Pay Off Debt, 7K to be Exact

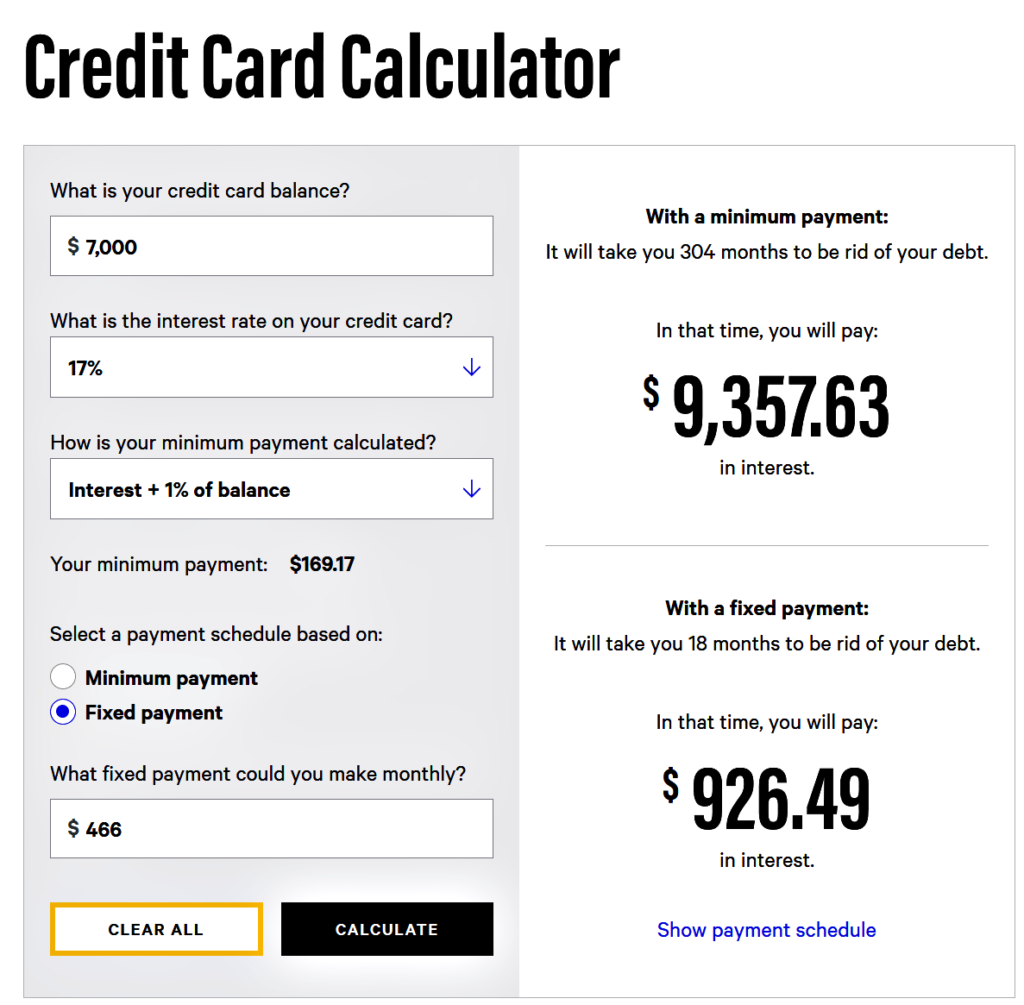

As I blogged in 7K in Debt, I knew that my monthly cash flow wouldn’t cover the balance and some debt would remain. Prior to this conclusion, I ran through all my available short term liquid funds to stay out of debt to no avail. So here I am! Let’s for a moment forget about how we get in debt, and instead focus on how we could structure and pay off debt. This is not the first and probably won’t be the last time I’m in debt, but I don’t plan to be in it long. I have a plan and I will execute that plan. For structure, I used a 0% balance transfer and business credit card with a pay down amount of $466 over 15 months. My (your) aim is to mitigate the cost of the debt (interest) as much as possible while vanquishing it.

Don’t Hide From Financial Picture

My hope is you’re like me in being keenly aware of your finances. I try to paint as complete a financial picture as I can using a money management tool like Mint.com. That way I see a snapshot of all my assets and liabilities at a glance. I don’t hide from the picture good or bad. The real danger is when you hide from a bad financial picture and don’t correct it because it only gets worse. Credit card, student loan, and installment debt without much or any counterbalancing assets make for a dire financial picture. The lenders know how the numbers work in their favor and if you don’t, debt can implode on you. You will be on the hook and the short, intermediate, and long term consequences will hurt you more than them.

So, I know my number is 7K that I need to pay off. Then, I would be in a debt position I’m ideally comfortable with, which is very little consumer debt. My disposition to mortgage debt is that it’ll be with me until I die because I don’t plan to pay off.

I’m Not Cutting Up My Credit Cards!

Although I have debt, on credit cards, I have no plans to cut up my credit cards as a form of punishment for me getting into debt. On the contrary, I’m quite comfortable managing a balance I can pay off in full each month all while getting out-sized rewards. As usual, everything, outside of this 7K, continues to be paid on schedule using a free service named Debitize. In addition, I didn’t make the mistake of using credit to buy a depreciating liability. Instead I purchased a rental property which is currently rented and cash flow positive. In fact, the initial cash flow is being used towards the 7K debt pay off.

Is Debt Bad?

Having debt isn’t necessarily an issue as is the cost for the debt. If not for debt, think about how many people, myself included, would be able to afford a house or a car? Most people are comfortable with structured debt payments for instance for a car or a house. However, they may not ponder the question how much this is really costing me? A car salesman ask you what you want your monthly payment to be? My wife recently got a new 2018 Toyota Camry SE for $25,894 tax, title, and license no money down and 0% interest for 5 years. Yeah, we’ve incurred consumer debt, but she needs a car. However, I cannot argue with these terms. How she minimized the cost of debt to be only for the car is awesome and is what I aim to do anytime I’m in debt.

Thus, making a determination where the debt will live becomes a concern. Should I take a personal loan, should I let it remain on credit card, if so, which one, can I get balance transfer, how many months, etc? These are the questions I’m posing. Which option I choose depends on cost, duration, and my discretionary income.

How Intentional Are You?

Paying off debt is not rocket science! Let’s backtrack a bit from strategy and focus on the most fundamental idea. It’s what happens in your head and your heart that makes any strategy work or not work. There is tons of advice on best ways to pay off debt. Add this to the list. What matters is how intentional you are towards paying off debt. If ‘you’ are reluctant to do what’s necessary—be it with your discretionary income, consumption, or both— to pay off debt, no technique can help you. It takes a personal transformation in you that ignites that fire. Once that happens, it’s make a plan and execute the plan.

Debt Pay Off Plan

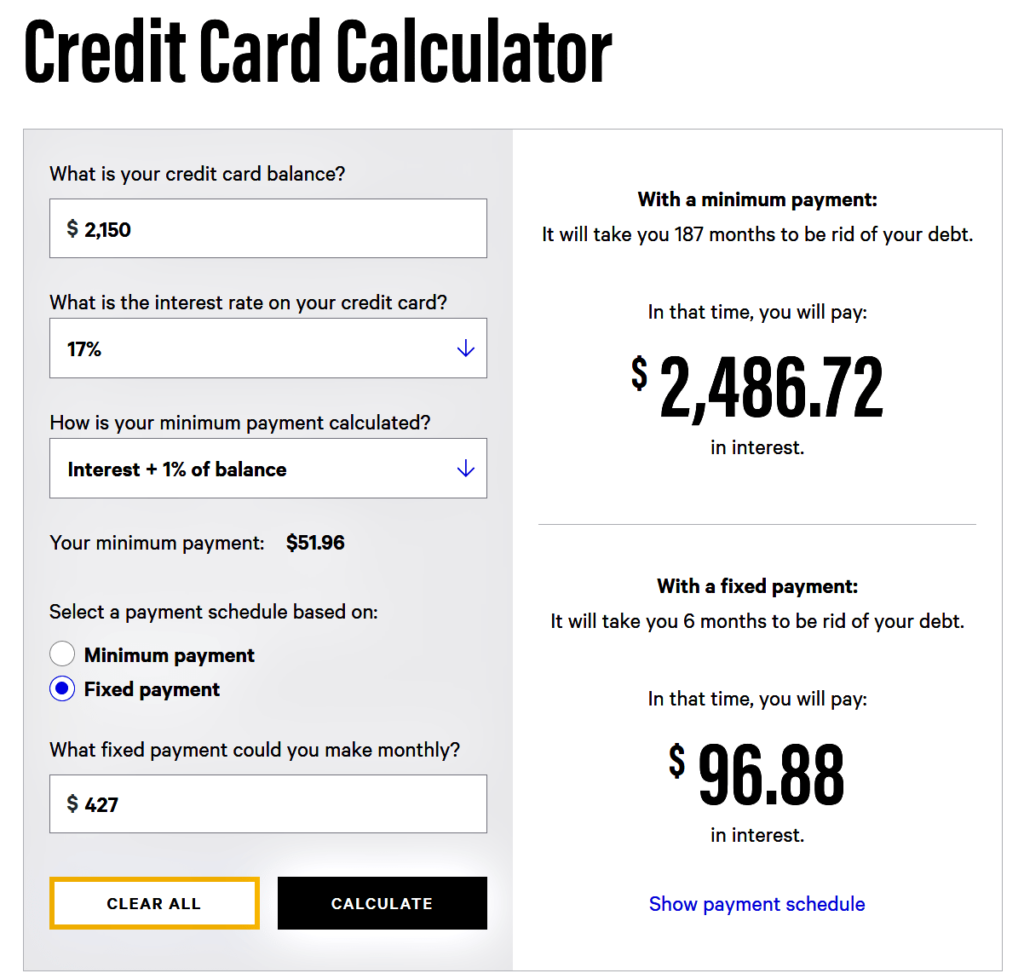

My plan is to minimize 17.74% credit card interest I would have if I left the balance on existing credit card. So, I used a balance transfer offer available to me from Barclays on AAdvantage Aviator Red credit card. I write in, “Deciphering Balance Transfer Offers”, which I try to select. When this offer became available, I had 5K credit limit of which I put $4850 of 7K balance on it. The other $2,150 is on American Express Starwood Preferred Guest Business credit card. This because I can deduct the interest as business expense.

I have 15 months of 0% interest on $4,850 before 17.74% APR kicks in. $4850/15 is approximately $323 a month. If I want to be out from 7K, it will be approximately $466 a month. First, I want to get rid of that $2,150, despite the business expense deduction. So, I’ll pay the minimum payment of $48.50 (1% of balance) on $4,850 and the difference of $466 – $48.50 to Starwood. Once that was paid off, I’d shift entire $466 to the balance on Aviator until it was $0, all within 15 months. It will cost me a little under little under $250 (interest ($96.88) & 3% balance transfer fee($150)) as opposed to $926.49.

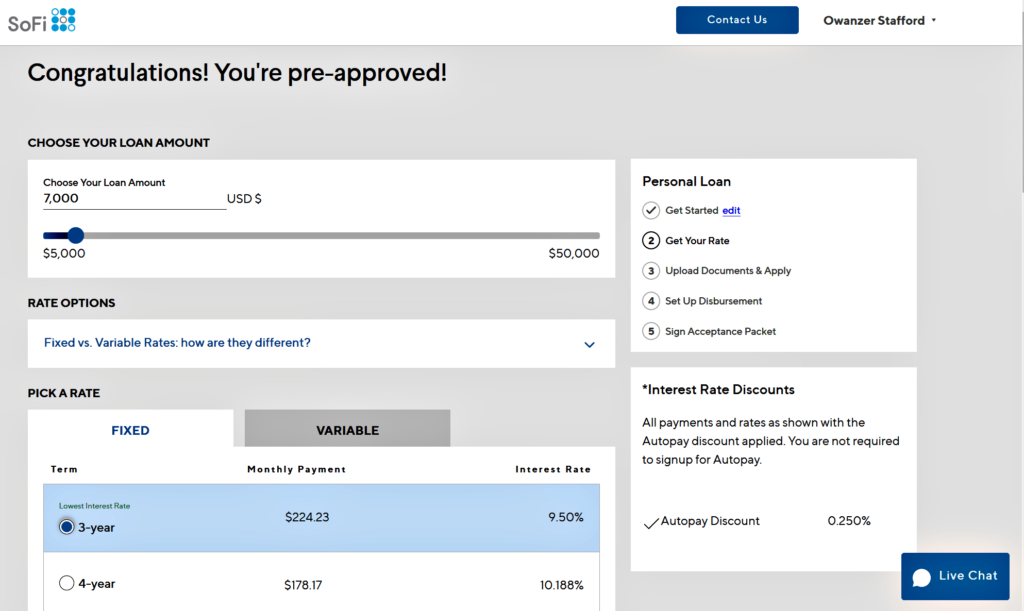

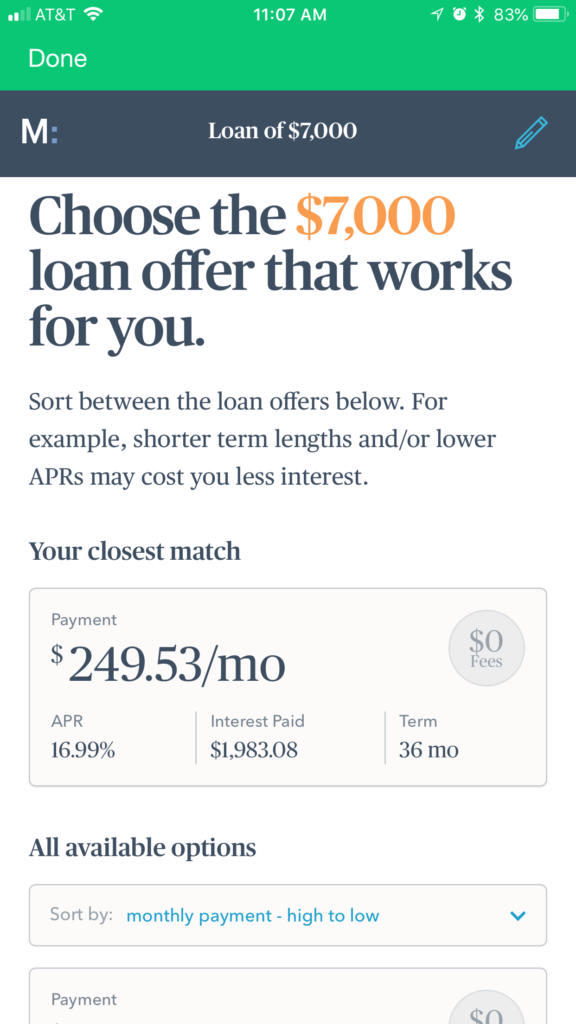

This is doable. I settled on a structure, pay down amount, and duration that I was comfortable with. My discretionary income from 3 rental properties and options trading premiums made this option right for me. Depending on your discretionary income and duration, you may have selected a personal loan structure for debt from Sofi or Marcus by Goldman Sachs for 36 months. This will vary by circumstance, but once you’ve selected, it then becomes about the execution.

Personal Loan Options

Closing

7K makes me nervous and I want to be out of it before high interest kicks in. I’ve determined the best structure and pay off terms for me given the cost I wish to save, my discretionary income, and duration. I’m very intent on paying off this debt due my mental transformation and now I’m all about executing my plan. How about you?

Check back to see what the payoff amount is during and up to the 15 months.

Pay Off Amount Remaining ⇒ $6,534

This made me laugh.