Transacting with Credit Card vs Cash or Debit

If you have ever been in the position of carrying a large credit card balance, for some, the sheer mention of credit card gives them chills. Credit card debt is the bane of some Americans existence. Sometimes it’s because we have no other choice in making ends meet. As of writing this, the average American has credit card balance of $6,375. So, why would I advocate transacting with credit card vs cash or debit? The focus being on the key term “transacting”, meaning how I choose to pay for ‘x’. I do my best to lay out my case and lay ground rules for those whom this method of “transacting” may serve best.

Road to Debt Ruin?

I contemplate am I leading readers down a road to debt ruin by planting this idea. Personally, I don’t think so. Here on TheWorldOfOs.com, I try to make you aware of the dangers of liabilities, especially of credit cards, but also the benefits. However, if you are at some tipping point that all that is needed is someone you can point to that gave you license for your actions. Hopefully your take away on TheWorldOfOs.com is a seed that improves your life and those around you. This post is simply stating from my personal experience why it may make sense transacting with credit card vs cash or debit.

Rewards Please!

Transacting with reward credit cards provides you an opportunity for points/miles or cashback. Which you prefer is your choice. I only suggest using credit card(s) that reward your “transacting” choice. Otherwise, it’s not always that compelling. It would then be equivalent to transacting with cash or debit, but with all the associated risk, such as high interest rates, that comes with credit and no rewards, except for few I list below. When you use cash, you don’t get any rewards and debit card have very limited rewards, if any. I have a list of Os Favorites credit cards for award travel in the sidebar of this post (referral affiliated) and on affiliate and referrals page.

Take This Plastic

In my opinion, it is safer than transacting with cash or debit card. I think we have all heard of the vulnerabilities of our data being stolen. As a result, I would much rather it be the banks money tied up and at risk from a credit card I used. Rather than my money directly because I used my debit card at Target, Macy’s, or the many other stores that have been hacked. You lose a lot of time and a good chance your money too.

Next, using cash visibly makes you a potential target to robbery and theft where there may not be avenue to return you and your financial accounts to wholeness. If someone were to rob me, they would get a wallet full of plastic.

The probability of harm transacting with credit card are less because there are unknowns to imminent threats. If your credit card are hacked, hopefully your only frustration is having to call bank and change payments which use those cards. I rather that than having to deal with banks or police to recoup money stolen from me or my bank accounts.

Protections

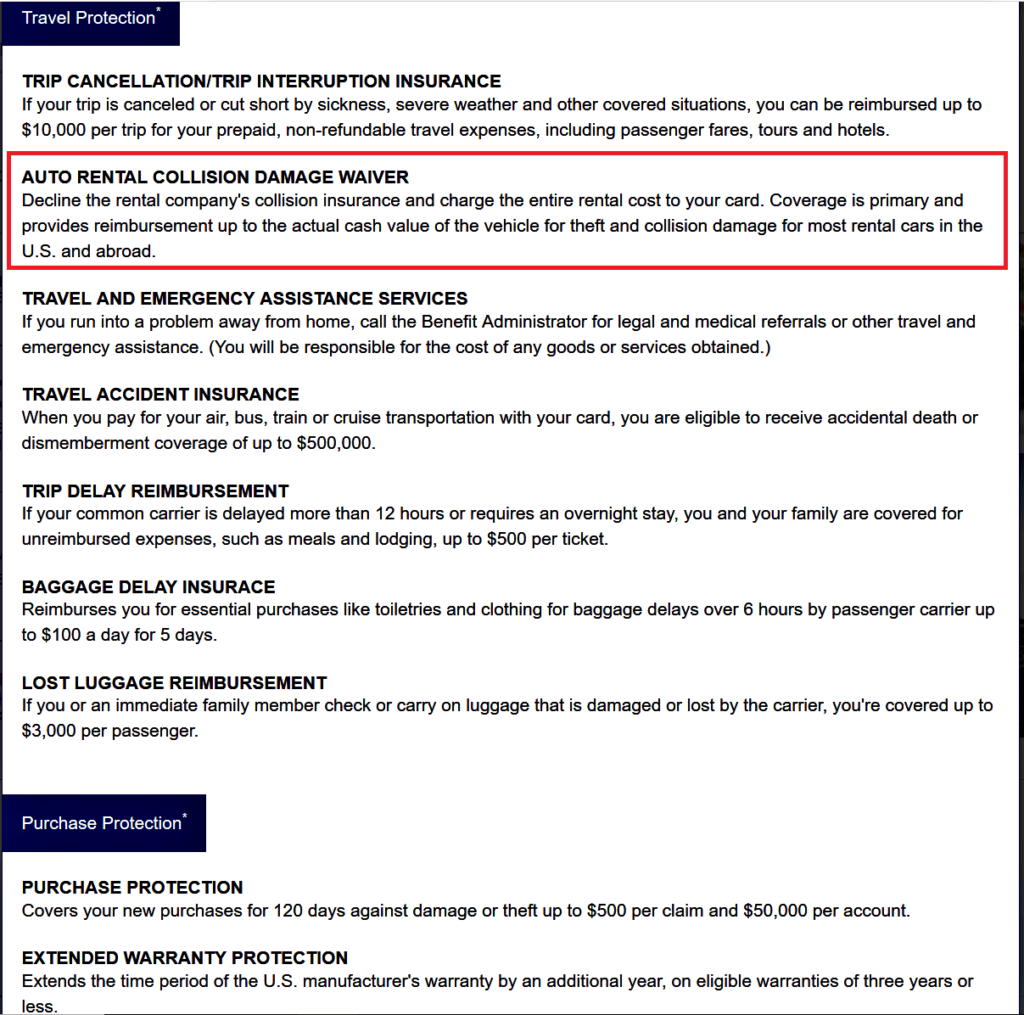

My wife rented a car and it was dinged by someone in parking lot at Walmart. When she returned the car, Enterprise charged her for the damage. We were in the position to pay $250 out of pocket and report to our insurance and let them handle it. However, had we used a credit card like the Chase Sapphire Preferred it would have mitigated that. A benefit that it has is auto rental collision damage waiver, but this credit card comes with $95 annual fee. That may be worth it if you rent cars a lot. It certainly would have saved us money. Here are some other protections that cash and debit card don’t provide.

Fiscally Responsible

I have a budgeted lifestyle, so what’s the worry with transacting with credit card vs cash or debit? My mentality to avoid finance charges is such that the interest rates that bank charge on credit cards is of no concern. Why, because if you pay your balance in full each month it doesn’t matter. The bank can charge 100% interest, but if you don’t keep a balance they are not privy to anything per the terms of credit card agreement.

Therefore, whatever benefits you are entitled to per the terms are without consequence to you. So, a promo offer for 50,000 points for $4K spending in 3 months, which you meet entitles you to this benefit. If you spend $1333 per month, and pay off $1333 on balance due, you pay no interest and you have 50,000 points worth approximately $500.

So no, despite the debt I’m in, I’m still not a proponent to philosophy of some debt-free advocates to cut up your credit cards. For example, using my on personal expenses, if I used simple no annual fee 2% cash back credit card it would equate to $500 per year. I plan to spend that money on my personal expenses anyway. As long as I stick to my budget, would I not be a fool to leave $500 on table every year. What fiscally responsible poor or middle class household can bypass easy money. It’s easy because of your fiscal discipline.

On the other hand, if you do carry balances, see 2 post below:

In $7K of Unexpected Debt, Evaluating My Options

Rules for Play

So, general guideline rules for play are as follows:

- Use a money management tool of your preference. I recommend Mint.com, but others are Personal Capital, Money Lion, or Clarity Money. Be a fiscally responsible household and setup a budget and track spending.

- Have the free service Debitize automate and manage the purchases you make on credit card be moved from your checking account to be paid towards credit card balance on due date

- Have an impeccable on time payment history and improve your credit score

- Cash flow that can generally cover any outstanding credit card balance in 2-3 month period

My Wins vs Banks

I didn’t make this world, I’m merely trying to survive in it. I realize we have to take advantage of our opportunities to save and invest. So, I treat transacting with a credit card vs cash or debit as a vehicle that allows me to do that. Much like fire is dangerous, it is also very useful when handled with care. I walk fine line in use of credit cards. If we are keeping score between my wins vs banks, let me show you some of my wins

- Trip to Hawaii – Hawaii Short Movie

- Upcoming European Cruise

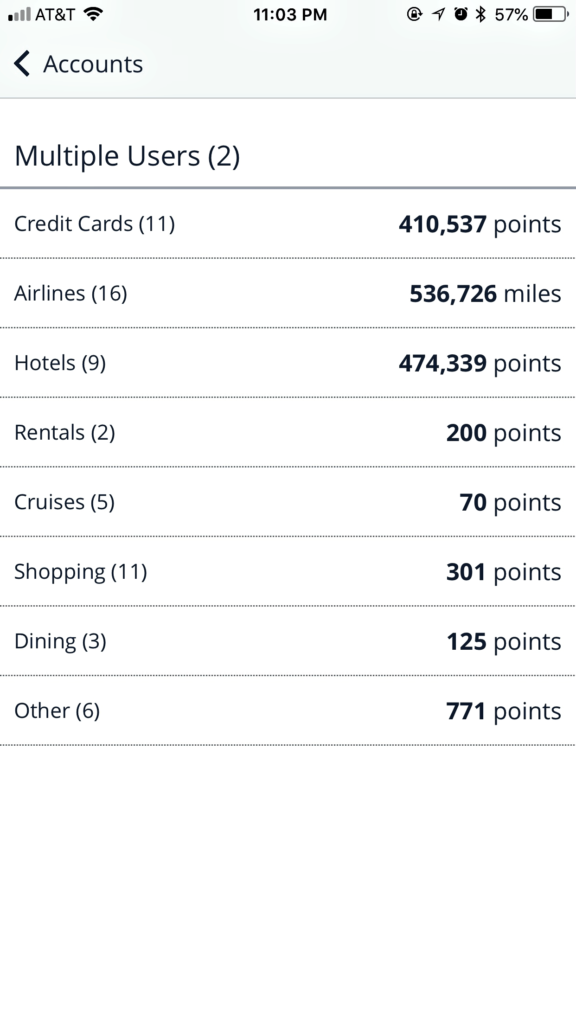

- Points and miles balances (approximate value of $14,000 w/ points/miles valued at ¢0.01)

- Balance transfer arbitrage

vs

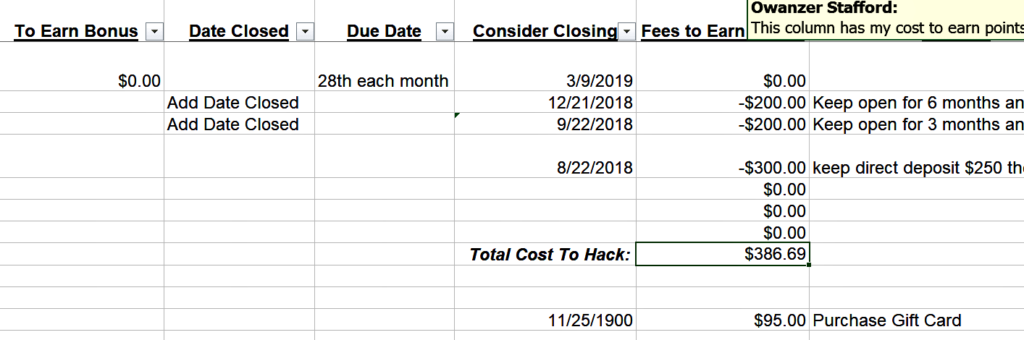

- My cost to hack

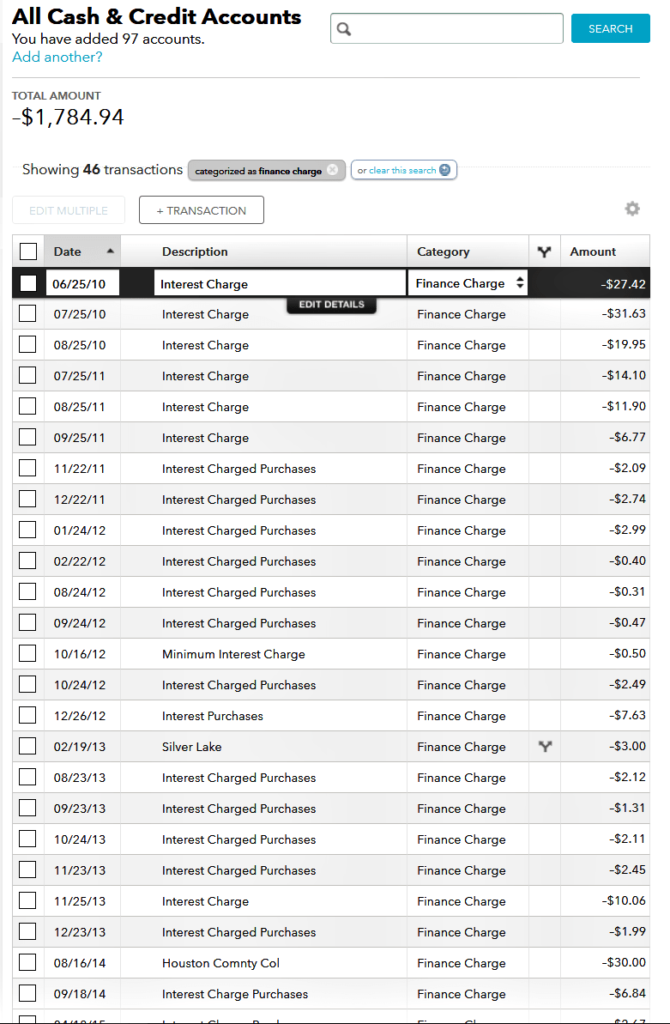

- Interest paid (2010 – current is as long as I’ve been tracking)

I feel pretty victorious thus far that these have played out in my favor. I don’t purport that any of this is without risk. It is quite calculated.

Conclusion

It’s by no means an end all be all solution, but it’s how I try to make “transacting” with credit card work for me. It makes sense if what you get far exceeds what you give up in return. I chose to keep transacting with credit card vs cash or debit because of the ideas I laid out above. Whether you see fit to do so for yourself is your choice. So far, I think my handling of debt, much like fire, has not been harmful to me. Thus, I ‘m choose to keep using credit cards in a safe and reasonable manner.