Floss vs Boss, Which Are You?

Floss vs Boss, Which Are You?

So often I have been conditioned on the perception of what rich looks like is not always what rich is. So, I wanted to define when a person(s) was just a floss vs Boss with capital B. Since, I’m after influencing mentality in regards to personal finance and giving food for thought; hopefully, this stokes that fire for financial literacy.

There is a material rich and an actual rich and they sometimes overlap in real terms. However, only when in proportion to the financial metric that follows is it real. The metric I will use here to differentiate whether someone is a floss vs boss is net worth.

Net worth (assets − liabilities = Net worth) is the amount by which your assets exceed your liabilities. The larger and more positive the number the more of a boss you are. By contrast, the more negative and larger the number the more of a floss you are. I chose this metric to remove the question of income from the equation. It in turn focuses much more to financial literacy in action.

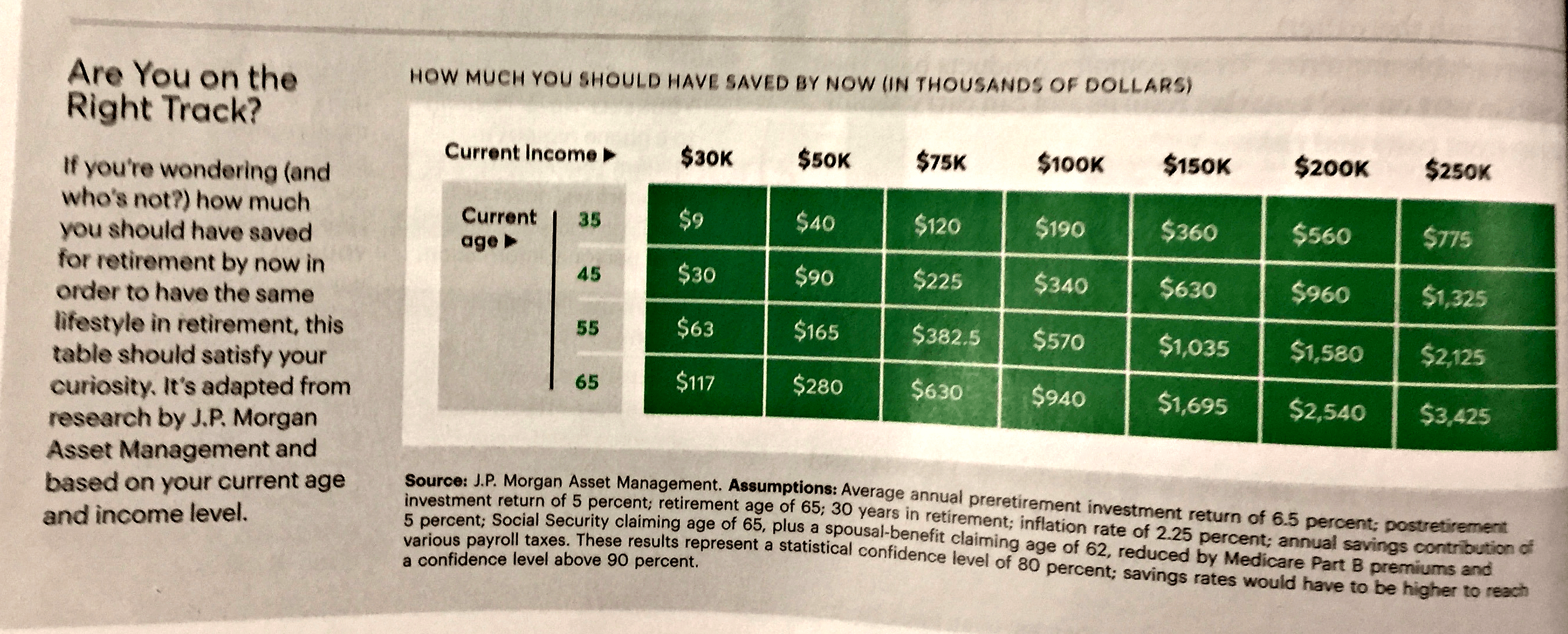

Everyone wants to think they are a boss no doubt and no doubt you should think that of yourself. This is more in the realm of a financial check-up vs psychological one. So, I’m not here to try to ruin your self-image. This is reality check for where you are financially. Based upon my age(40) and income(column 3) shown in the chart below, I’m in line with being a boss. Although this is the case now, my net worth has gone from −_ _,_ _ _ (5 figures) to +_ _ _,_ _ _ (6 figures). This happened only in the last 10 years.

As I’m a bit of personal finance junkie, I found this chart when going through a magazine. It measures by age and income if you have saved as much as you should to retire and live as you do today. As an aid, you too could measure how much of a floss vs boss you are with your finances. Though it mentions retirement, it is an accurate measure because a lot of people have a large part of net worth associated to retirement accounts like a 401K or IRA. Nevertheless, if your overall net worth is within or over the box allotted, then keep bossin’! If not, than stop flossin’ and start working to be a boss with your finances!

You have seen what it looks like to have wealth in such things like fine luxury cars, big expensive house(s), jewelry, brand clothing, etc. Frequently, people floss with these items. However, it doesn’t have to be the finest of these in order to be flossin’. Everything you have within proportion to a growing overall net worth can be fine if you are still close or within the box in the chart above. However, if it isn’t, it means your flossin’ has you living over your actual means irregardless to whether you are in Mercedes or Toyota. That shows up in the net worth calculation.

If you have some time and are not afraid of a reality check, calculate your net worth and measure where you are by the chart above. Are you a boss? Or are you a floss? A quick money management tool I use to get and keep track of my net worth is Mint.com. It gives you a comprehensive snapshot of your overall financial health by allowing you the ability to have a centralized view of your finances. You can link bank, brokerage, retirement, loan, and credit cards accounts in one place. Also, you can do this manually on paper or spreadsheet/online calculator like here by listing out all your assets and liabilities and doing the net worth calculation above. The former being easier to do because it dynamically does so for you as your financial picture continually changes.

You may or may not have status symbol to point to the fact that you are indeed rich or wealthy, but when you’ve done this exercise you’ll know in yourself that you are a boss if that number is nice, large, and growing. If you choose to measure yourself against someone you believe is doing so much better than you, then measure yourself against a metric that is income neutral to see who is really wealthy. So, floss vs boss, which are you?

Investing Starts With Saving - The World Of Os

October 10, 2017 @ 6:14 am

[…] waste my time and energy writing that investing starts with saving? Because I know that people floss more than they are boss. Statistics show that 63% of people can’t cover unexpected expense of $500. That means […]