Achieving Cheaper Travel

I love to travel, and if you’re a travel enthusiast like me you know it’s not always cheap to do so. Depending on the destination, it can be too expensive to reasonably consider for some households. I used to feel that as well for some places I desired to go, like Hawaii, but my wife and I couldn’t justify paying that much for a vacation. That was until I found there was a way to achieving cheaper travel to the point of being essentially free.

I’ll use the term “essentially free” instead of “free” because there could be some cost. I wouldn’t want you to say, “You said it was going to be free” and you had to pay a little money. However, it’s minuscule in comparison with your alternative — retail price— even on discount travel websites like Priceline, Orbitz, etc. So, how can we be achieving cheaper travel? Through amassing transferable points on select credit cards via sign-up bonuses and normal spend. There are two methods for this; namely:

- Direct redemption (point of sale redemption)

- Non-direct redemption (post purchase statement credit)

Direct Redemption

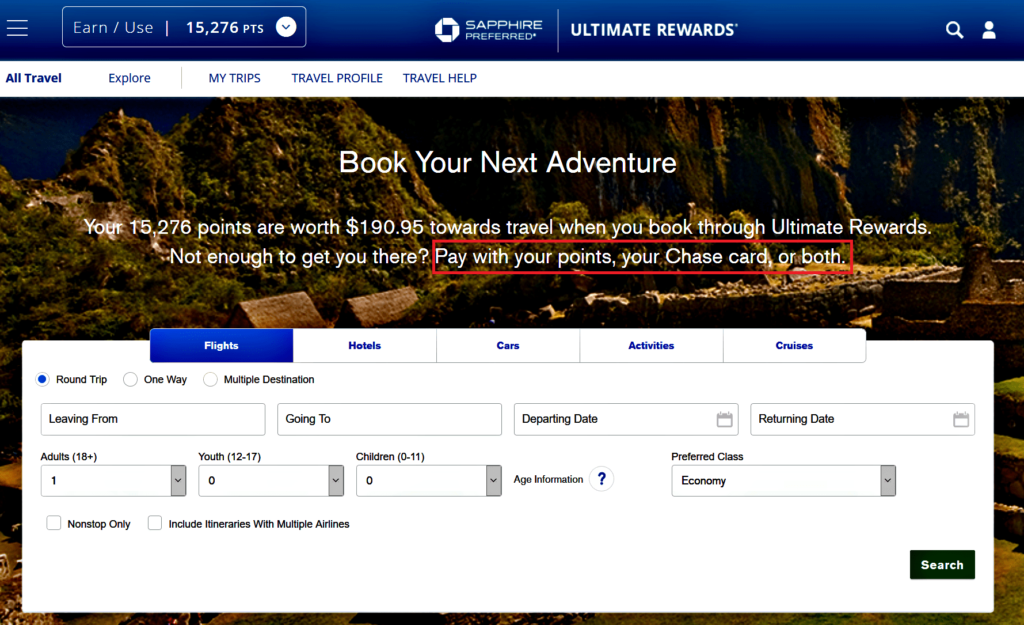

An example of direct redemption using a notable credit card by Chase named Sapphire Preferred. Its transferable points are called Ultimate Rewards(UR) which can by used independently on Chase’s Ultimate Rewards portal for no black out date travel. In addition, these points can also be transferred to select airline and hotel loyalty programs at 1:1 ratio.

A typical promotional offer for Sapphire Preferred is spend $4,000 in 3 months and get 50,000 UR points worth $625 towards travel. Were you to meet these terms, the bonus + points for $4,000 spent is the initial point tally you get started with. Whether you get the bonus or not, similar to a discount travel website, you can go on the Ultimate Rewards portal and book a hotel and flight and use your UR points, credit card, or both.

Transferable UR points can continue to discount your travel. You can continue to earn points from purchases even after the initial sign-up bonus through normal spend. This will cause your —retail price— travel cost to go down because your points will offset the amount you need to come out of your own pocket for travel.

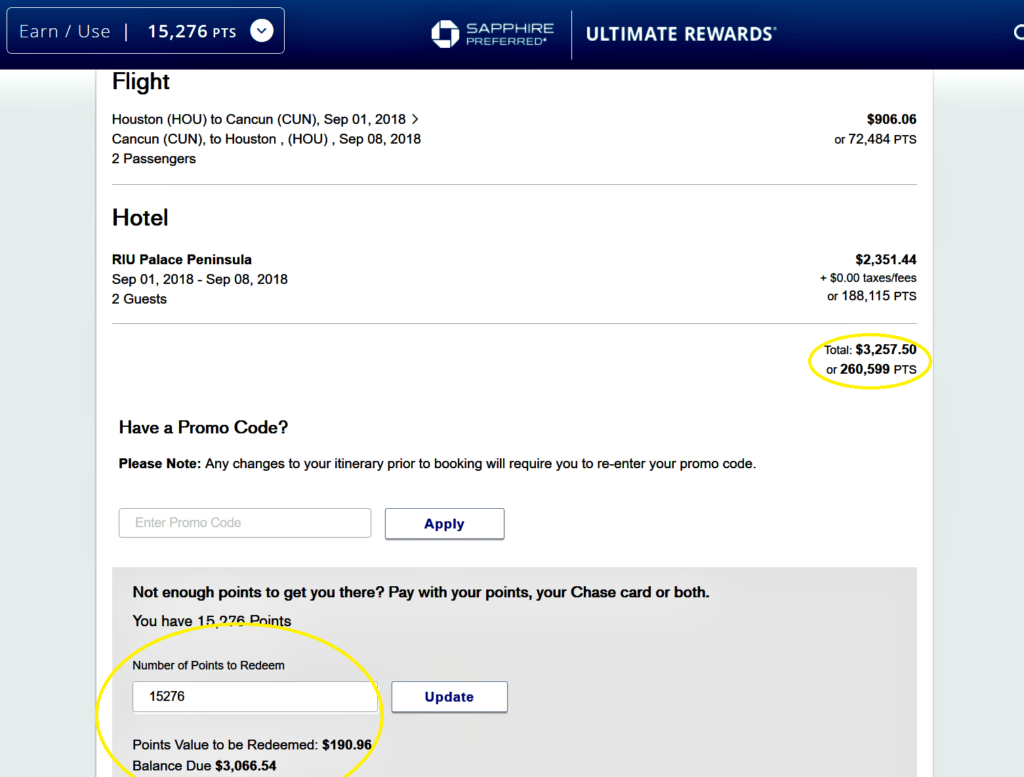

The example circled below for a hypothetical trip from Houston to Cancun demonstrates, though small, the discount off the retail price of the trip of $190.96. If you had 260,599 UR points at the time, the trip would be free.

Direct Redemption Credit Cards

Chase (Look for Ultimate Rewards)

- Sapphire Preferred

- Sapphire Reserve

- Freedom Unlimited

- Ink Preferred

- Ink Plus

- Freedom

- Ink Unlimited

Citi (Look for Thank You Points)

- Prestige

- Thank You Premier and Preferred

- AT&T Access

American Express (Look for Membership Rewards)

Non-Direct Redemption

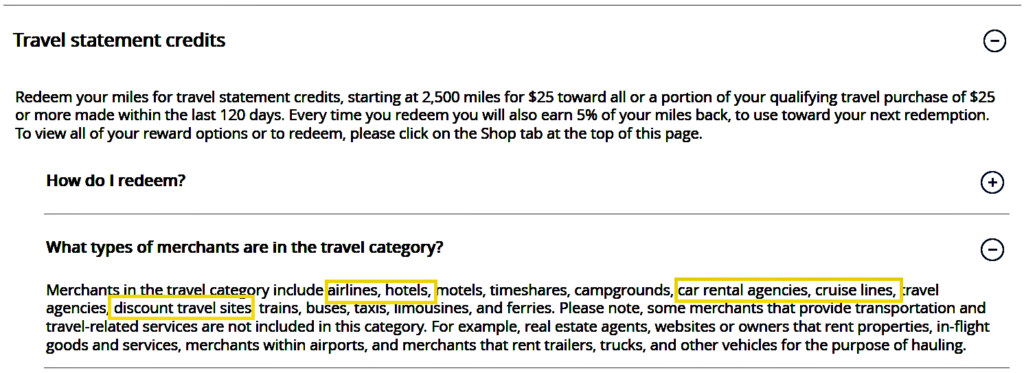

An example of a non-direct redemption using another fabulous credit card by Barclays named Arrival Plus/Premier. What makes either or both of these methods work is the flexibility of the points in question. No black out date travel is still available with this method. The difference between the two is that non-direct redemption travel is reimbursed post purchase via a statement credit.

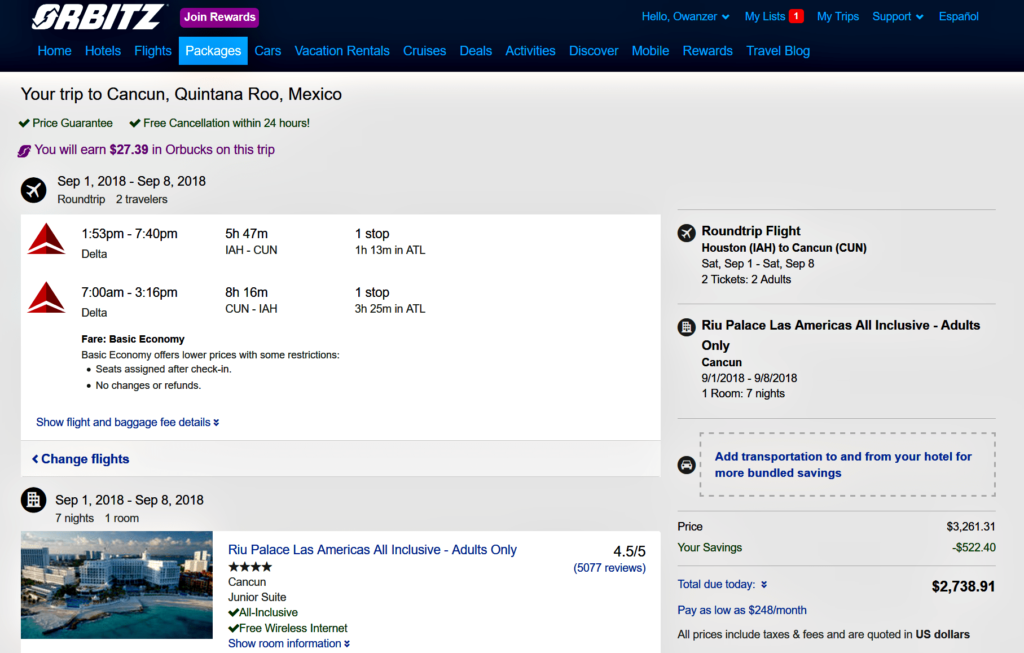

The current promotional offer for Barclays Arrival Plus is 40,000 points after $3,000 spend in 3 months worth $400 towards travel. With the Arrival Plus, you can book the hypothetical Houston to Cancun trip on Orbitz as shown here. You would charge the $2,738 to your Arrival Plus. Later, you will have an opportunity to redeem points from your account as statement credit to offset some or all of the retail cost. In other words, if you pre-statement balance due is $2,738, if you used the 40,000 points from bonus, your new balance would be $2,338.

If you have a favorite discount travel website like Travelocity, Priceline, or Orbitz, you could further offset the retail price amount to be even less than the $2,738 with their loyalty program benefits.

Non-Direct Redemption Credit Cards

Discover

Barclays

- Arrival Plus/Premier

- Arrival

Bank Of America

- Premium Reward

Capital One

- Venture

- Spark Miles

Substantial Savings Over Time

So, it’s using these two brands of credit card constantly for spend on those purchases you use everyday like cell phone, food, cable, insurance, etc. You can turn these transferable points into real savings for you on travel throughout the world.

If you spend a little time and effort to learn how to do this, the savings can be substantial. An individual or couple using strategic sign-up for credit card bonuses and through normal spend can potentially reduce cost to nothing. My wife and I did that on 7 Day Cruise in Europe with UR points.

The example I used for Houston to Cancun trip outlines the two methods for achieving cheaper travel. Depending on your point tallies in one or the other, the non-direct redemption would have been the better choice here. Orbitz had the cheaper retail price for bundle of airfare and hotel for 1st – 8th September trip. This may or may not always be the case. So, if you’re not a hard core award travel enthusiast, it’s best to pick one of the two methods and stick with it as to not dilute your point accumulation potential.

Conclusion

Both methods can help towards achieving cheaper travel. If you let these brand of credit cards become your go to credit cards for all your purchases you will be in a very good position to make travel “essentially free”.