Best No Annual Fee Credit Cards

Are you looking for the best no annual fee credit cards which still come with great benefits? If so, you’ve come to the right place. A no annual fee credit card is a good cornerstone to contribute towards good credit history. You are more likely not to close this credit card because an annual fee is on the horizon that you don’t want to pay. Thus, as of writing this, below are the best no annual fee credit cards to add to your wallet or purse for points/miles or cashback.

Take Your Pick

I’ve listed the credit cards in a sequential order of sorts to consider the cards in due to unique lender rules, cash back value, and flexibility. You don’t have to adhere to that order, but if you’re doing as points/miles enthusiasts, take heed. Choose the credit card(s) most likely to meet your needs.

I give a brief synopsis of the card, its perks, and sign-up link if you’re interested in applying. In all the examples below a point is typically worth 1 cent. So, if you earn 1.5% cashback or 1.5x points/miles, they are both equivalent to ¢1.5($0.015). In addition, points/miles do not expire as long as the card remains open.

Unless otherwise stated the type of points earned, redeemed, or transferred for Chase and American Express(AMEX) personal and business cards are the same. The only difference between personal and business cards are who can apply for business card(s) and the earning rate per dollar spent in categories. Please note that the bonus(es) depicted in the images below are transient; whereas, the general earning rate structure is consistent. And the listed order is somewhat slanted more towards that consistency post-bonus.

Personal Credit Cards

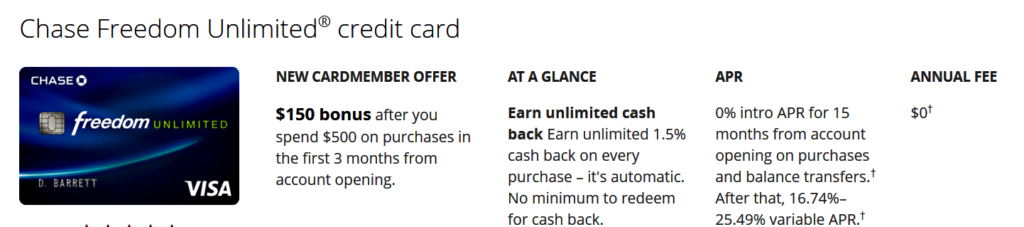

1.) Chase Cash Freedom Unlimited

The Chase cards listed here and below earn Ultimate Rewards(UR) points, but UR points can be redeemed as cashback. UR points can be used on Chase’s Ultimate Reward portal to book travel, entertainment, purchase merchandise, or as a statement credit. So, these rewards are pretty darn flexible. Unless you have a premium card like the Sapphire Preferred or Reserve or the Ink Preferred, you cannot transfer points to third party loyalty programs via the Ultimate Rewards portal. The Freedom Unlimited is 1.5% cashback on every purchase.

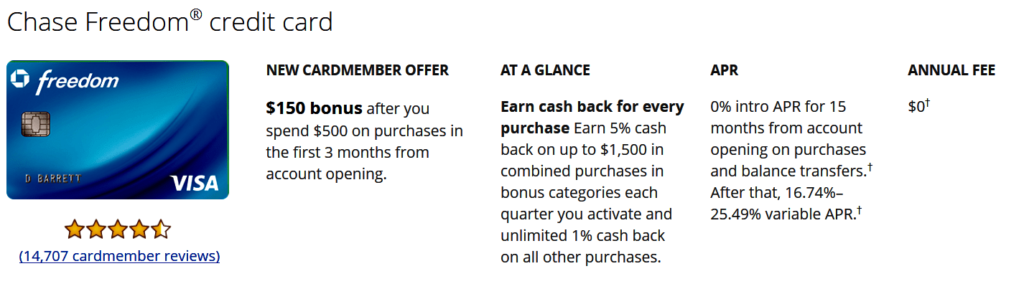

2.) Chase Freedom

This card can earn 5X on purchases in bonus categories each quarter up to $1,500. Typically, those bonus categories are at grocery stores, gas stations, or department stores, but it varies. The Freedom also earns UR points which can be redeemed for cash. The Freedom and the Freedom Unlimited can be coupled for the optimal opportunity to earn UR points. Ideally, you could spend in 5X bonus categories when available; otherwise, earn 1.5% instead of 1% on all other purchases. Besides being good quality cards, these are #1 and #2 due to Chase 5/24 rule. So, if you find these offers compelling, sign up for Chase cards first.

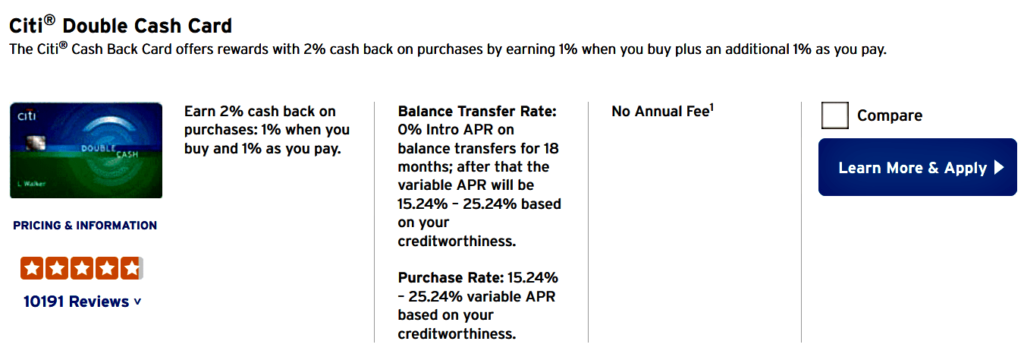

3.) Citi Double Cash Card

This card is the best standalone of the group and you consistently can get 2% cashback if you spend and pay off balance each month. You can also pair this with other cards in this list when you can achieve better than 2% cashback. A very solid card. Cashback can be used either as statement credit or check.

4.) American Express Blue Cash Everyday

The Blue Cash Everyday card earns Membership Rewards(MR) points. MR points, like UR points, can also be used on the Membership Rewards portal to book travel, entertainment, purchase merchandise, or as a statement credit. The earnings potential on typical spending is what earned this card the #4 spot.

- 3% cashback on US supermarkets up to 6K purchases per year

- 2% cashback on gas stations and select department stores

- 1% cashback on all other purchases

There are some limitations to American Express cards which is it’s not always accepted everywhere. However, still a strong card for spend. Cashback is only in the form of statement credit towards your existing balance. Despite that, one additional perk for MR points are that they can be transferred to selection of loyalty programs without needing a AMEX premium credit card to do so. Consider pairing AMEX card with Visa or MasterCard brand from this list for superior coverage for spending.

American Express Blue Cash Everyday

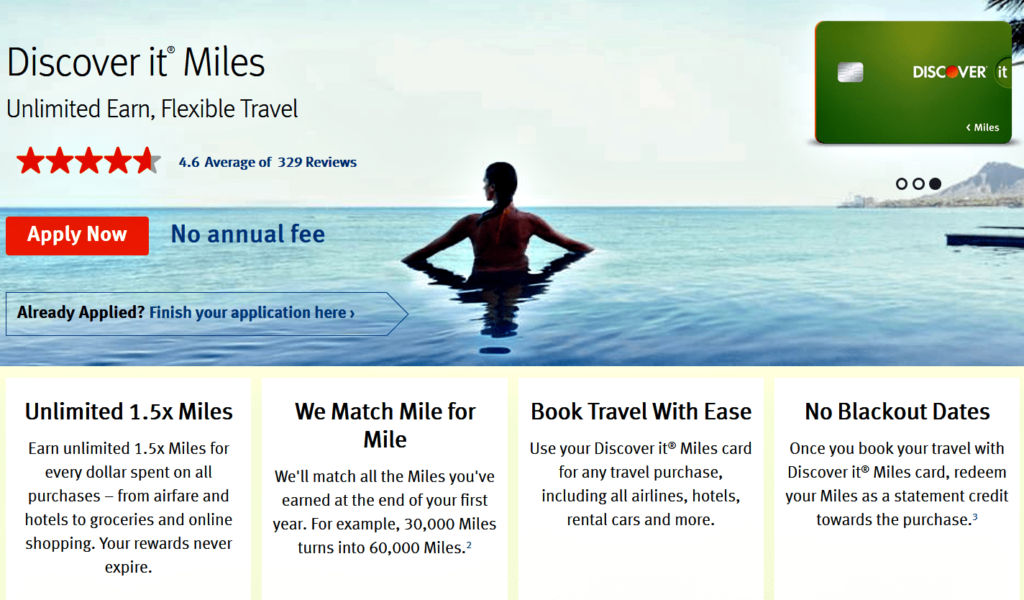

5.) Discover It “Miles”

The most compelling perk for the Discover It Miles is the chance to double your points in the 1st year. This is equivalent to earning 3% on all purchases for 1 year. Thereafter, it’s 1.5X miles on all purchases. You can redeem points on travel purchases in the form of a statement credit towards a balance or get cash as direct deposit to your bank account. Like AMEX, Discover may not be accepted everywhere as well. Consider pairing Discover card with Visa or MasterCard brand from this list for superior coverage for spending.

6.) Bank Of America Travel Rewards

If you happen to be a Preferred Rewards client or have a checking/savings with BOA, there are few other perks. Otherwise, 1.5 points for every $1 spent on all purchases. You can redeem points on travel purchases in the form of a statement credit towards a balance or get cash as direct deposit to your bank account.

Bank Of America Travel Rewards

7.) American Express Cash Magnet

The Cash Magnet card earns 1.5% cashback on all purchases. Cashback can also be redeemed as a statement credit. Consider pairing AMEX card with Visa or MasterCard branded card from this list for superior coverage for spending.

8.) Discover It

The Discover It is for straight cashback in the form of statement credit or get cash as direct deposit to your bank account. You can earn 5% cashback on rotating categories like the Chase Freedom. This is another card you can pair with a higher earning card when a purchase doesn’t fall in the rotating category.

Business Credit Cards

You must have a business to apply for credit cards below.

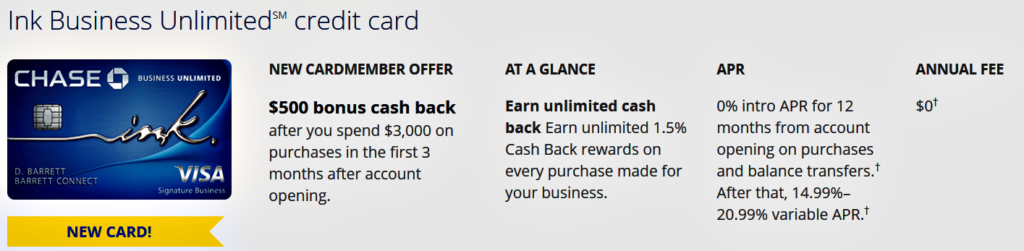

1.) Chase Ink Business Unlimited

The Chase business cards points earning structure and redemption are similar or the same to the personal cards above in #1 and #2 spot.

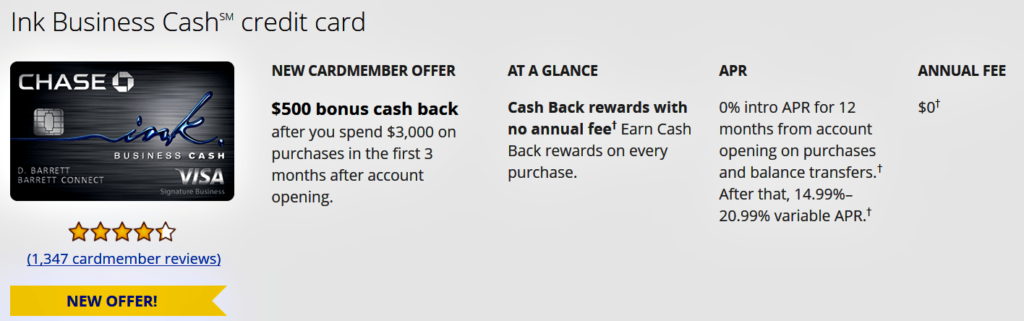

2.) Cash Ink Business Cash

The difference between this card and Chase Freedom is that 5X UR are not rotating on the categories below. They remain constant up to 25K in that category each year.

- 5% cashback on office supply stores, cell phone, landline, internet, and cable TV services on first 25K purchases per year

- 2% cashback on gas stations and restaurants on first 25K purchases per year

- 1% cashback on all other purchases with no limit the amount you can earn

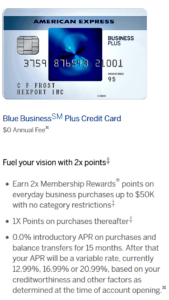

3.) American Express Blue Business Plus

Blue Business is 2X MR points on all purchases up to 50K per year. All similar MR points redemption and transfer characteristics as AMEX personal cards listed above applies, as well as limitations. Pairing this card with another card listed where returns are optimal is preferred. It is hard to beat 2X on everything though.

American Express Business Blue Plus

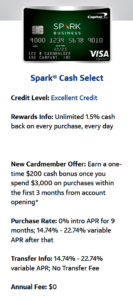

4.) Capital One Spark Cash Select

The Spark Cash Select earns a good 1.5% cashback. Cashback is in the form of a statement credit.

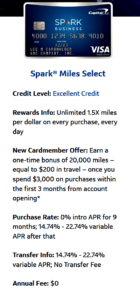

5.) Capital One Miles Select

If you are going to travel a lot, then you can chose this card as well, but it’s simpler for me just to have the option of cashback on any occasion. Cashback is in the form of a statement credit.

Capital One Spark Miles Select

Conclusion

These personal and business are the best no annual fee credit cards you are likely to find in the marketplace. Based upon your needs, select from these and be assured that you have made a good choice. The best no annual fee credit cards are the bedrock for your long term credit history and provide perks that you wouldn’t get otherwise through spending by debit or cash purchases.