Paying for Life Insurance with a Credit Card

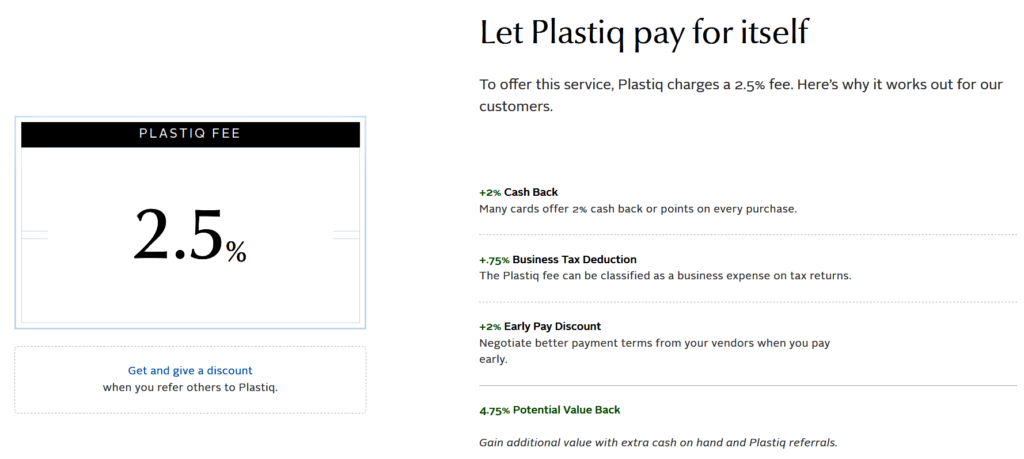

Ever since I read the blog post, “The Easiest Bills to Pay with Plastiq”, where the author mentions she recently learned she could pay her life insurance premiums via Plastiq, the light bulb went on for me. I’ve known about and used Plastiq for sometime, but I didn’t know I could pay my life insurance with it. I guess it really never dawned on me. Now that it has, I’m considering way(s) when paying for life insurance with a credit card make sense. You might ponder why I’m even considering Plastiq to pay for life insurance? I’d reply, it’s for award travel. Typically, life insurance and mortgage, to name a few, are bills you cannot pay with a credit card. However, Plastiq allows you to pay for these type of expenses with a credit card. The challenge is overcoming the 2.5% service fee that Plastiq charges. That I discuss below.

Expenses You Normally Can’t Pay with Credit Card

Mortgage(s) make up 38% of my monthly expenses and life insurance is 22%. That is because I currently own 3 rental properties. Also, I believe whole and/or term life or both, long term care, and disability insurances are core to sound financial foundation. So, for 60% of my expenses, if I don’t make use of a service like Plastiq, I’ll get no points/miles benefits for these transactions. This is a huge loss. If you are new to award travel, it may be hard now to fathom why this is huge. However, once you realize the tremendous opportunity for ‘essentially’ free and/or discounted travel domestic and abroad, you’ll understand perfectly why being able to charge these types of transactions to a credit card is crucial.

Plastiq Makes Improbable Possible

I’m already charging every expense I can to the credit card that offers optimal rewards. There aren’t any service fees I need to pay for these transactions. Food, fuel, clothes, cell phone, cable, you name it aren’t normally at additional expense because I pay the balances in full each month. The mortgage, life insurance, and car payments are the conundrum. I can make these transactions with Plastiq, but a 2.5% service fee makes it less attractive if I cannot either offset the fee and/or supersede its cost. I have some methods to do so, but these can all be so transient that I can’t depend on any one of them all the time.

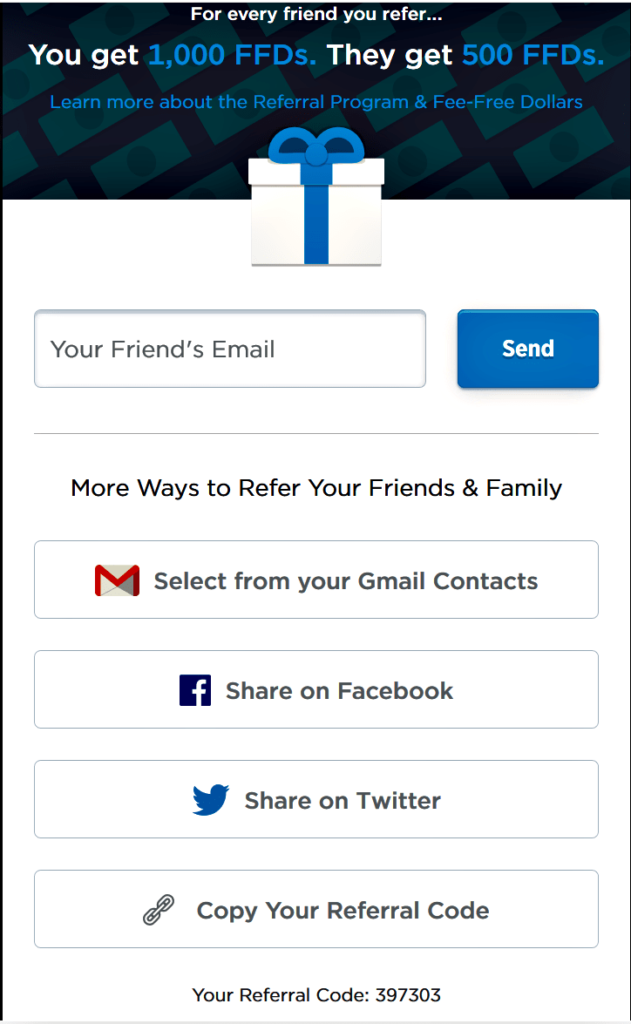

Referrals

For every person I refer to Plastiq that uses my code 397303, they will get $500 in fee-free dollars once they make $500 in payments with Plastiq. In turn, I will get $1000 fee-free dollars. Then, a new sign up has the same ability to refer people to Plastiq with aforementioned terms above. The more referrals I have that meet these terms, the easier it is to offset the 2.5% service fee. For example, I have a mortgage that is $941. If I paid it through Plastiq, the total amount would be $964.52(941 + 23.53). $23.53 (941 × 0.025) would be the 2.5% service fee charged on the $941. However, if I had earned a $1000 fee-free dollars from a referral, the service fee would be $0 with $59 fee-free dollars remaining.

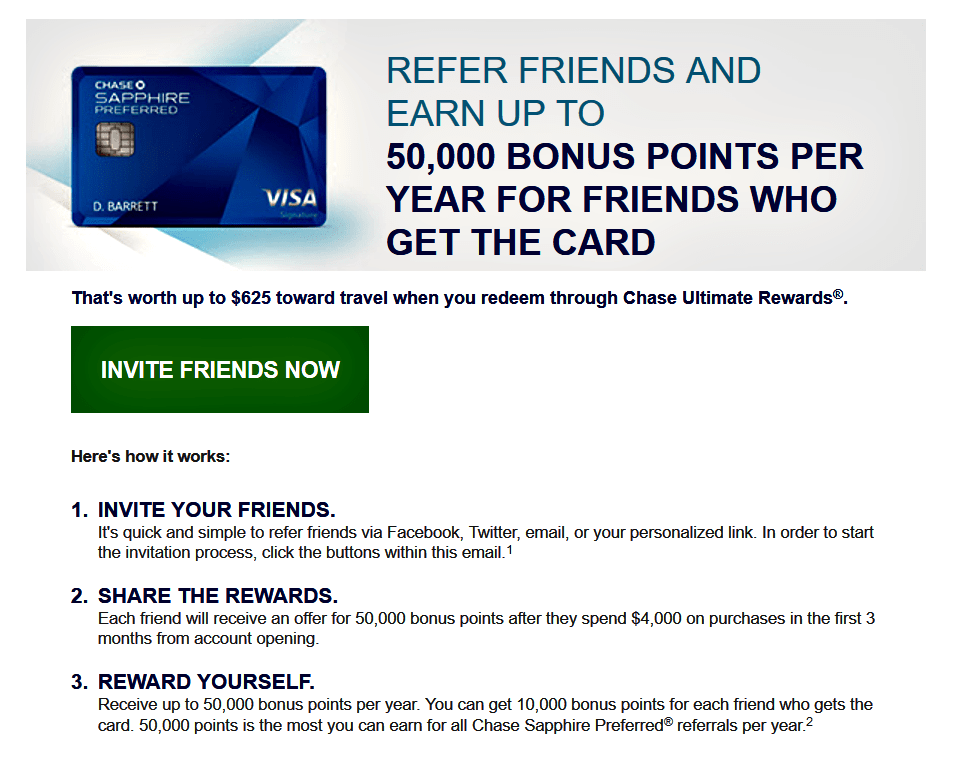

Big Sign-Ups Bonuses

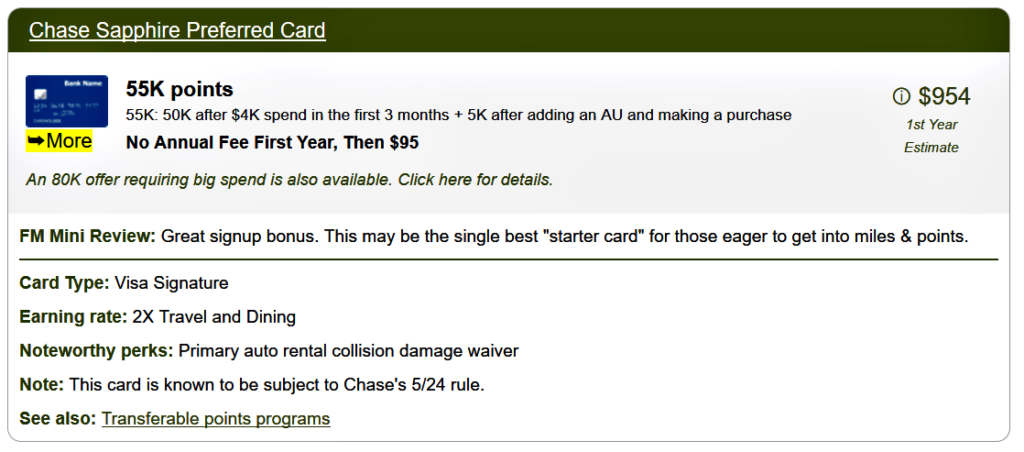

Often there are promos like Chase’s Sapphire Preferred. It offers spend $4,000 in 3 months and get 50,000 bonus points no annual fee first year, then $95. Sometimes if you needed to pay an expense you normally couldn’t to help you reach the minimum required spend for a sign-up bonus, Plastiq is perfect for that. It is a good fill in that using the mortgage example above would cost you $23.53 to get $625 worth of value in this bonus.

Sign Up for Chase Sapphire Preferred Here

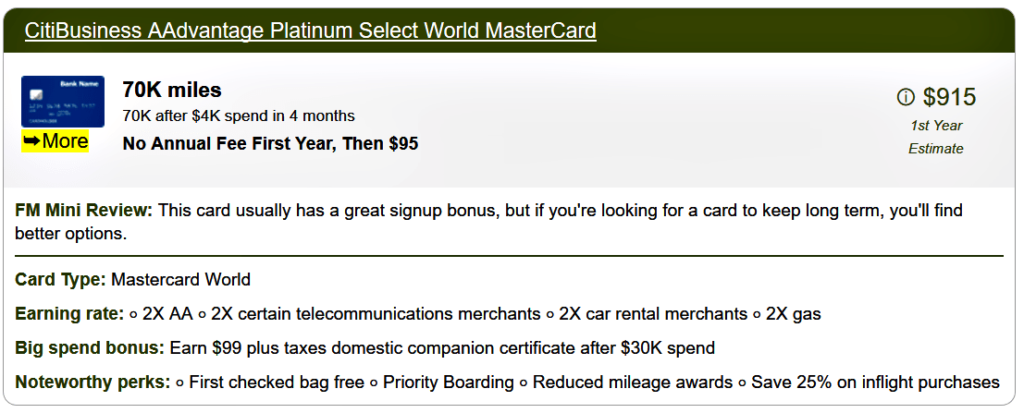

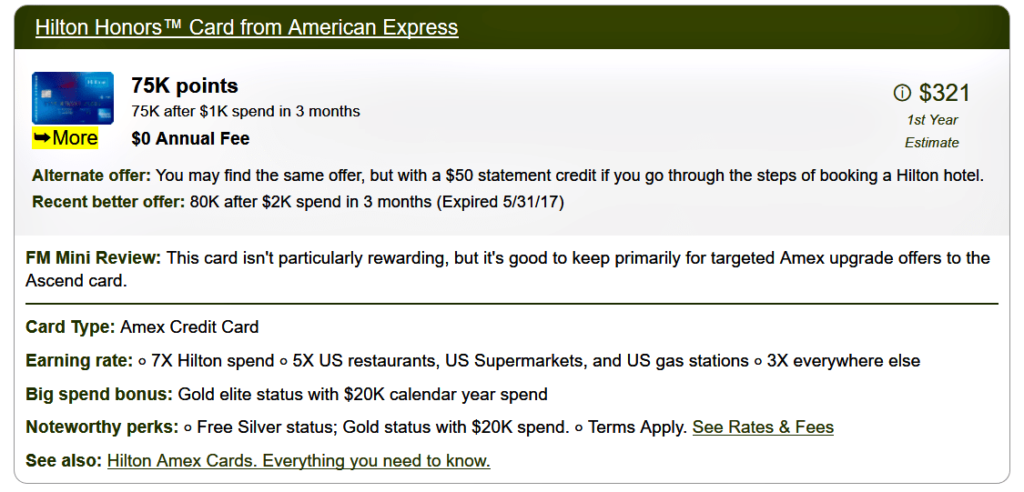

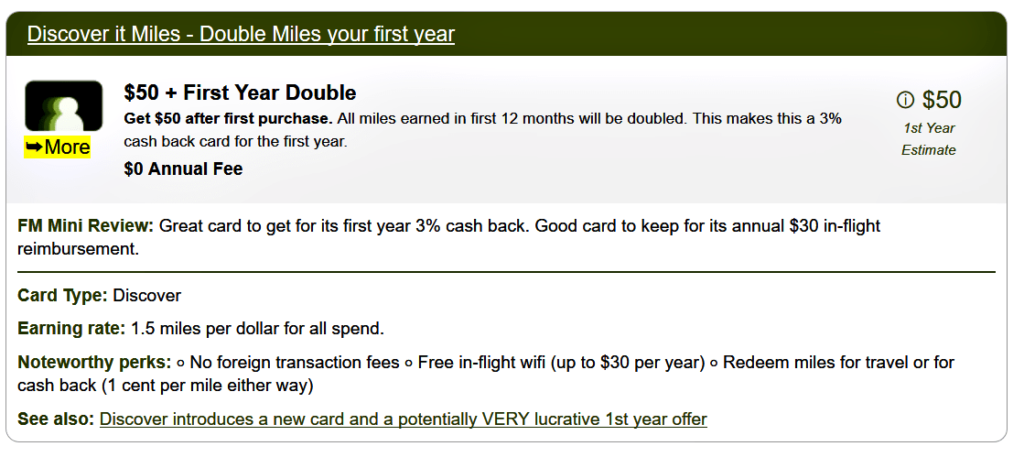

If you use Plastiq in stacking multiple of these sign-up bonus promos, the value you obtain quickly supersedes the 2.5% service fee. For example, according to the FrequentMiler here are 1st year valuation estimates for these 3 credit cards below. If I used Plastiq alone, and just charged my mortgages and life insurance, I could hit the minimum required spend of 4K + 1K + 4K on all 3 of these bonuses in 3 months. The 2.5% service fees would cost me $225(9K × 0.025) over the 3 months, but I would have gained $2190(915 + 321 + 954). Despite the service fees, the net net value gained is $1965(2190 – 225). In my opinion, that’s not a bad trade-off. It can make a lot of sense to use Plastiq in these scenarios. However, there will be times you’re not eligible for sign-up bonuses.

Banking Promos

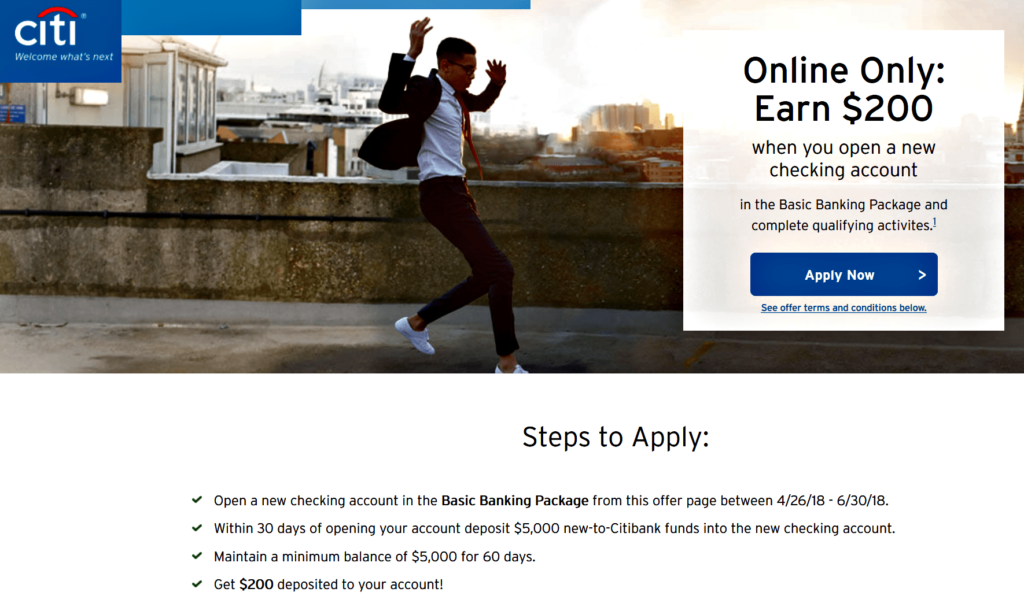

I’m resigned to the fact, in my quest for award travel, I’ll incur some fees I cannot avoid paying. So, the best I can do is reduce the overall cost of fees using banking promos. I sign up for best banking promos. Typically a promo offer is open a new checking account and get $200. Once I’ve met the terms, I can use these funds to offset service fee and/or credit card annual fees.

Plastiq Promos

Plastiq seems to encourage people to use there platform and they sometimes run promos that get you fee-free dollars, or lower service fee than the standard 2.5% when you pay with select card brands like Visa or American Express, or rebates when you sign-up for consecutive payments with select card brands. As of writing this, here is Plastiq’s latest promo. I’m using this promo now to pay my mortgages and life insurance for next few months.

All The Above

Ideally, I would like to pay my mortgages and life insurance all year long on Plastiq. If the service fees aren’t cost prohibitive because one or all of the above methods are helping to offset or supersede the cost, then it makes sense to do so.

I’ve recently signed up for the Discover It Miles credit card which earns 3% in the first year.  That’s 0.5% over the 2.5% service fee. In addition, according to website, I can potentially take a 0.75% business tax deduction on taxes. If Discover ups my credit limit from $1000, I plan to use Plastiq to pay the mortgages for my 3 rentals. It’s then like I’m earning 1.25% for transacting through Plastiq; whereas before I was getting nothing.

That’s 0.5% over the 2.5% service fee. In addition, according to website, I can potentially take a 0.75% business tax deduction on taxes. If Discover ups my credit limit from $1000, I plan to use Plastiq to pay the mortgages for my 3 rentals. It’s then like I’m earning 1.25% for transacting through Plastiq; whereas before I was getting nothing.

As for paying for life insurance with a credit card, you’ll have to pick and choose optimal times to use. I think you need a combination of referrals, sign-up bonuses, bank and Plastiq promos in order to make the cost proposition feasible. Otherwise, I don’t think it’s worth it. For now, I’ve removed my life insurances auto-draft to give me the flexibility to do just that—choose.

In Closing

If this blog post is your first introduction to Plastiq, I hope I’ve demonstrated the value proposition it poses for award travel. Utilizing referrals, big sign-up bonuses, and bank and Plastiq promos, gives you good chance you’ll be able to offset the 2.5% service fee. Although it may not always be a constant 12 months out of the year, paying for life insurance with a credit card is possible. As is for other expenses, like your rent/mortgage, you normally couldn’t pay with a credit card. Just try to use this service when the value added makes sense for your award travel endeavors.