positions on shortsightedness of some market participants; otherwise, you miss out on run-ups in stocks like I showed in the charts on my blog, “Loyal3 10 Stock Plan Addendum”.

Possible Sell Signal

That being said, if you see earnings start to shrink, then only should you consider to take action to consider selling and it shouldn’t be after one quarter, but perhaps several before throwing in the towel. It is a companies earnings that drives this all as from it you get dividends and re-investment that lead to larger earnings and higher stock price. If you can, track the earnings on a stock that you decide to purchase and let that help guide you in whether you still want to be in that company.

Conclusion

As with anything you buy, you make the real money when you buy and not when you sell, so let’s use metrics like P/E ratio to ensure we are buying at a good price and have some margin of safety, so that we really see the upside when others begin to take notice of the value as well, but get in at higher P/E multiples; thus increasing the initial value of our investment.

Please provide feedback or questions pertaining to this blog post by leaving a comment below. Also please be sure to share this content with your friends and family. I thank you in advance.

Please provide feedback or questions pertaining to this blog post by leaving a comment below. Also please be sure to share this content with your friends and family. I thank you in advance.