Experiencing Award Travel Payoff

In the last week of March, my wife and I were able to experience 2 wonderful things, the wedding of her sister in a Nigerian and American traditional ceremony on two separate days in Washington, D.C., and award travel continuing to payoff. The maximizing of award travel started for us in 2016 and it is still paying dividends. How so? 2 of the 5 days of our stay were free. I decided not to use points for 3 of the days because the room price was reasonable. In addition, there was a promo that would result in additional points for paid stay. The round trip flight on Southwest for 2 people was paid for with Chase Ultimate Rewards(UR) transferable points. A retail cost, excluding food and Uber, that could easily be $2,000 or more for flight and hotel accommodations, we came away $458 out of pocket.

The Payoff

I read that as a blogger, I should try to solve a problem for my readers. So, there are a few problems I hope to solve for you in this post and it is:

- Paying more for travel (flight and hotel accommodations) and experiences than is necessary when opportunities exists to bring this cost down is possible

- Putting self imposed limitations on yourself because of lack of knowledge of the extent to which you can push this is artificial

By paying potentially much much less for travel and experience, that means disposable income that can be directed into investment. I don’t know about you personally, but I know statistically many people are living paycheck to paycheck with little or no savings. Yet they still like to travel. Personally, I am not to proud to take any breaks where I can get them. I tell my wife all the time, “baby, we have not arrived!!!”.

I will be very clear in stating that working towards award travel doesn’t at all mean seeking stuff to buy on credit card that you wouldn’t otherwise. In fact, it’s the opposite. It’s putting your budgeted normal spend on items like food, utilities, fuel, mobile phone, cable, day care, etc on a credit card. Particularly on credit cards with large sign-up bonuses.

Also, this is not meant to encourage you to get into more debt, especially credit card debt. This is intended more for readers with good personal finance habits. You may be on the fence about using credit because of self imposed limitations largely due to lack of knowledge. I’ve been there myself. I once thought the 50,000 point bonus I got for signing up for the Barclaycard Arrival Plus was tops. After that I just thought I was to stick with that card putting all my spend on it. I just didn’t know what I didn’t know. It’s the creditable information on sites like follows that can enlighten:

Creditable not only because I say so, but because it can be proven to be factual.

This Is Not Alternative Facts

Below is our recent itinerary for stay from Mar 27 – Apr 1 for Washington D.C. trip.

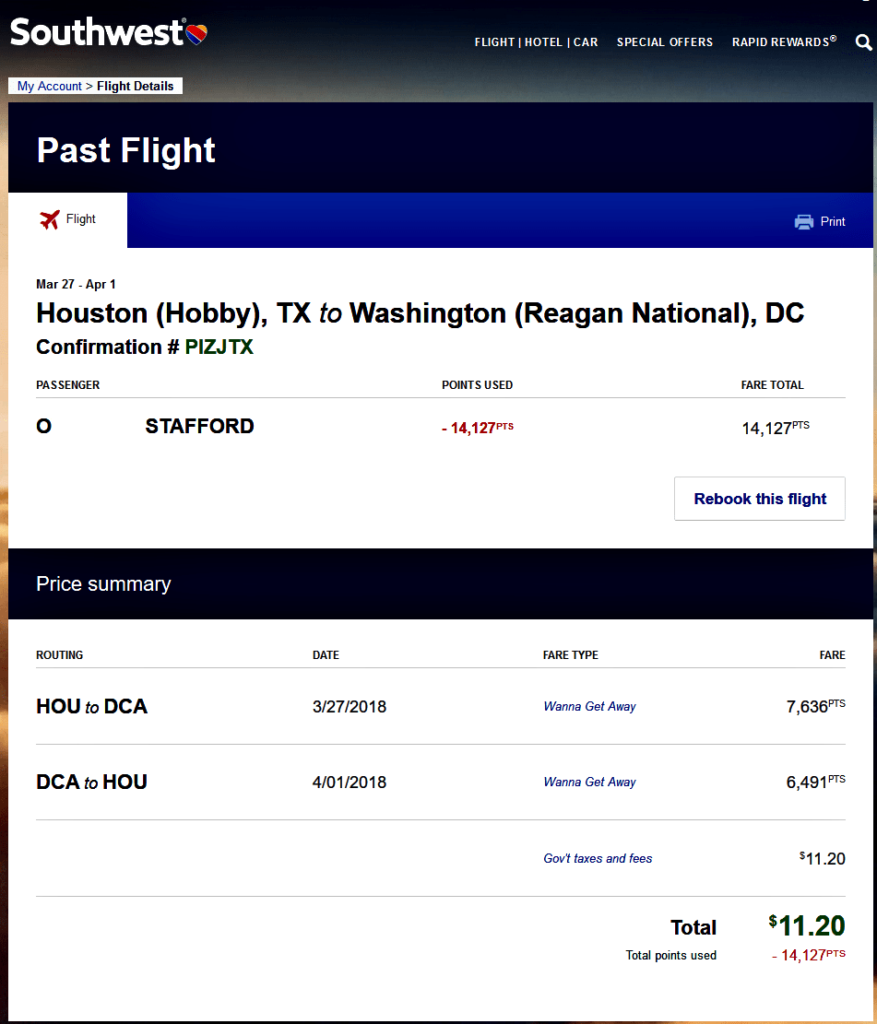

Flight

The flight was 14,127 points I transferred to a partner of Chase Ultimate Rewards(UR) which is Southwest.

Hotel

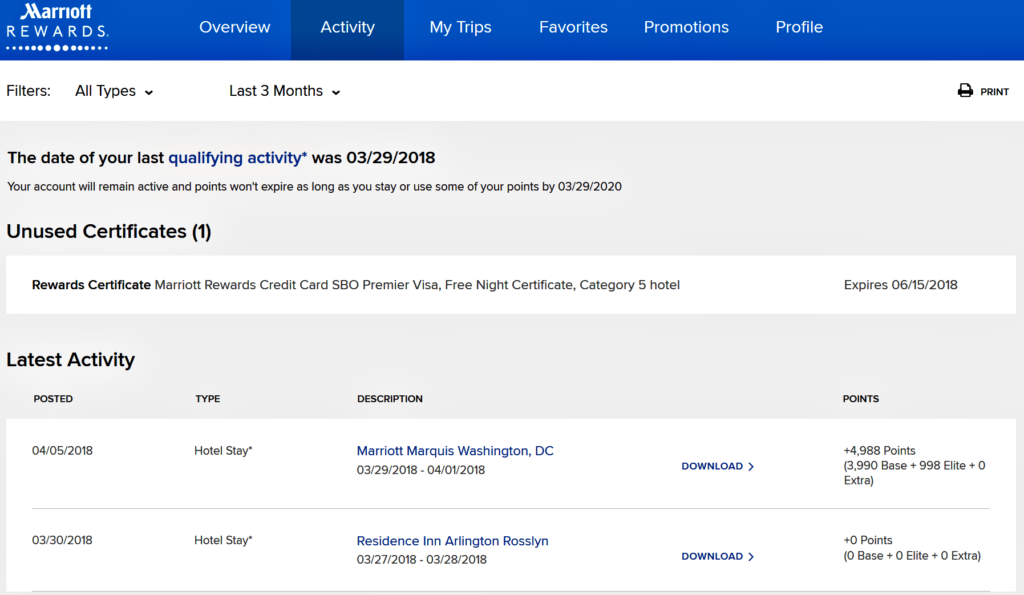

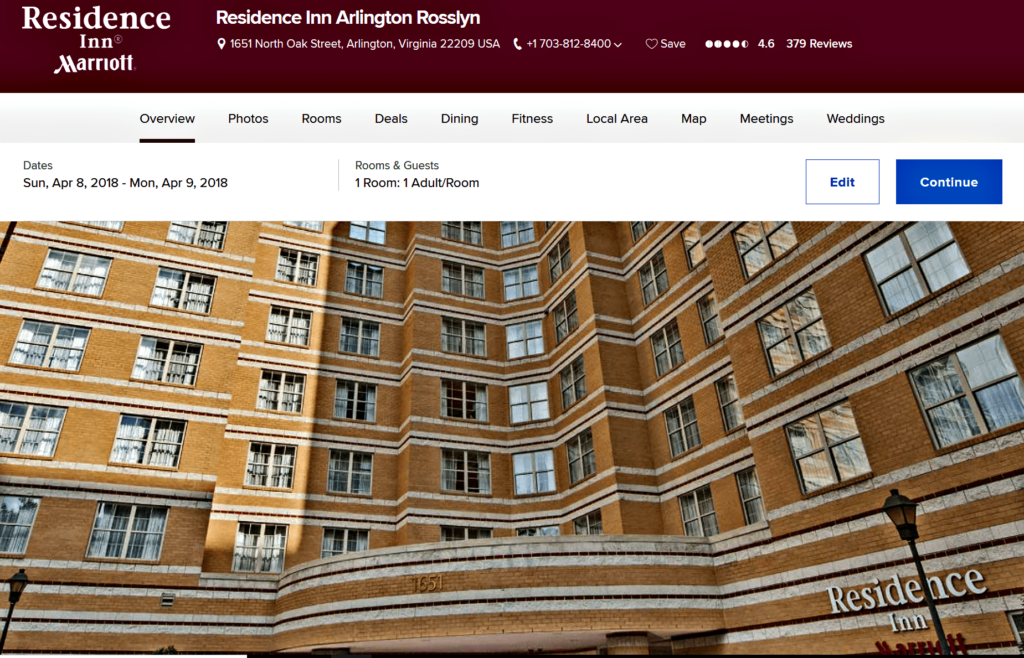

The 1st free hotel stay was using a Marriott free night certificate at category 5 hotel. We stayed in Residence Inn just outside of D.C. I obtained free night on 1 year anniversary by way of the following credit card:

Chase Marriott Rewards Premier Business

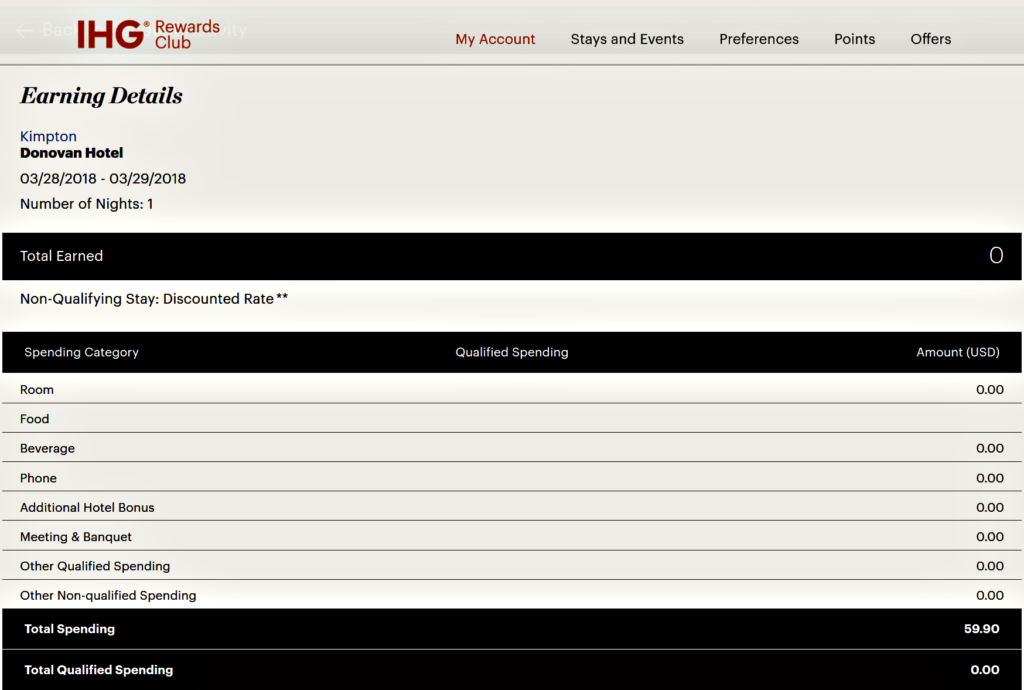

The 2nd free hotel stay was using a free night certificate in downtown D.C. I obtained free night on 1 year anniversary by way of the following credit card:

Chase IHG Rewards Club

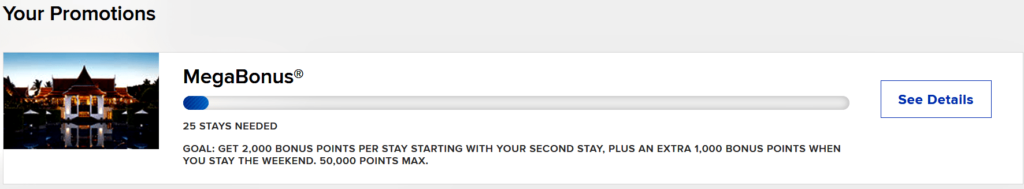

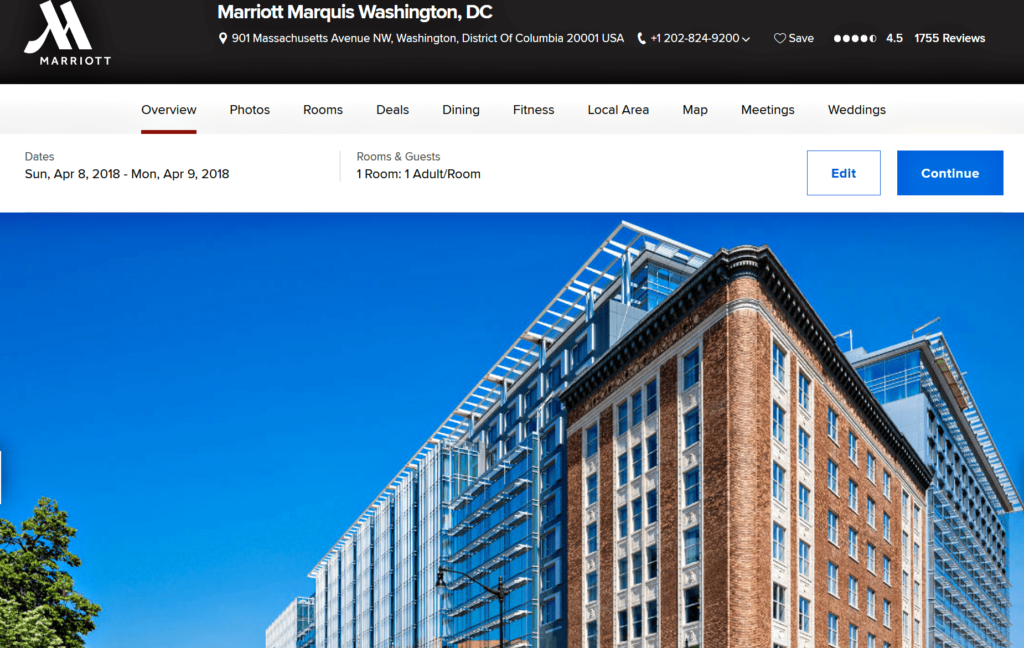

For the remaining 3 nights, we had paid stay at Marriott Marquis Hotel for $133 per night. It was better in this case to pay as opposed to using points. The redemption rate for the 105,000 points I had was not good; thus, I paid and coupled with the promotional offer below:

These were nice rooms to stay in.

Ready to Take Plunge?

Although my blog is not a full fledged travel blog, I’m my own test case for proving it works. I’m continually shown that award travel not only works but pays off in a major way. I view TheWorldOsOf.com as a bit of a conduit to transfer my own knowledge and experience in the topics I write on with hopes that what I’ve learned might help you. Convincing you on the other hand to take the plunge is another matter.

Have you every heard the saying, “Stuck on Stupid”? So many readers that are fully capable of doing this on a regular basis are either unaware or are just happy to remain in credit card cruise control. In fact, instead of the question being how can I do this, they would rather continue to enact and live in their very own self-imposed restrictions.

There should no doubt be a restriction that the amount you spend on credit card does not exceed the money you have to pay with. You should aim to pay the entire balance 100% of the time each month; otherwise pursuing award travel is counter productive. If you are going to have a small balance, free cash flow should be able to payoff in no more than 3 billing cycles.

However, the aforementioned is not the restrictions I speak of. Instead it is around how many credit cards at any particularly time you feel you are privy to have. Without going into detail here, I discuss this in the post, Loyal Only To Next Big Sign Up Bonus. So often I come across people I tell this to that are working off credit card myths.

I am not saying credit card issuers do not have restrictions because they do. As you become eager to learn more about award travel, there is plenty information on the internet what card issuers restrictions are. I often prowl FrequentMiler.com for best offers and restrictions.

Are You Stuck on Stupid?

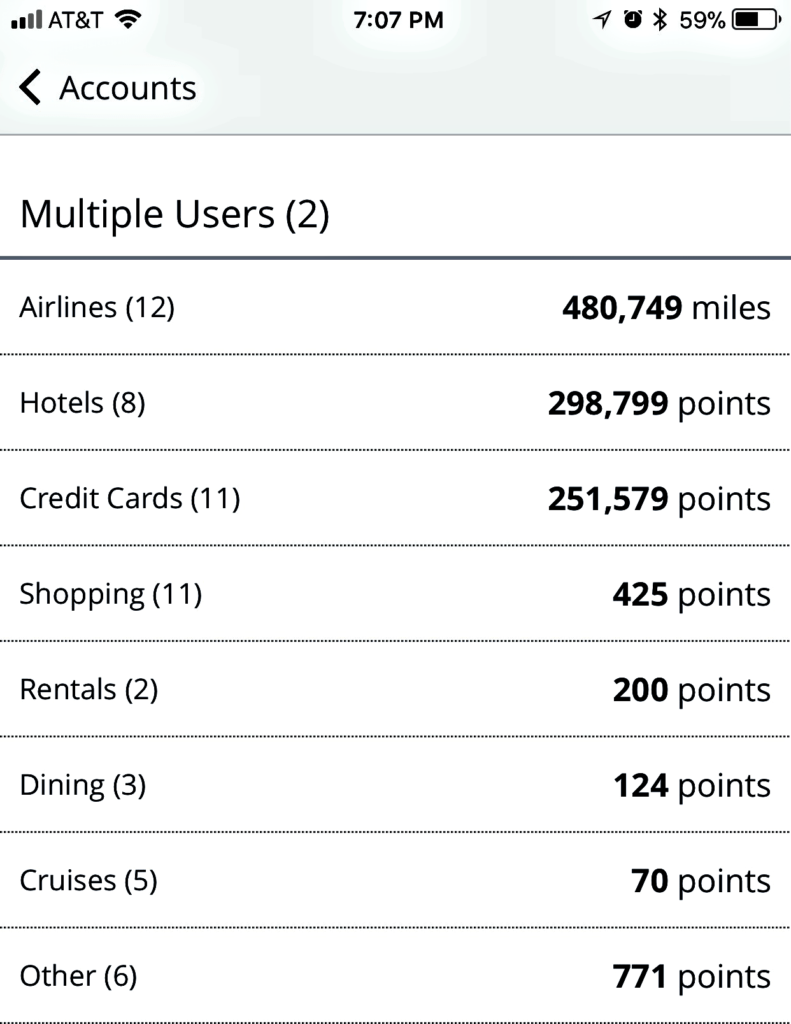

If at this point, you’re not convinced and you have one or two credit cards you received a bonus on 5 years ago and you look no further because you say, “I can’t keep signing up for different cards with large sign up bonuses”. Is it really just you don’t know you can or is it more you won’t because of your own self-imposed restriction. Is your stance based on fact, or is this the stuck of stupid mentality I mentioned early. If what you say to yourself about can’t is true, how do you explain 20 cards I have or the 1 million+ points/miles below my wife and I accumulated?

All of which aren’t reflected here because I have opened and received the bonuses and either closed and/or downgraded since 2016. I understand perfectly that all will not be able to sign-up for business cards like some shown; however, nothing limits you from personal versions, am I right?

It’s up to you.

In Closing

I really hope the feeling you come away from this post with is:

- I could be saving a lot of money on travel and experiences if I follow a different approach.

- Just didn’t know how far I could push this before seeing some example proofs like above as far as the trip and the number of credit card I could potentially use.

If you are not going remain stuck on stupid or in credit card cruise control and are ready to take plunge consider the Chase credit cards first. I lay out strategy in this post, Award Travel with Chase Credit Cards. I show my experience with award travel continues to payoff and I am ecstatic about being able to travel for less. What about you? Happy travels!

PS Congrats to Emerald and Tulo on their beautiful matrimony. It was fun! I leave you with song from wedding — Davido, “If I Tell You That I Love You”