Entrapment of Expenses

I was listening to Stacking Benjamins podcast and a guest used the phrase “Entrapment of Expenses” to describe how by varying degrees an added expense burden can be self inflicted. An example being we need a car to easily get around, that’s a pretty common and normal idea. However, which car do we choose? Is it one that is economically feasible or not? Will that choice potentially extract more than needed from our income? Our choices which lead to more an entrapment of expenses can only diminish our ability to not live paycheck to paycheck, to be able to save more, and to have more discretionary income.

Pressure, Pressure

Social media can’t be to blame for people wanting to appear other than what they are. Prior to the age of social media, I remember pressure as a youth to purchase brand name cloths and the like. As we get older, I suppose those material effects transport into other material effects. Today, I find myself more interested in purchasing the stock of brands I use to think it was only my duty to be a consumer of.

I think sometimes it’s a mistake by us to overstate what we think we deserve or what we can afford. In addition, without a budget in place to see income inflow and outflow, we could easily live in a delusion that we can afford more than what our income allows for.

The image of living a conservative lifestyle is not viewed as cool enough. I believe our lifestyle is pretty conservative, but probably nothing to be glamorized. Yet, the bullet list below is more of a model middle class families should take as ideal and real cool.

Potential Middle Class Model

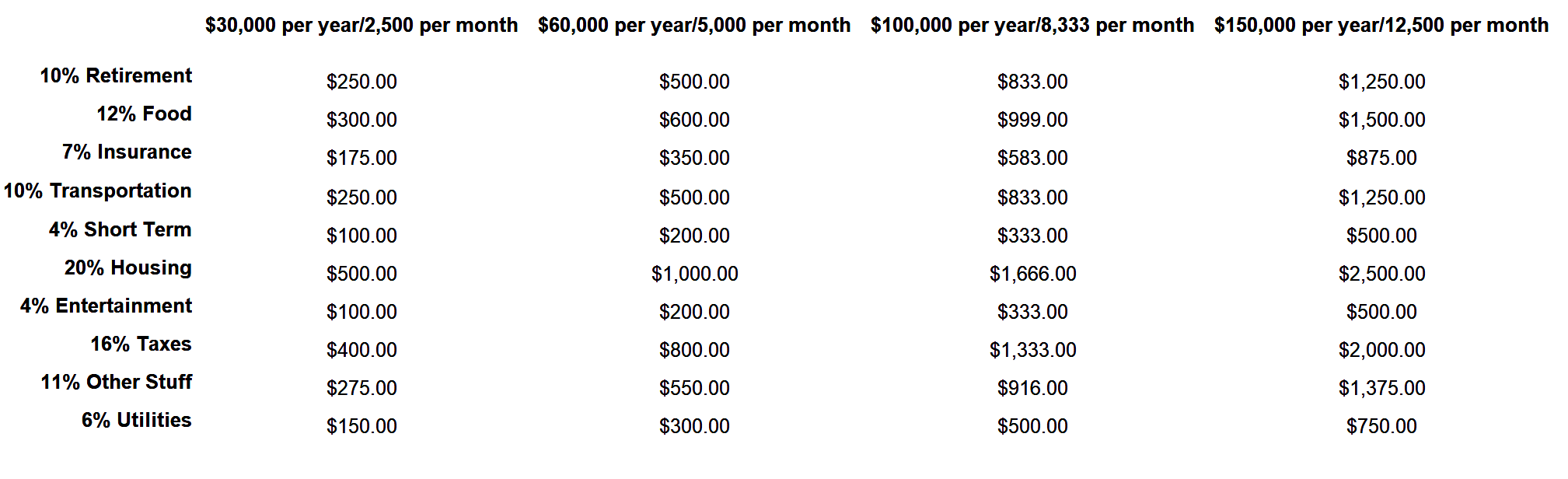

In the chart below, we fit in 100,000 lifestyle. Here is brief synopsis our lifestyle.

- A 3/2/2 1333 sq/ft house in a suburb of Texas that was purchased under $120,000. We’ve lived there for the past 9 years

- 2 cars, one which is 12 years old and paid off, and 1 new financed car

- Coverage of Life, Long Term Care, Medical, Dental, Flood, Property, and Umbrella Insurances

- Investments in 401K, Roth IRAs, brokerage accounts, precious metals, and pension(s)

- Own 2 rental properties

- Side hustles in Online Blogging, Hair Stylist, Football Officiating, and Award Travel

- Relatively low credit card debt

- $0 student loan debt

- $0 personal loan debt

No children yet, and that and good financial fundamentals has probably certainly allowed for us to have a much higher net worth. As of writing this, my wife is in her late thirties and I in my early 40s.

I by no means say praise money, but use money to live a life well lived. The more you are able to escape the entrapment of expenses, I believe the more likely your life will be enriched, even if you might assume it’s less cool.

Lifestyle Charts

The chart breaks down 10 categories we all likely have commonality of need for, poor and middle class families alike. It displays, based on gross income, how much money should ideally go to each of these categories. I use the pie chart of an USAA article I read years ago as the model.

The experience of champagne mind and the welfare pocket book, are you living it? Judge for yourself if you have entrapped yourself in some expenses. What now must you forego or rob from another category above as a result of an entrapment of expenses?

It is important not to have such entrapment because if income ever is interrupted for extended period of time, we can easily go from good to bad to worst.

People front!!!, afraid to seem to others like they don’t got it all. It reminds me a little of the movie I recently seen called Girls Trip. People grow up learning things that they entrap themselves in and become defensive to protect even if to their detriment. Instead of learning good personal finance measures, like how their expenses compare to above chart, or unlearning bad personal finance habits, seems there is doubling down on doing what we’ve always done. I’m just holding up a mirror to view yourself.

Resolve To Un-entrap

In seeing this information, if this is you, resolve to un-entrap yourself from expenses over and above your means. What does that mean for you? A need to make more income, to cut back on expenses, or both. That decision is up to you. However, I’ll be here continuing to speak on topics of personal finance, challenging the psychology preventing us from doing better financially.

Mint “Free” Money Management Tool

Ways To Reduce Debt With A Plan

Addendum To Ways To Reduce Debt With A Plan

In Closing

We know our own personal financial circumstances, good or bad. You know if this is you and I’m just acting as the mirror into which to see yourself in relation to your financial circumstances. If you are over-extending yourself to out do others in your lifestyle to feel better about yourself and where you are at, don’t do it! Consider living a conservative lifestyle more within the framework of the chart above. You don’t have to be entrapped by your expenses!