Make Money Trading Monthly Options

This post is a continuation series about how I make money trading monthly options. I share here what my trades are for this and previous month’s. Also, I also discuss how much money I have made or loss for the month and how I am managing positions. Previous post have delved more into my psychology behind trades and why which choices were made. If you are curious, I cover this more below. It may be helpful for you that are on the fence about can you do this yourself as well. Nonetheless, what has become apparent to me is that our economic survival may hinge on knowing other ways to generate income besides a traditional job. A working knowledge and experience of how to trade options can help you tremendously today and in future.

Making Money Trading Monthly Options Series – November 2017

Make Money Trading Monthly Options Series – October 2017

Make Money Trading Monthly Options Series – September 2017

Previous Month’s Positions

Legend

- Gray – Highlighted gray implies a position in repair due to stock price being below original strike price I purchased the stock at. However, I am still able to collect premium from covered call position.

- Green – Highlighted green implies a position which I made some or all the money I intended to make.

- Red – Highlighted red implies a position which I loss money.

- Black – Highlighted black implies an open position which I cannot yet render a gain or loss assessment.

Covered Call

- 11/20 Bought to Cover 5 TWLO Dec17 32.50 Call @ $0.17

- 11/20 Sold 5 TWLO Dec17 27 Call @ $0.56

- 11/20 Sold 2 ACIA Dec17 40 Call @ $0.75

- 11/20 Sold 3 AAOI Dec 22 ’17 48 Call @ $1.30

- 11/20 Sold 1 AMGN Dec17 170 Call @ $2.75

- 11/29 Bought to Cover 1 AMGN Dec17 170 Call @ $5.35

- 11/30 Sold 1 AMGN Dec17 177.5 Call @ $1.25

Secured Put

- 11/14 Bought to Cover 2 GOOS Nov17 21 Put @$0.05

- 11/14 Sold 1 ROKU Jan19 35 Put @ $3.60

- 11/20 Sold 1 ULTA Dec17 210 Put @ $11.50

- 11/29 Bought to Cover 1 ULTA Dec17 210 Put @$0.05

- 11/29 Sold 1 ULTA Dec17 200 Put @ $2.70

- 11/30 Sold 1 NVDA Dec17 187.5 Put @ $2.05

Long Stock

- 100 AMGN* with $172.48 cost basis

- 500 TWLO with $39.90 cost basis

- 200 ACIA with $57.65 cost basis

- 300 AAOI with $58.18 cost basis

*Dividend – The ex-dividend date for AMGN is 11/16, so I will earn a dividend as well during this time because I’m long the stock.

Previous Positions Analysis

Repairs

I’ve had a really good year trading options. In fact, so good it surprised me that I didn’t think I put aside enough for the taxes I would need to pay on capital gains.

I am still repairing positions in TWLO, ACIA, AAOI, and AMGN, but as of writing this, it appears AMGN with its price at $184 will be called away from me at $180 strike price. Considering what I mentioned in my November post about this being a cornerstone type of stock, I may very well put on another position in AMGN at $180 on the put side.

Successes

ULTA, GOOS, and NVDA all wind up being good trades. I got the directions right on ULTA and GOOS during earnings and collected nice premiums as a result.

This Month’s Positions

Here are the trades I entered for this month which are either a continuation of, a new, or a closed position. Options will expire on the 3rd Friday in January (January 19th), unless I close early, roll up, roll out, or roll up and out of a position(s). I have some positions this month that I planned to close earlier then that. Furthermore, I list the position taken in companies by their stock ticker symbol, i.e. ACIA. If you want to know who these companies are, here’s the part you need to do a little research:

Covered Call

- 12/4 Bought to Cover 1 AMGN Dec17 177.50 Call @ $3.70

- 12/4 Sold 1 AMGN Jan18 180 Call @ $4.97

- 12/7 Bought to Cover 3 AAOI Dec 22 ’17 48 Call @ $0.10

- 12/8 Sold 3 AAOI Dec17 40 Call @ $0.50

- 12/15 Bought to Cover 3 AAOI Dec17 40 Call @ $0.10

- 12/15 Sold 3 AAOI Jan18 40 Call @ $1.98

- 12/15 Bought to Cover 2 ACIA Dec17 40 Call @ $0.30

- 12/15 Sold 2 ACIA Jan18 40 Call @ $1.65

- 12/15 Bought to Cover 5 TWLO Dec17 27 Call @ $0.03

- 12/15 Sold 5 TWLO Jan18 27 Call @ $0.58

Dividend

- 12/8 AMGEN INC CASH DIV ON 100 SHS REC 11/17/17 PAY 12/08/17 $115

Secured Put

- 12/4 Bought to Cover 1 ULTA Dec17 200 Put @$0.80

- 12/4 Sold 1 NVDA Dec17 182.50 Put @ $4.65

- 12/15 Bought to Cover 1 NVDA Dec17 187.50 Put @ $0.01

- 12/15 Bought to Cover 1 NVDA Dec17 182.50 Put @ $0.15

- 12/18 Sold 1 YY Jan18 107 Put @ $3.10

- 12/18 Sold 2 MU Jan18 42 Put @ $1.83

- 12/18 Sold 1 SWKS Jan18 95.50 Put @ $3.30

- 12/29 Sold 1 GOOS Jan18 30 Put @ $1.10

- 12/29 Sold 1 AAOI Jan18 38 Put @ $2.50

- 12/29 Sold 1 NTNX Jan18 35 Put @ $1.15

Long Stock

- 100 AMGN with $172.48 cost basis

- 500 TWLO with $39.90 cost basis

- 200 ACIA with $57.65 cost basis

- 300 AAOI with $58.18 cost basis

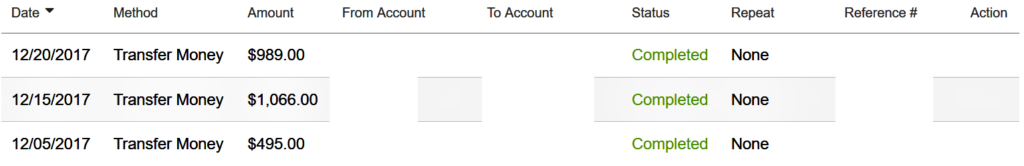

I was able to make money trading monthly options this month of $2550 with these positions including a dividend from stock ownership of AMGN.

My Trade Psychology

I had a few stocks like TWLO, AAOI, and ACIA that I rolled the positions down because the price had gone down in the stock. I wanted to ensure I managed the position to keep premiums coming in if to further reduce cost basis if price is going to continue to drop. With earnings season in swing, let’s see if my fortunes change in these names; otherwise, for me it will just be more biding time.

I hope you notice the dividend received from owning AMGN that also a benefit of owning stock while you trade options. This is like the cherry on top.

I have taken some fresh positions in companies like SWKS and YY that look very compelling after researching on IBD. I continue to find trades that are attractive valuations with good premiums.

Last Post on Make Money Trading Monthly Options Series

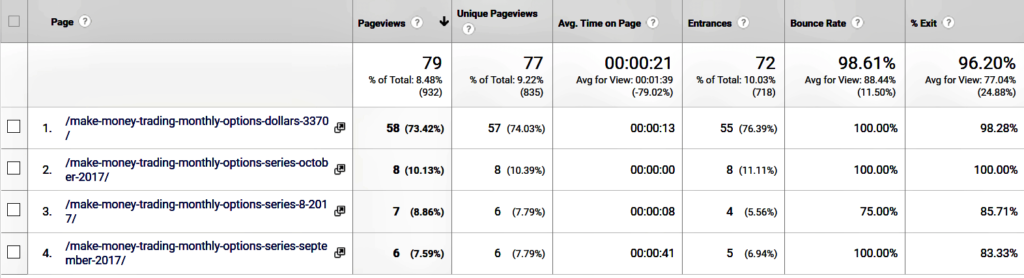

I thought writing post in this style was detail readers were looking for to get started trading options. However, statistics appear to suggest otherwise. I am too soon or readers were just not interested. Based on Google Analytics, my bounce rate on these post are 98% and average time on page was 21 seconds. Due to the time I have to take to reconcile my trades and write these posts, I don’t think it’s worth the energy at this time. With that said, I will still write on how and why I believe readers should learn to trade options. If you have substantial IRA, 401K, or brokerage balances, you especially should know how to use options to your advantage when redeeming your securities for cash flow. I will discuss more around topics like this.

In Closing

This is the end of this series unless by popular demand and reader questions, it be requested to come back. If you are interested in trading options, existing post on this subject can be found under my Investments page (I’ll consolidate these as well in future post). They are a good guidelines for doing, particularly, covered calls and secured puts. I do hope there is more of an audience for this topic in the future as it is truly a wonderful avenue to produce cash flow much like real estate.