Couple Necessary Spending with Sign-Up for Credit Card with Huge Bonuses

There can be times when spending 3K – 5K may seem daunting for a credit card sign-up bonus. However, sometimes a window comes open that you know it’s absolutely necessary that you spend ‘X’ amount of money. Is the amount in the range of reaching an offer or close enough you can couple with normal spend? It is in these moments that you should be thinking to couple necessary spending with sign-up for credit card with huge bonuses. I am assuming you have saved or will receive the money that will be spent. There may not be an easier time to assure you can meet the terms of a credit card offer.

This has recently happened to me. Unfortunately, Hurricane Harvey impacted one of my rental properties. An insurance claim needed to be made for the repairs. I knew I was going to have to pay my deductible and I would get check from insurance company. Also there are federal taxes that I may need to pay instead of getting return. In addition, I just closed on a rental property that will require a few repairs that can be paid with a credit card. Even before that, I had to pay $650 for appraisal, $375 and $125, respectively, for home and termite inspections. So, at times expenses stack up like the aforementioned. In turn, you could easily be able to hit the minimum required spend on credit card(s) with huge sign-up bonuses.

I don’t know about you, but I don’t like to easily part with my money. So, I ask myself if I’m going to have to relinquish my cash(an asset) what do I get in return? Sometimes it’s just the product or service. However, with credit cards, some unique opportunities arise. In return, you can get this alternate currency, called points & miles. They have value and can be exchanged later for flights, hotel accommodations, experiences, or even cash. This makes giving up my cash a little more bearable. I’ll describe later how I have or I am planning to turn this situation into a lot of points & miles.

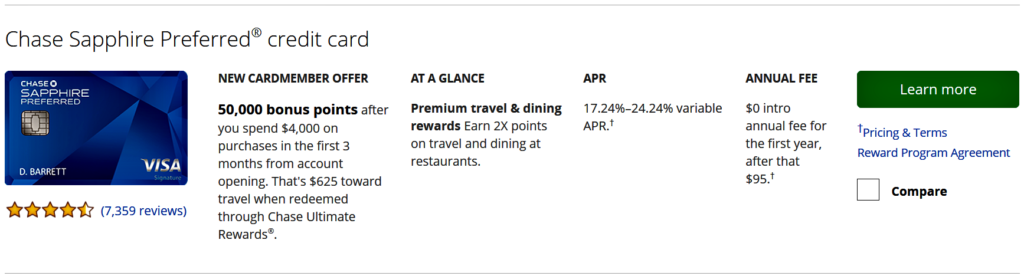

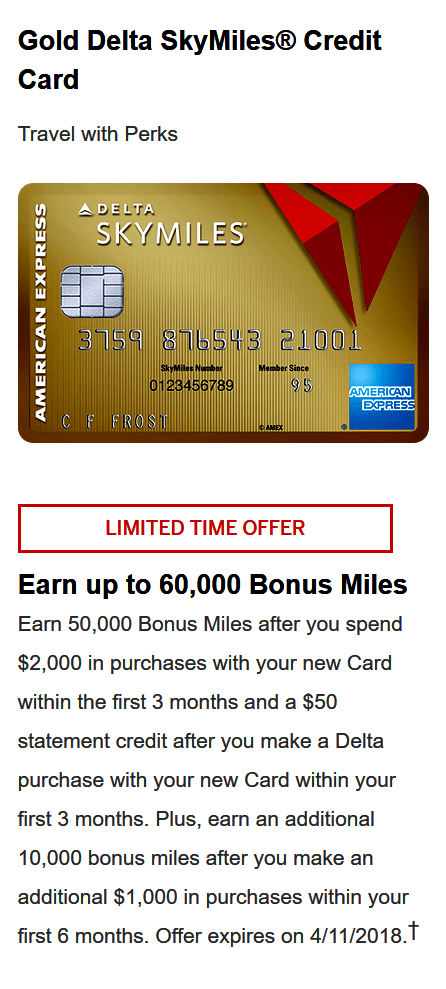

So, do you ever get offers like the below from lenders like Chase or American Express? If so, this is exactly the type of offers you should sign up for if you’re in a similar situation. This could be just what the doctor ordered.

You could sign up for both these offers and come away with 110,000 points & miles. Chase list in its offer that 50,000 points are valued at $625 toward travel. Typically a point/mile is worth ¢0.01 each. Thus, the American Express offer to the left would be worth $600(60,000 × ¢0.01). In turn, you would wind up needing to spend a total of $7,000. That’s a nice trade off compared to the alternative which is no perks for your spending. In my situation, my expenses will exceed that $7,000 total. Thus, for that I have multi-card sign-up strategy.

points are valued at $625 toward travel. Typically a point/mile is worth ¢0.01 each. Thus, the American Express offer to the left would be worth $600(60,000 × ¢0.01). In turn, you would wind up needing to spend a total of $7,000. That’s a nice trade off compared to the alternative which is no perks for your spending. In my situation, my expenses will exceed that $7,000 total. Thus, for that I have multi-card sign-up strategy.

American Express Gold Delta SkyMiles Business Credit Card

The Multi-Card Sign-Up Strategy

I discussed some of the expenses I had coming due. I have signed up for the following credit card offers to pad my wife and I points & miles balance for future travel both domestic and abroad. If successful on all these sign-up, it means and additional 540,000 points & miles (@ ¢0.01 each equivalent to $5,400). Why this is important is because we already have the money to pay off expenses charged to credit card. There is no guessing how we going pay for this.

Does this seem like an efficient use of capital? Personally, I think so because for my loss opportunity cost, at least, I’ll get the perk of points & miles in exchange for my spend on a credit card. My wife and I can then use these for travel or simply cashback. So, I’ll pay for these expenses with a credit card and then pay off the full balance on the due date.

Credit Card Sign-Ups Status

Me

- American Express Platinum Card for Schwab – 60,000 points (received bonus)

- Bank Of America Premium Rewards – 50,000 points (completed spend and awaiting bonus)

- American Express Gold Delta SkyMiles Business Credit Card – 60,000 miles (received bonus)

- Barclaycard AAdvantage Aviator Business Card – 50,000 miles (pending approval)

- American Express Hilton Honors Business Card – 100,000 points (approved – spend in progress)

My Wife

- American Express Starwood Preferred Guest Business Credit Card – 35,000 points (pending approval)

- Chase Southwest Airlines Rapid Rewards Premier Business Credit Card – 60,000 miles (pending approval)

- American Express Gold Delta SkyMiles Business Credit Card – 60,000 miles (pending approval)

- Chase Marriott Rewards Premier Business Credit Card – 75,000 points (pending approval)

Reasonable Consideration

I would like you to really really consider one thing, which is the alternative. You just get the good or service you paid for with cash, check, or debit card. Do you know that is money you can never ever make a rate of return on? So, if a lender offers to take the edge off of this fact by providing a perk, I think it is reasonable to accept, if and only if:

- you are not already swamped in credit card debt

- the bonus is compelling 25,000 points & miles or greater

- you can pay off the balance(s) in full each month

- your credit score is in the high 650 and above range

You aren’t locked into anything should you decide to sign-up and get the bonus and that’s it. Just be sure to keep open for at least a year. Then you can downgrade and/or close the card as it has served its purpose. That purpose is get something in return for having to give up your cash. Also, remember it doesn’t just need to be points & miles, it can be cashback or cash equivalent like a gift card.

Come Out Of Your Box

On TheWorldOfOs, I discuss opportunities pertaining to strategical use of credit cards. Trust me when I say it is hard to convince people, even those who aren’t in the except for list above, that this can work in their favor. Take for example my cousin, we are going on the European cruise together. In fact, he is the one who invited my wife and I. However, how much we paid and how we will get there is slightly different. Why? Our approach was different. I crafted a points & miles strategy to get us there. Here are the facts:

- We both got balcony rooms on the cruise ship

- My wife and I have business class flights to and from Europe

If I could have convinced my cousin to the legitimacy of this sooner, perhaps both our outcome would have been identical. Except it wasn’t. Unfortunately, my cousin likely paid a great deal of cash for the cost of cruise, we didn’t. It was later he came out of his box and listened to what I was saying, “sign up for these credit cards that have big bonuses…” As a result, although he didn’t have enough points for business class this time around, he and his wife are going to fly round trip to Europe with the 120,000 AA miles he got from signing up for Citi and Barclaycard offers below.

AAdvantage® AviatorTM Red World Elite MasterCard®

Citi® Platinum Select AAdvantage® World MasterCard

His pocket book thanks him. My wife and I are going on business class because I received this knowledge early on from others in this space. I was receptive and willing to play outside the box. My pocket book thanks me too. To be real though, without points & miles, I’m pretty sure I would not have gotten a balcony room nor flew business class. We simply could not afford it or would not want to pay that much for it. Luckily, we didn’t have that problem because of points & miles accumulated over time by strategically using credit cards with huge bonuses in conjunction with necessary spending.

In Closing

In my opinion, when you have to spend your cash, these are opportunities to turn loss opportunity cost into something more bearable or even desirable. You may have times when you can stack upcoming expenses with sign-up for credit cards with huge bonuses. These can become your way to vacation without guilt. However, you must be able to come out of you box and the sooner the better. Your pocketbook will be a lot heavier for it. Look to accumulate points & miles by strategically using credit cards with bonuses if you are not in the exceptions list above because the alternative not optimal.