Holding Onto Our Assets

The post suggested in the featured image is, “Cash Flow from Trading Options in the Stock Market”, because on this platform and in real life personal relationships, I’m pushing for people to have transformative change in terms of their personal finance. This is the information not taught in school that the ‘rich’ master and we don’t. It comes down to the choices we make each time in situations like I share below that separate them (the rich) from us. Our choices come with their own set of consequences. In this case, if they follow their traditional train of thought, I think they will be materially richer but financially poorer.

Why? In my opinion, it’s too often, we (the not rich) make poor choices with our assets because we are too shortsighted. Instead of holding onto our assets (cash, land, real estate, stocks, credit, etc.) and leveraging them to our advantage, we give them up. In fact, all too easily. And what are we often getting in return? Another liability. I think they have better options than what they are considering choosing, but the choice is theirs. Follow side narrative and text conversation below.

Unlocking Access to Home Equity

I got a call a couple of days ago from someone I know with a situation they were trying to address. They know I typically have good credit score, but times have changed where my score isn’t what it used to be. So, I couldn’t help to add as authorized user. They are trying to tap home equity line of credit (HELOC), but despite them having 700+ credit score, their credit rating is a ‘C’. What was holding them back from having ‘A’ rating is the credit utilization on their credit report. It is at 92%. If they had access to capital to pay down the credit card balance, their fortunes might change. Their utilization would be 0% leading to ‘A’ credit rating; therefore, the key for them unlocking access to home equity.

Capital Needs

Hmm, can I help them in their capital needs and if I do when will I get my money back? So, I needed more information on how this home equity plan is supposed to work. They did some leg work to know the appraised value of their home and how much they could get out.  Also, they were familiar with loan process and possessed a degree of confidence they can be approved. Once the process was completed, I would get my money back with interest for the 2 months it would tentatively take. They have been good paying me back before. I like the prospect of getting this money and previous money I lent back with a little interest. In addition, I would be helping them solve a problem they have, right?

Also, they were familiar with loan process and possessed a degree of confidence they can be approved. Once the process was completed, I would get my money back with interest for the 2 months it would tentatively take. They have been good paying me back before. I like the prospect of getting this money and previous money I lent back with a little interest. In addition, I would be helping them solve a problem they have, right?

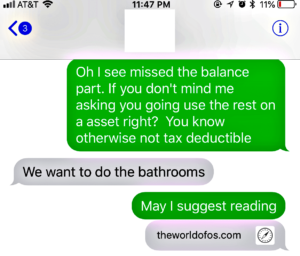

Mentality Mantra

If you don’t mind me asking, what is this needed for? HELOC not deductible with new tax law except if purchasing or repairing/improving home. I have done cash out refinance before on rental properties I owned to tap equity. That was nothing new, but I was always doing this with intent to leverage more assets that could generate cash flow. They said it was to do the 2 bathrooms in their house. Oh man, tapping the equity for lower interest rate compared to what they were paying previously was sounding all good. Taking equity out of house was nice move. I like nice new bathrooms, but that was deflating to hear an asset acquisition wasn’t on the horizon.

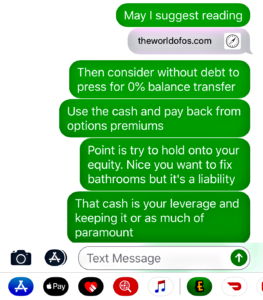

My mentality mantra, “Leverage assets and use cash flow from those to pay for your liabilities”, kicked in. I wanted them to know, at this very moment, there was an opportunity for this. I feel like I’m fighting a losing battle in trying to convince people that I’m not special and you too can do what I’m doing. It requires a change in mentality, but it’s the choices you make today that shape your tomorrow. The thing is that you can’t give into that need for instant gratification. It is so pervasive in this society to the point it corrupts having better long term options that favor you.

Leverage OPM

I try to explain that before it’s too late to reverse decisions and actions made. Give yourself more time because now you will have impeccable credit score and cash(equity) to leverage. Heck, consider doing one bathroom and the other later. Just don’t give up the things which give you leverage very easily. Money (other peoples money(OPM)) is still very cheap and they are giving access to it to people who are good credit risk as determined by your credit score. Now, you’d be in that select group. The balance transfer offers my wife and I received are fantastic and we’re using them. I get offers still on credit cards I have already maxed out (funny Barclays).

Don’t Give Up Equity So Easily

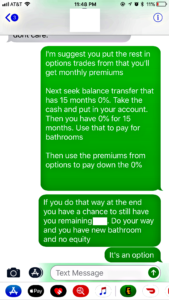

My thinking was don’t give up your equity so easily. Here’s how I would play this given what I know now and shared in the text and this post. I could help acclimate them to trading options. I lean towards trading options for ease of liquidity and ability to generate cash flow. There is even opportunity for partnership towards real estate. Nevertheless, the point is, there is a way to get the bathrooms you want and keep some of your equity. I assume they’d settled on and have the discretionary income to pay on the HELOC. After they pay me out, what’s left over is truly their ‘unfettered’ equity.

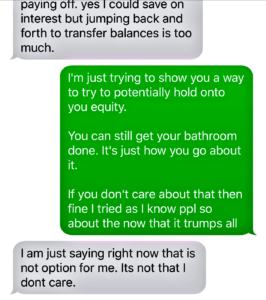

Their plan is to use it towards improving their bathrooms. So, you’ve essentially refinanced previous credit card at a lower interest rate, which is good, but you’ve added the cost of bathrooms to that amount. You still have to pay off the HELOC, but what if you leverage your new credit score/credit rating to secure 15 month 0% balance transfer where you can deposit OPM into your account? You use OPM to generate cash flow through trading options. That cash flow, net of tax, could pay towards your HELOC balance, which was used to pay for your bathrooms. You should still be eligible for deduction because you did improve your bathrooms. Of course on the balance transfer, I would just pay the minimum payment. As the 15th month approaches, liquidate your options account balance to pay back the balance transfer. Hopefully, despite market volatility, that initial balance is as close to what you started with give or take.

Yes, it’s true you’re probably not going to be able to pay off the HELOC in the 15 months. But guess what, if you can be patient and continue to leverage your credit using OPM via balance transfers. In conjunction with trading options as your cash flow generator, you’ll have something to put towards the HELOC balance. This spread between what you would have been giving up is your saved equity.

Hypothetical Example

For example, the HELOC has X cost for X duration. Assume your monthly cost is $300. Over 15 months, if your average monthly cash flow from trading options is $200. That’s 2/3 less of the cost that would come out of your pocket. When you extrapolate that out 15 months, that is $3K ($200 × 15). That is your retained equity.

Traditional vs Suggested

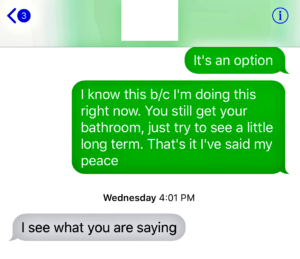

Nope, it’s not quick, but look at the possibilities. The traditional plan gets you a lower interest rate on your debt, deduction, 2 new bathrooms, and no equity. My plan negates none of the former, except the no equity part. It adds the ability for you to keep some of your equity, per example above, through leveraging your credit to use OPM and trading options as a cash flow generator to pay off HELOC balance. In addition, the latter teaches a life long lesson that can potentially be done to perpetuity. My plan is not the traditional train of thought for the non-rich, but this is the type of situation in which ‘rich’ and ‘non-rich’ diverge.

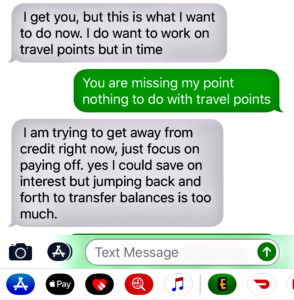

Burnt By Credit

It’s hard for people that have been so burned by credit working against them that as soon as they have a chance for better access and terms they want to get away from it. Instead of working to improve how and for what purpose they use credit, it’s easier to follow the cut up your credit cards philosophy and leave so much ‘our’ money on the table.

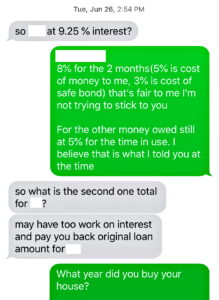

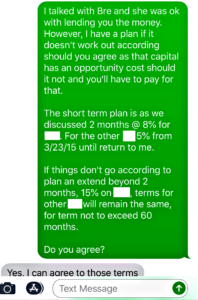

My Terms for Loan

I still need to consider the risk that things don’t go according to plan and amount owed will be higher and take time before I could be paid back. That is a worst case type situation since there is opportunity cost for that capital that I’d lose out on. In addition, I have a cost too for the capital of 5% as it’s a policy loan from my whole life insurance policy. Therefore, I asked what is contingency plan if I don’t get back the money right away? This is business and nothing personal, but I needed terms attractive enough for me to be cool waiting and/or unattractive enough for them to want to get free of. As result, here was the terms I set forth in the arrangement.

In Closing

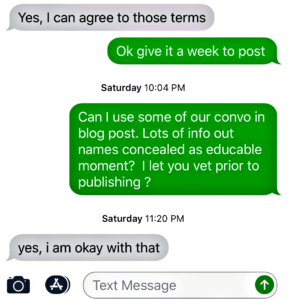

First, I sincerely hope that in reading the case I’ve laid out in this post that they choose to hold onto their asset, which in this case is their equity. Still do the HELOC, but couple with the balance transfer and trading options strategy. If they are open to trying the non-traditional approach, they still get what they originally desired and more. I thought this was such an educable moment that I asked could I share. I know they are not the only ones that are in or will be in this situation. So, like I pose to them there are ways to hold onto our assets, but what will you choose?

Joke: