Evaluating Chase Balance Transfer Check Strategy

Leverage Up

Back in my blog, “Leveraging Debt Using Chase Checks”, I talked about using Chase promotional on balance transfer checks to leverage the 0% offer for 10 months. My premise was that I could use this offer and make it work in my favor by arbitrage. I’m evaluating Chase Balance Transfer Check Strategy to give some insight into some things I learned during this process.

Lesson 1

I wound up using Barclay’s 0% Promotional offer over Chase as theirs was similar but better. That also meant I didn’t have to give up use of my Sapphire Preferred card and could still earn Ultimate Rewards points. I made this decision because the Sapphire card is so useful for and during travel. I would rather have Barclaycard Arrival card on the shelf, which I rarely use, than my Sapphire Preferred.

Barclay’s Promo Offer

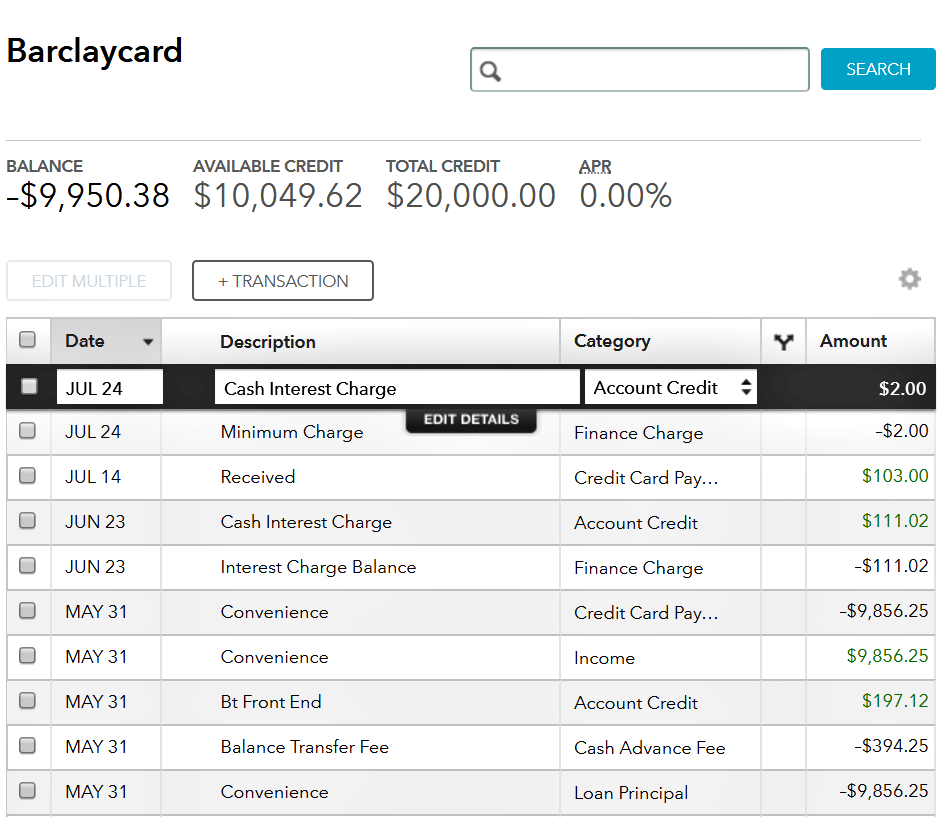

Barclay’s promo offer was 0% Promotional APR through November 1, 2018. 2% fee for the balance transfer amount ($9,856.25 × .02 ) = $197.12). Also, I could still cash the check right into my bank account. In addition, the term of Barclay offer was 7 months longer than Chase’s.

Lesson 2

I didn’t know that you’re still required to pay the minimum payment. Typically it is $25 or 1% of the balance, whichever is greater. I assumed, I could wait all the way up to November before paying anything. That assumption was wrong. This meant I had to pay approximately $103 per month on $9,856.25 borrowed. Nevertheless, I am able to arbitrage at a higher amount than that so far each month. I’ll let you know in later post how well I’ve done each month until November 2018. For the last 3 months I have made the following:

1st month

- Sold 2 MULE Jun17 25 put @ ¢0.65 for net $123.94

- Sold 2 AMD Jun17 11 put @ ¢0.30 for net $53.94

- Sold 1 GOOS Jun17 20.5 put @ ¢0.20 for net $14.49

- Sold 1 GDX Jun17 22.50 put @ ¢0.38 for net $32.49

Total: $244.86

2nd month

- Sold 2 MULE Jul17 25 call @ $1.50 for net $293.94

- Sold 2 AMD Jul17 12 put @ ¢0.59 for net $111.93

- Sold 1 AAOI Jul17 60 put @ $3.50 for net $344.49

Total: $750.36

3rd month

- Sold 2 CTRL Aug17 22.5 put @ $1.35 for net $263.94

- Sold 2 CTRL Aug17 22.5 put @ $1.50 for net $293.94

- Sold 1 GDX Aug17 23 call @ ¢0.38 for net $32.49

Total: $590.37

Note: One options contract constitutes 100 shares of stock.

I made this via the options trades made above on stocks typically in the $20 – $60 stock price range. I used secured put and covered call strategies without going much over the $9,856 allotted.

Lesson 3

Calculate out what your cost should be for the transfer fee and the minimum payment as you understand it. If they are outside of this range, you need to call the bank to get more context as to why. In my case, I was alerted by Mint.com to an interest charge from Barclay’s for $111. I knew immediately this was not right if I had 0% promo, so I contacted Barclay’s to see why this was happening. They had to open a case to review. Though I met all the requirements, they didn’t apply the promo for the check I cashed into my bank account. After 4 weeks of investigating and me persisting, they finally straightened it out. They reversed the interest charge, decreased the balance transfer cost to 2% instead of 4% and my minimum payment was $103 instead of $214. As the balance decreases, so will my minimum payment.

Lesson 4

Ensure to remove anyone you have as authorized user on the credit card you plan to use. Although I was aware that my credit would take a hit, I didn’t consider my wife’s credit as an authorized user on this card. She told me her credit took a 100 point hit. Nonetheless, my wife reported just after a month of removing her as authorized user, when the bank reported again, her score was back up 100 points to where it was before at 750.

Lesson 5

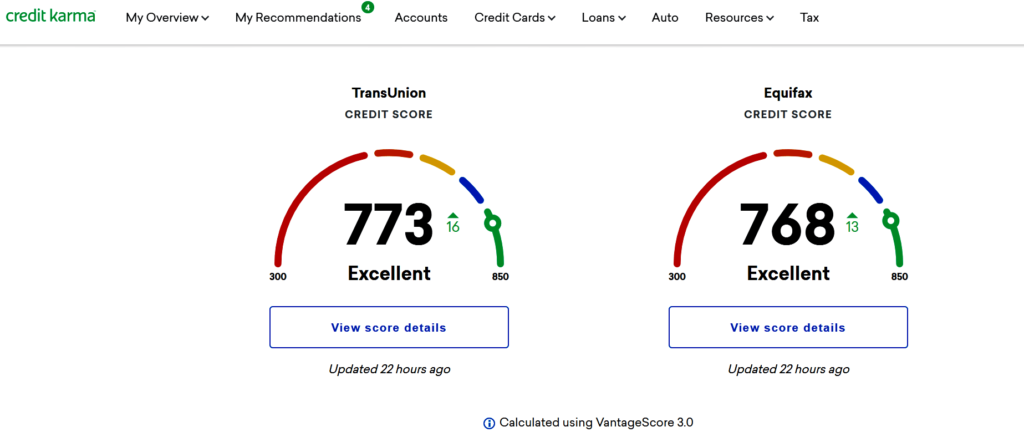

My score went down by 59 points to 750, which is still an excellent score, because I was at 100% utilization on this card. However, my overall credit usage was still only 6%. After contemplating increasing the credit limit, I confirmed with Barclay’s representative it would not effect my promo offer, so I increased it by an additional $10,000. Therefore, my utilization will only be 50%. My credit score has gone up since that time.

In Closing

So far, my results have been exceedingly positive, as I’ve been able to exceed the initial upfront cost within the first 2 months, even after paying a portion of the gains from options premiums to the credit balance. I have been able to move the difference, after I deduct tax I will owe, to a Roth IRA into two motifs; namely, “Os ETF 87/13 Allocation” and “Os Own What You Love”. I will revisit this topic at the time this promo expires and again I will be evaluating the Chase balance transfer checks strategy success. Hopefully, the lessons I learned thus far can help you to be aware of issues that could arise or to check for if you consider to employ a similar strategy. You have to stay on top of this and ensure it starts off well and to execute on your plan to leverage the capital that banks are offering. Make sure that you are certain you can arbitrage more than the cost they are charging to borrow the money.