Crack Your 401K If….

If you’re into personal finance topics like I am, I’m sure you’ve heard something contrary to what I’m about to say. I’m going to say it anyway because I don’t agree with what I’ve heard some financial pundits advocate. All to often, in order to appeal to the masses, the message gets watered down. It simply becomes do this and don’t do that. Forget that! If you are employee, you probably have a 401K for your retirement savings. The pundits say, don’t ever touch(borrow) from your 401K. I say crack your 401K open if you are going to buy asset(s) that produce positive cash flow.

Why Is This Never An Option?

Is this too hard for everyday Americans to do? Is investing in the stock market the only thing you can and should do because there is a financial advisor to hold your hand? I say no, and in some cases, this can be bad advice to have so much exposure to one asset class. Especially when there are other viable options. Why have so much exposure to financial markets, if you could diversify?

If you didn’t know, you can borrow from your 401K and diversify. Notice I stated to crack your 401K open if you are going to buy asset(s) that produce positive cash flow. The emphasis is on positive cash flow. I know of one such asset that can meet this criteria quite easily. It is called “rental real estate”. Also, rental real estate gives two highly important components which you hope to potentially obtain with your stock investments:

- appreciation

- cash through rents (dividends from stock(s))

Well, it may never be an option for some people if all they do is listen to the pundits. However, for me it’s been an option twice. I did it 7 years ago successfully, and I’m planning to do again on my latest purchase of rental real estate. The point of investing is to own assets, and it doesn’t have to just be in stocks.

Truly Diversified

What better reason to access money that may have been matched by your employer. Couple that with if the stock market has done well (which it has as of writing this). You can take some of that gain off the table, or re-position it, in a sense by moving it out of your 401K via loan. Yes, it needs to be paid back over 5 years with interest. However, this can potentially be net neutral, from rent you receive.

Now, let’s consider what is at stake. How would you like your retirement savings to be positioned? Do you want 100%, at all times, in the stock market that goes up and down? Especially at exactly the time you are approaching retirement à la 2007-2008 Financial Crisis?

However, what if you mix in borrowing from your 401K to buy rental real estate. Then not all your retirement savings are at risk in the stock market. That seems to be more truly diversified to me. What about you? In addition, you can now get cash flow outside of your retirement account which typically cannot be done otherwise.

You can take out a mortgage using debt for some of the purchase price; thus, increasing the return on investment. Once the amount you borrowed from your 401K is paid back, you still have the real estate and you get all the benefits of depreciation, appreciation, principal pay down, and cash flow. If your all in cost in the real estate is paid back to you over time, what’s your return on investment? Infinite. That is because you now technically have no money in the deal. Your initial investment has been paid back to you.

Example Using Rental Real Estate

One of the rental properties I purchased, I took a loan from my 401K for approximately 15K. I had to pay it back over 5 years at 5% interest. The interest is what you are paying to yourself. I was OK with that accountability trade-off that I pay myself back. 15K amortized over 5 years at 5% is $283. My net profit after expenses from my rental property was $500. $283 was injected from cash flow from rent despite the $283 that came out of my paycheck. Over and above, my net positive cash flow is $217.

How many people like that their 401K balance is going up in value, but wished that translated into something material today? I’m sure plenty of people could use a couple hundred bucks here and there to pay for little things that come up in daily life. Using rental real estate helps meet that need.

I do the research, acquisition, and management of my rental real estate myself, but this may not be for everyone. This doesn’t mean there is no hope for you if you don’t want to do all this as well. In fact, there are options like Roofstock that may help if you want to delegate out some of these duties.

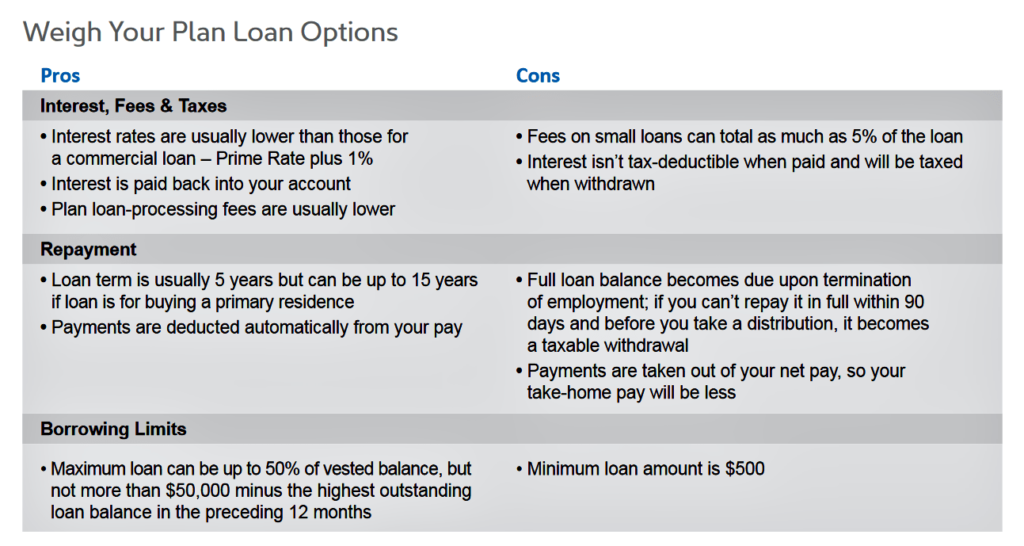

Pros and Cons of Borrowing from 401K

Here are loan pros and cons for my 401K plan

In Closing

When it comes to borrowing from your 401K, definitely consider going in opposition to the pundits. It can make a lot of sense to crack your 401K open if in return you are going to get an asset that generates positive cash flow. You get a great deal more real diversity to your overall portfolio than having all your retirement savings tied to stocks.