Make Money Trading Monthly Options

This post is a continuation series about how I make money trading monthly options. I share here what my trades are for this and previous month’s. Also, I also discuss how much money I have made or loss for the month and how I am managing positions. Previous post have delved more into my psychology behind trades and why which choices were made. If you are curious, I cover this more below. It may be helpful for you that are on the fence about can you do this yourself as well. Nonetheless, what has become apparent to me is that our economic survival may hinge on knowing other ways to generate income besides a traditional job. A working knowledge and experience of how to trade options can help you tremendously today and in future.

Make Money Trading Monthly Options Series – October 2017

Make Money Trading Monthly Options Series – September 2017

Making Money Trading Monthly Options Series – August 2017

Previous Month’s Positions

Legend

- Gray – Highlighted gray implies a position in repair due to stock price being below original strike price I purchased the stock at. However, I am still able to collect premium from covered call position.

- Green – Highlighted green implies a position which I made some or all the money I intended to make.

- Red – Highlighted red implies a position which I loss money.

- Black – Highlighted black implies an open position which I cannot yet render a gain or loss assessment.

Covered Call

- 10/20 Bought to Cover 5 TWLO Oct17 32.50 Call @ $0.17

- 10/20 Sold 5 TWLO Nov 03 ’17 32.50 Call @ $1.03

- 10/25 Sold 2 ACIA Nov17 50 Call @ $0.65

- 10/25 Sold 3 AAOI Nov 03 ’17 42.50 Call @ $0.60

- 10/31 Sold 1 AMGN Nov17 180 Call @ $1.40

- 11/06 Bought to Cover 1 AMGN Nov17 180 Call @ $0.28

- 11/06 Sold AMGN Nov17 175 Call @ $0.98

- 11/06 Bought to Cover 2 ACIA Nov17 50 Call @ $0.03

- 11/07 Sold 2 ACIA Nov17 40 Call @ $0.20

- 11/09 Sold 5 TWLO Nov17 28 Call @ $0.25

- 11/09 Sold 3 AAOI Nov17 46.50 Call @ $0.50

Secured Put

- 10/23 Sold 1 AMGN Oct 27 ’17 180 Put @ $2.60

- 10/23 Sold 2 CRUS Nov 03 ’17 52.5o Put @ $1.90

- 10/26 Sold 1 AAOI Nov17 40 Put @ $3.80

- 11/07 Sold 1 AMAT Nov17 55.50 Put @ $1.05

- 11/07 Sold 2 GOOS Nov17 21 Put @ $0.75

Put Spread

- 10/11 Bought 1 GM Nov17 44 Put @ $0.82

- 10/11 Sold 1 GM Nov17 40 Put @ $0.11

Long Stock

- 10/23 Bought 200 AAOI @ $55

- 10/23 Sold 100 NTNX @ $22.50

- 10/30 Bought 100 AMGN* @ $180.00

- 500 TWLO with $40.23 cost basis

- 200 ACIA with $59.10 cost basis

- 100 AAOI with $59.66 cost basis

*Dividend – The ex-dividend date for AMGN is 11/16, so I will earn a dividend as well during this time because I’m long the stock.

Previous Positions Analysis

Repairing

I am still largely managing positions that are in repair for ACIA, AAOI, and TWLO. The market sentiment for these stocks are negative despite my own bullishness that they have good fundamentals worthy of higher multiple and price. I need to be careful not to allow my bullishness on a stock(s) to crowd out what could be other good trades because market doesn’t see it my way. I could be wrong, especially when the stock continues to retreat from higher price, or right. The question becomes how long are you/I convicted to wait and see a turn, if any? How much should you continue to double down?

Despite being repaired, my covered calls on these stocks were all successful. This means my cost basis will continue to go down. For example, my cost basis last month for TWLO on 500 shares was $40.23. This month it is $39.90. In order to not have loss any money, I need to sell my positions at or above this amount. As long as, either or both, I can continue to collect premiums on these covered call positions and/or the stock price appreciates in value, I have the chance to make money or be even on this trade. I am fine with what is, hopefully, a temporary paper loss if I can indeed repair this trade and all it takes is more time.

Losses

On the GM put spread, I could have been successful on this trade had I taken half the profit. I didn’t and the trade went against me towards the expiration and I wind up losing on the position.

Successes

On the secured put positions, I got the direction right away from the put strike prices I selected and just had 100% gains on premiums collected from these trades. However, I would have been comfortable owning these and would, in turn, have placed covered calls for this month had they been put to me.

This Month’s Positions

Here are the trades I entered for this month which are either a continuation of, a new, or a closed position. Options will expire on the 3rd Friday in December, unless I close early, roll up, roll out, or roll up and out of a position(s). I have some positions this month that I planned to close much later. Furthermore, I list the position taken in companies by their stock ticker symbol, i.e. ACIA. If you want to know who these companies are, here’s the part you need to do a little research:

Covered Call

- 11/20 Sold 5 TWLO Dec17 27 Call @ $0.56

- 11/20 Sold 2 ACIA Dec17 40 Call @ $0.75

- 11/20 Sold 3 AAOI Dec 22 ’17 48 Call @ $1.30

- 11/20 Sold 1 AMGN Dec17 170 Call @ $2.75

- 11/29 Bought to Cover 1 AMGN Dec17 170 Call @ $5.35

- 11/30 Sold 1 AMGN Dec17 177.5 Call @ $1.25

Secured Put

- 11/14 Bought to Cover 2 GOOS Nov17 21 Put @$0.05

- 11/14 Sold 1 ROKU Jan19 35 Put @ $3.60

- 11/20 Sold 1 ULTA Dec17 210 Put @ $11.50

- 11/29 Bought to Cover 1 ULTA Dec17 210 Put @$0.05

- 11/29 Sold 1 ULTA Dec17 200 Put @ $2.70

- 11/30 Sold 1 NVDA Dec17 187.5 Put @ $2.05

Long Stock

- 100 AMGN with $172.48 cost basis

- 500 TWLO with $39.90 cost basis

- 200 ACIA with $57.65 cost basis

- 300 AAOI with $58.18 cost basis

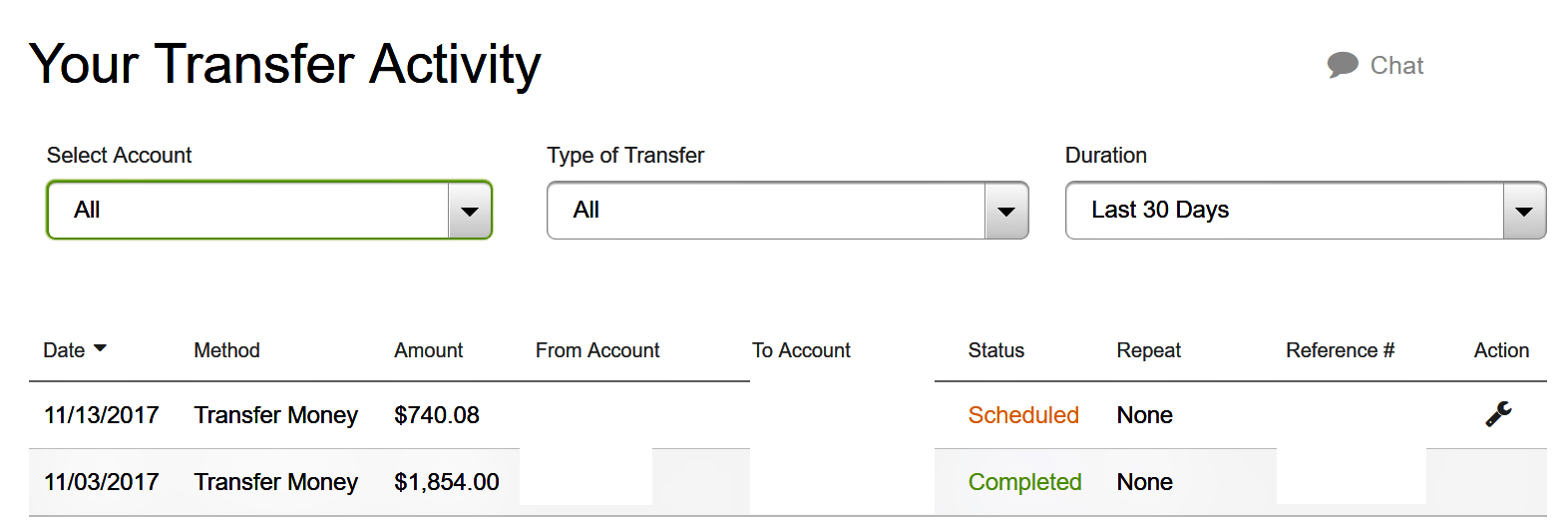

I was able to make money trading monthly options this month of $2594 with these positions excluding anticipated dividend.

My Trade Psychology

I thought my AMGN trade had went awry and it was a lot of volume and MACD downtrend to suggest the price was going to stay below $170. However, I was wrong and I used what would have been a really profitable trade in ULTA to offset my mistake.

One thing that I did realize was how I could use a stock like AMGN that has a low implied volatility and leverage it to make additional trades in stocks like NVDA. AMGN would serve for quick liquidity if the NVDA was put to me on margin. Otherwise, I had chance to get additional premiums if these trades finished out of the money. I still had a good month all considered.

In Closing

Finally, updates of trades I’m positioned in and how they have been working for me can be found here each month.