Repairing Credit Score To Have Access To Credit Offers

My wife helped me to realize the necessity of a post like this one because a lot of people may want to get started with award travel, but are limited by (both real and imagined) their credit score. I have a better than average knowledge and experience of what causes credit score to move up or down. That’s because I have been at the high 809 and low 600 range of credit scores. In addition, I know what got me there. I imagine part of the reason you are reading this is that you want a better credit score. Hopefully your intent to repair your credit score is so that you can have better access to credit and the opportunities that are intertwined.

Benefits Of Having Access To Credit

In 7K in Debt, I touched on having access to credit being a good thing in and of itself. That access to credit isn’t a given though. You have to earn it. Moreover, if you’ve earned it, it opens up opportunities for award travel through huge credit card sign-up bonuses. Also, access to potential balance transfer offers you can use to pay down debt financed at higher interest rates. These are very good reasons to want to repair your credit score. In terms of travel and/or paying interest, a credit score over 700 can equate to real savings. The below posts detail how my wife and I went to Hawaii and are going to Europe for ‘essentially free’.

How Much Does It Cost To Go To Hawaii?

How To Book Cruise with Points

Know Your Credit Score

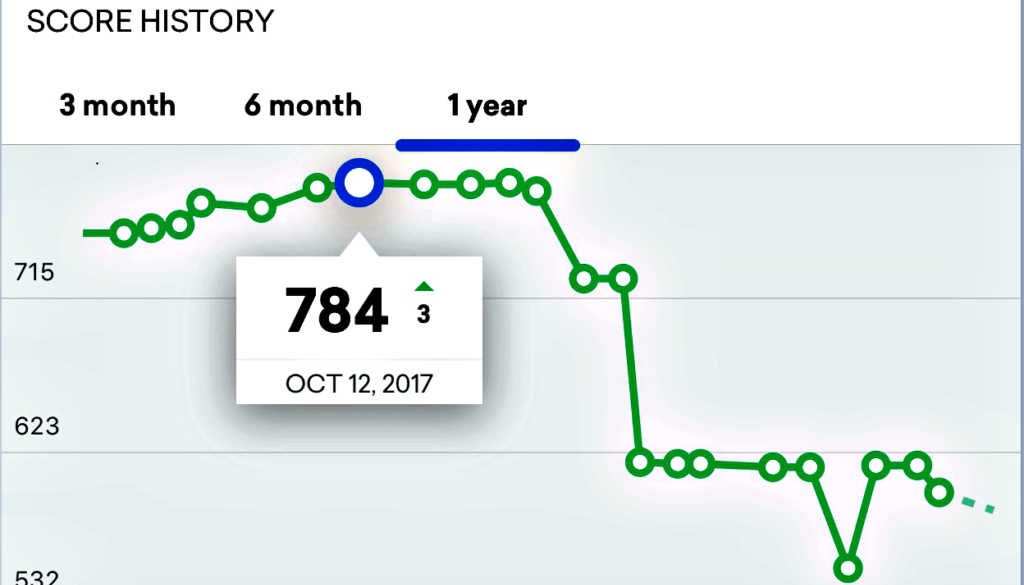

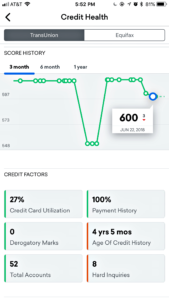

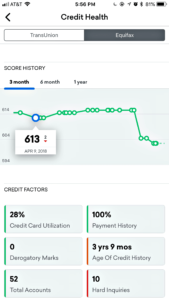

My Current Credit Score is 600

You are going to need to know your credit score to track your progress. I use a few free services to check my credit score and report; namely, Credit Karma and Credit Sesame. Recently, my credit score reflects I have had a fall from grace, but trust me when I say it’s by design. I explain this in, “Crucifying My Credit Score”. While my score is in the doldrums, in regards to access to credit and the terms offered, what better opportunity do I have to personally experience and experiment with what 30% of Americans with a credit score below 600 may be privy to?

Focus On 2 Credit Factors To Improve Credit Score

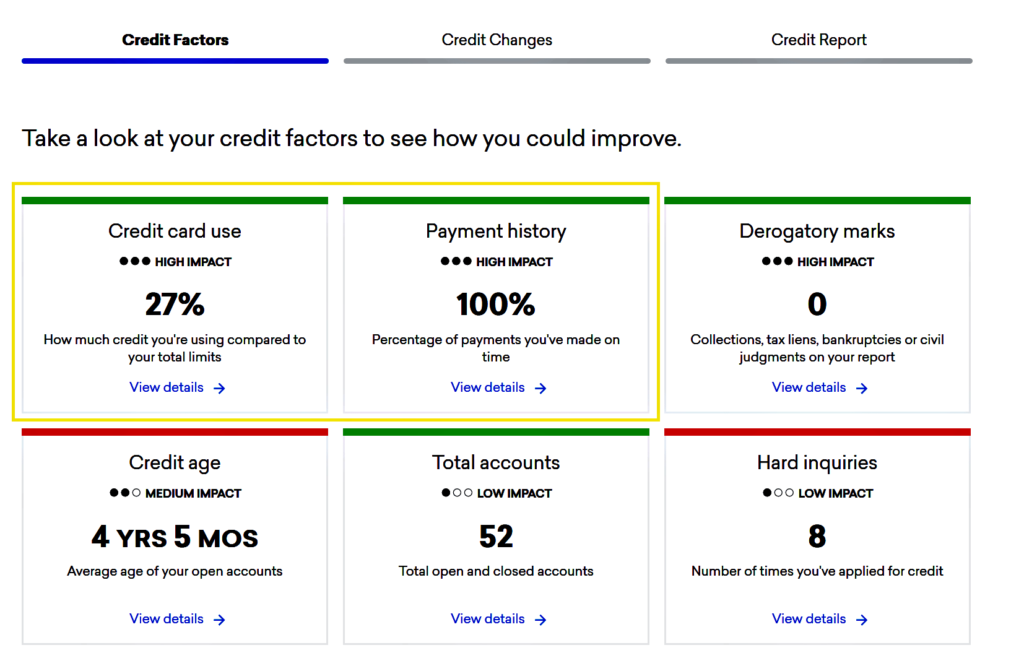

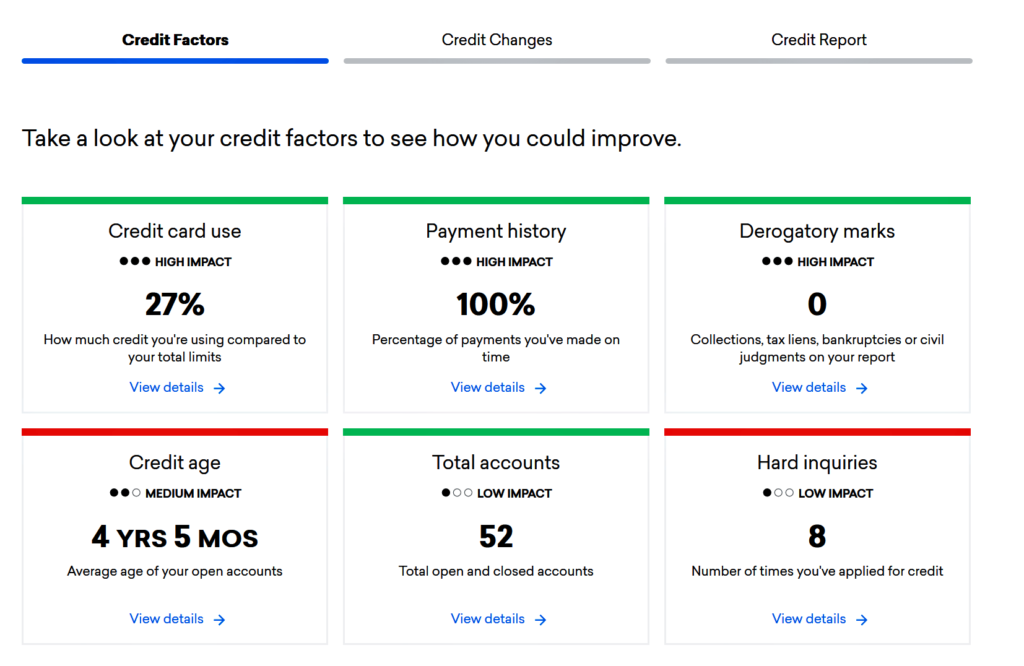

Payment History

There are 2 high impact credit factors that are more within our power to change than the 3rd (Derogatory Remarks). So, I’ll focus on the 2 in the picture directly below highlighted in yellow. Paying your bills on time every month is one way to a better credit score. This is a high impact credit factor. That is why I’m a big proponent of putting expenses on credit card and using automation to assist in this area. I use a free service Debitize to, at least, ensure the minimum card balance due gets paid on due date. Start getting this right consistently every month and your credit score will catch a boost. While tracking your score, check back every month you pay on time for anything that gets reported to the 3 credit bureaus to see just how much of a boost. It may be couple points here or there.

2 High Impact Credit Factors

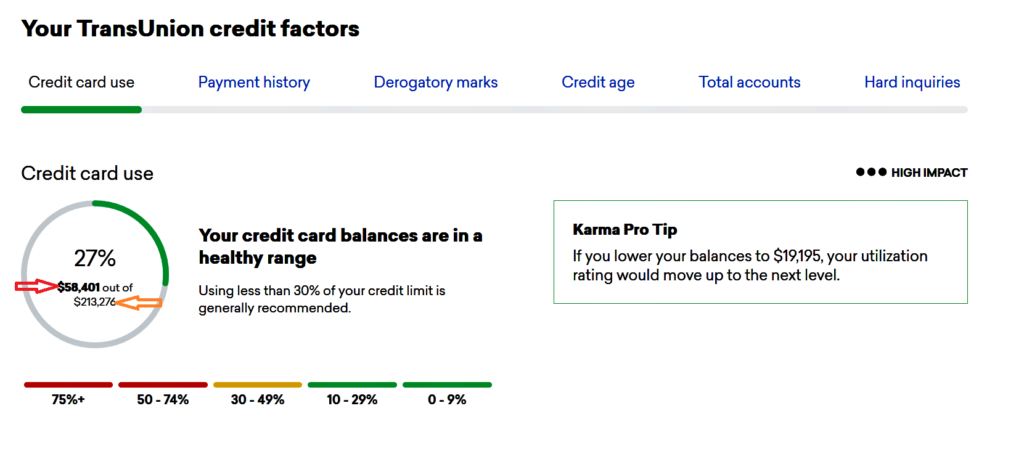

Credit Card Use

Keeping your credit card use (credit utilization) low is another way to a better credit score. In the picture directly below, for the equation (credit used ÷ credit limit), you want to make the number next to the red arrow, if not 0, very very small in relation to the number next to the orange arrow which you want to be very big.

Credit Card Use(Credit Utilization) Metric

How do you make the red arrow number small? By paying down and/or off all your credit card balances. And the orange arrow number? It runs a little counter intuitive, but if you sign-up for new credit card(s) and are approved and your credit use stays the same or goes lower, but your credit limit increases, your credit score gets a bump higher. So, the real challenge is not limiting your sign-ups. Instead it’s getting approved and then keeping credit use very low and credit limits very high.

Note: If you have a card with annual fee you are considering closing, consider if there is option to downgrade to no annual fee card to keep the credit limit available. Otherwise, closing, especially when you have balances, can negatively impact credit score because credit available (orange arrow number) is decreased.

My credit utilization is 27, which is stated as a healthy range, but the 180+ drop in my credit score is directly correlated to my $58,401 credit use.

Authorized User

Another tip for improving your credit utilization metric is by being an authorized user on personal credit card(s) of someone with credit score in range of 700 – 850. Preferably on credit card(s) with a high credit limit and low credit use. My wife had 100 points boost higher to her credit score from being authorized user on my credit cards. She’ll need to return the favor to help boost my lowly score because her credit score is in mid 750s.

Bookmark this post (Crtl+D) and check back here in approximately 30 days for update to see how many points my score is up by becoming authorized user on my wife’s credit cards. I’ll post picture below:

[Coming soon: new AU credit score picture]

Note: Authorized user need not get the physical card for use on the owner’s credit card. Owner just adds your name and has shipped to their address where they can put on shelf. At anytime later, you can be removed as authorized user.

Note: Business credit cards credit limit and balance information is not typically reported to 3 credit bureaus. Thus, don’t anticipate a credit score bump if you are added as authorized user on a business credit card.

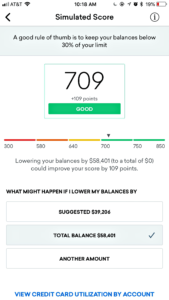

Credit Karma Simulation Tool

Credit Karma has a simulation tool which shows what your score could be when your credit utilization changes. For example, if my credit use was dropped to zero, my new simulated credit score is 709.  That’s 100+ jump! My last balance transfer ends in April 2019. Add 30 days from then, when I’ve paid back the balance, for it to post to 3 credit bureaus and I’ll post picture of my actual credit score.

That’s 100+ jump! My last balance transfer ends in April 2019. Add 30 days from then, when I’ve paid back the balance, for it to post to 3 credit bureaus and I’ll post picture of my actual credit score.

[Coming 2019: new credit score picture]

Improving your payment history and credit card use alone are 2 surefire ways to boost your credit score by 10 points or more.

I’m going discuss below some experimentation I’ve been doing applying for select credit card promotional offers. You may see the sense in taking a gradual approach to credit card sign-up offers. Because if approved, the amount of your credit limit increasing will automatically change your credit utilization metric if your credit use stays the same or goes down. I recommend this option only after or if you know no one qualified who can make you authorized user.

Since My 784 Credit Score Has Been Gone

Despite my credit score being down to 600, I want to push the limits to see what credit card offers I still can be approved for. Personally, if my score gets worse, so what. They tell me no and I call to ask them to reconsider or find out the reason for the disapproval decision. Although, if I’m success at getting approved for a few new credit card offers with big sign-up bonus, I’m keeping essentially free travel open to me. That’s what’s important to me because I know my low credit score is temporary, but my quest for award travel isn’t.

Lender’s Pump The Break Rules

Do note that some lenders have their own pump the break rules for those who try to sign-up for too many cards. I don’t try to skate these rules and they are something you should consider. Here are a few key ones from the main players:

- Chase – 5/24 rule

- Citi – 24 month wait when closing card within same brand

- American Express – 1 Welcome Bonus Per Lifetime

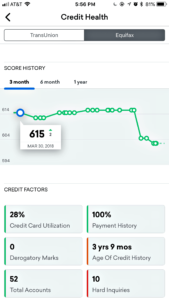

Hard Inquiries

A request for new credit results in a hard inquiry on your credit report. Based on my experience, a hard inquiry impacts your credit score by 2-3 points. Before my last credit request, my score was 603. Shortly thereafter, it was 600. This inquiry stays on your credit report for 2 years but it’s impact is minimized over time and if you get approved.

Before Request for Capital One Credit Card

After Request for Capital One Credit Card

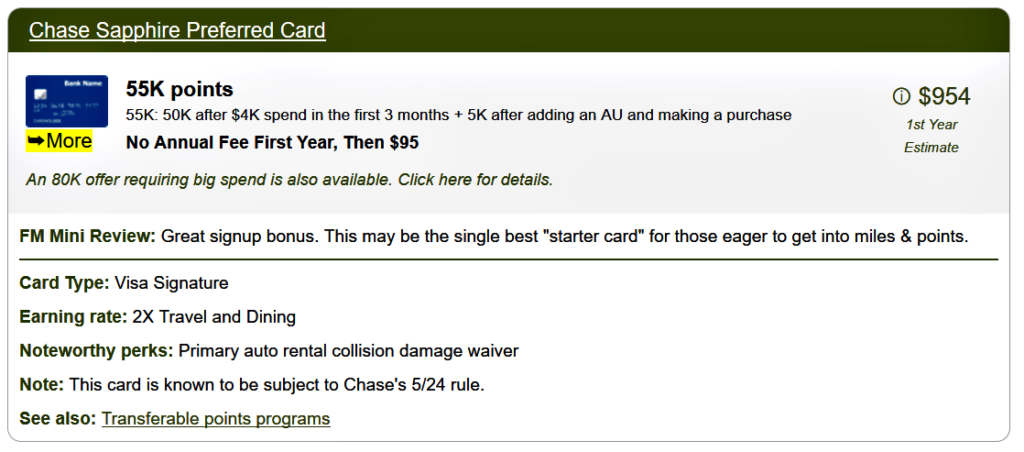

So, for example, is a promotional offer (50K points after $4K spend in the first 3 months and no annual fee first year, then $95) for the Chase Sapphire Preferred credit card worth 2 – 3 point credit score reduction, when the value you get in return is worth approximately $954? Considering that you’re approved and meet the terms of the promotion. I know the answer for me has been sign me up and keep signing me up.

If I go back to April when I made request for 2 new credit cards, you can see similar pretty instantaneous credit score decrease.

Before Request for British Airways and Discover It Credit Cards

After Request for British Airways and Discover It Credit Cards

Note: Request for new business card credit is also a hard inquiry, but see note above concerning business cards reporting to credit bureaus.

Note: It depends on the lender which bureau it uses to get your credit score. In order words, they pull your credit score from specific bureau, not all 3.

You’re Approved/Not Approved

During this time of both navigating lenders rules and low credit score purgatory, here are my success and failure sign-ups when credit score was sub 620. Bear in mind that my metrics may or may not align perfectly with yours, but if there is some semblance there is high probability for you to be approved even with credit score in this range.

My Credit Factors Snapshot

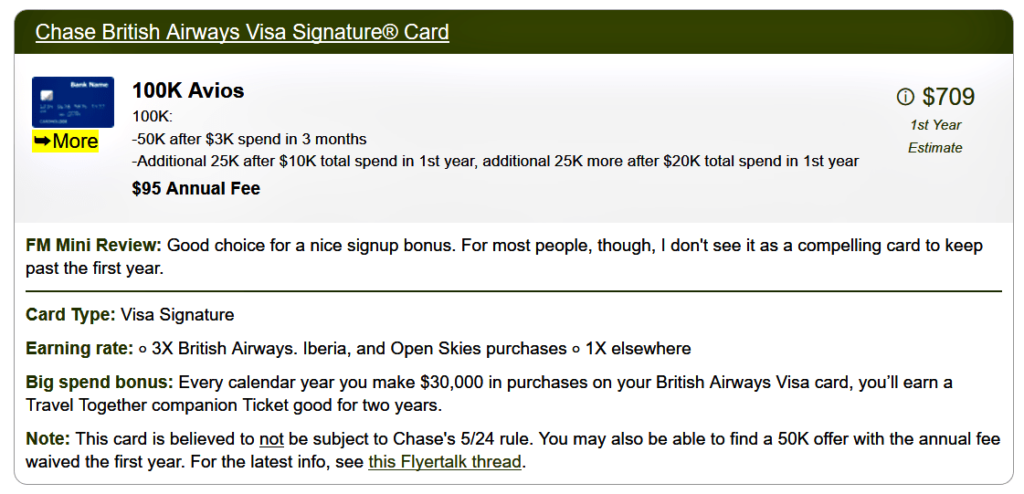

Successes

I applied for and was approved for these 2 credit cards in April. Although, the Discover It Miles only gave me $1,000 credit limit. For a credit limit increase, they told me call back after 3 credit cycles. I will too.

- Chase British Airways (50K points after $3K spend in 3 months, an additional 25K after $10K total spend in 1st year, $95 Annual Fee)

Note: The thought that this card is not subject to Chase’s 5/24 rule appears to jive because at time of application I was over limit, yet was still approved.

Note: The thought that this card is not subject to Chase’s 5/24 rule appears to jive because at time of application I was over limit, yet was still approved. - Discover It Miles ($50 statement credit. All miles earned in first 12 months will be doubled. Essentially a 3% cash back card for the 1st year)

Failures

- Capital One Spark Cash for Business

They sent a letter stating the denial was due to revolving credit balances vs my income. That I will be calling to find out more about because I don’t know what they are basing my income off.

Repair Credit Score All While Reaping Benefits

The question I posed to my wife was that all my writing on award travel was not resulting in any sign-ups through my offer links. I don’t understand why people aren’t catching onto this. The reward I get for the referral comes from the lender and doesn’t cut into what they would get. Her response was basically, “most people credit is not good, so they don’t think they could get approved”. The average American’s credit score is 695, which is more than sufficient to take advantage of these opportunities.

From that my approach to this blog post was to:

- Tell you where you can track your credit score

- Give some solid tips to help you improve your credit score so your access to credit opportunities increased

- Show that even with a not so stellar credit score, approvals are possible

- Downplay some misconceptions of impact to credit score for signing up for ‘too many’ credit cards

In Closing

TheWorldOfOs is not about influencing you to get into debt, no. In fact, it is about providing you information, experience, and application of utilizing tools known or unbeknownst to you can enrich your life both now and in the future. I hope this and other post on my blog provides you tools to repair your credit score and confidence to get started in award travel. If so, try some the cards offers in the side bar. Also, please leave comments or questions. I would like to know what you think.

I know I can be oh so serious all the time so in order to remember to take it easy and have a laugh, here’s a joke.

“Today at the bank, an old lady asked me to help check her balance. So I pushed her over.”