My Approach to Debt

I had and have my fair share of experience with debt and various debt products over my lifetime. Through my experience with debt, I have a better approach to debt for myself and how I use debt. I’m not much of a Dave Ramsey advocate to cut up your credit cards and be debt-free as much as I am a debt opportunist. My approach to debt is, “Can it help me achieve a positive return?” If yes, then I’m using it; otherwise, I’m limiting or not using it because debt can be an amplifier of gains or losses when used correctly or incorrectly. Is your approach to debt helping or hurting you?

Debts Product I’ve Used

I have used the following debt products at some point in my lifetime with different degrees of success and failure:

- 2 Student Loans

- 24+ Credit Cards

- 3 Mortgage Loans

- 2 Store Credit Cards

- 4 Auto Loans

- 2 Personal Loans

- 3 Balance Transfer Loans

The younger and less experienced I was with debt, the more unsuccessful I was dealing with it. For many young people our first experience with debt may be our first introduction to how the real world works. Depending on your education about debt, that experience might be positive or the beginning of downward spiral of never ending debt.

Rebound from Debt Management Failure

My failure with debt was with student loans where I started out going to college, but quickly found myself in college without much direction. I dropped out and my loans when into default and my parents said to me it’s on you. I didn’t have a job and creditors were hounding me for payment. That was the worst feeling and a real wake up call. In seeing the low income job prospects without a college degree, I know I needed student loans to go to school because I didn’t have the money to pay for college myself. So, I rebounded from this mistake by going to the military to reset my debt.

While enlisted, I paid off my defaulted student loan. I later would get real smart about student loans. I used my GI Bill money, scholarships, and grants. If possible, I avoided getting student loans, but if I did get, I only got what I needed. When I graduated, I focused on paying off this faster then scheduled.

Debt Management Success

Post my student loan debacle, I was awoke to the realities of debt and I then had much better success taking on a little debt and having keen focus to pay it off quickly and avoid paying interest where possible. So, credit card, auto loans, personal loans, mortgage loans, I have managed much better now.

As you can imagine, we need debt because how many of us have the money on hand to pay for the things we want today? I didn’t have $20,000 in 2006 to pay for the Honda Accord I now drive. So, I needed to get financing and have no qualms about that. The difference was I knew I would pay the debt down on time. I would often apply additional to get from under the debt faster because, as I would later learn, this wasn’t the type of debt I wanted to be in.

Debt Fear

I stayed in what I am characterizing as “debt fear” which is more akin to debt avoidance or not overextending myself through spending on credit cards and the like that I could not pay off at the end of the month. Until 2010 or so, I was stuck here in my mentality towards debt. By no means is this necessarily a bad thing as you should have a healthy fear of debt because it can eat you up and spit you out.

Opportunities With Debt

Real Estate

My wife and I were out of consumer debt in 2010 largely due to “debt fear” and except for mortgage, this was only debt we had. We used credit cards occasionally, but paid off the balances. So, there was opportunity to use debt to buy rental real estate which we did. We acquired 2 rental properties and used debt. It is here that you can see the amplification that use of debt has on return on investment as opposed to using no debt/leverage. I learned it is here where you want to use debt and also due to the tax ramifications that mortgage interest can be deducted and property depreciated. When you have positive cash flowing real estate, this is really the only time you want to load up on debt.

Credit Card

I didn’t realize until 2016 the gold mine credit cards could be if you didn’t get stuck behind the eight ball. The bank bonuses in points/miles you can receive for travel and all types of experiences if you could manage the debt is simply Hawaii for essentially free amazing! I have been all in on maximizing my credit score and debt management skills in taking advantage of the array of offers from banks seeking your spending loyalty and hope for you to fuck up for them to profit off you. Credit card debt is the worst debt for you to be in as the interest rate are often in the mid teens and compound so quickly if you get behind (the negative amplification of debt).

Personal Loan

In looking at the utilization of money, if it could be arbitraged for greater amount than interest charged, then it might be worth leveraging with debt. I have taken 0% balance transfer loans or personal loan and used it in options trading or to buy rental real estate when it generated a positive cash flow for my family that would not otherwise been there. Money is very cheap these days and if you can borrow for an asset, I consider my options.

Limiting Liabilities

My approach to debt is determining if I can use debt for an asset that puts money in my pocket where the gain is greater than the cost of the debt, I’ll use it. Otherwise, I limit using debt regularly to buy any type of liabilities in depreciating assets like cars, cloths, vacations, furniture, electronics, etc. I would avoid going into debt for these items like the plague. This doesn’t mean I would not finance a car and the like, no it just means I will not be doing this activity on a regular basis. I still drive the same Honda Accord I purchased in 2006. The next car I get will probably be used and I’ll probably finance because I don’t want lost opportunity cost.

Debt Management Strategy

Here is my debt management strategy that I am using:

- Buy rental real estate with debt when it will generate a positive cash after expenses

- Utilize and maximize credit cards for big signup bonuses for points/miles and pay off balances in full every month or with balances not extended beyond 2 months

- Utilize 0% balance transfer money or cheap money in the options market or real estate as arbitrage and contribute cash flow towards long term portfolio and discretionary spending

- Maintaining a high credit score as to minimize interest rates from results of paying bills on time and in full every month

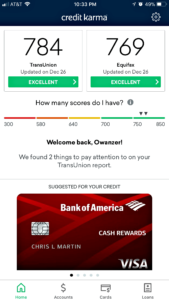

This is my approach to debt and I can’t think I would do much differently given what I have learned since I first started out my experience until now. The result of this approach is as follows:

- 784 credit score

- 2 positive cash flowing rental properties with infinite return on investment using mortgage loans

- 950,942 points/miles, a near free trip to Hawaii, Washington DC, New Orleans, Miami, fully paid cruise in 2018, upcoming Washington DC trip, and future travel

- Positive cash flow in options income from cheap money arbitrage

- Little credit card debt

- 1 Car Loan

- 1 Homestead Mortgage Loan

- Healthy discretionary income to put towards 401K, Motif Investing Roth IRA, Acorns, future rental real estate, and cash value life insurance because I’m not debt-laden

Conclusion

These days I feel I am using debt properly towards my advantage and avoiding it otherwise; thus, my debt fear is reduced. The result of my understanding of debt later led to results above. I can only hope that readers, especially the youth, learn to use the tactics I use later in my life instead of the former. So using my results as comparison, I ask the question again, “Is your approach to debt helping or hurting you?”. If not, consider if any of my approach can help turn that around and keep up with information on this website geared towards my shared successes.