Cash Flow From Trading Options In The Stock Market

I vaguely recall a speaker at a real estate investment club I was part of saying, “you can’t go into Burger King and purchase a burger with securities from your stock portfolio”. He of course was giving his sales pitch for investing in rental real estate, which could produce cash flow, over stocks. At the time, based on what I knew about investing in the stock market, this was true statement. However, based on what I now know, that statement is only half true. You can very well earn cash flow from trading options in the stock market. In addition, you can do so with far more liquidity than with real estate.

Don’t get me wrong, I’m not at all against owning rental real estate. So, I won’t pit one over the other. As a matter of fact, as of writing this, I’m under contract to purchase my 3rd rental property. There is room for both in portfolio. I take the philosophy of owning an assortment of positive cash flowing assets(physical and paper alike). This seems practical as well because there is not much evidence of real estate being correlated to go up and down in price with stock market. Moreover, there are some notable differences between the two assets:

Trading Options

- cash flow from trading options varies from month to month

- much greater liquidity versus real estate

- potentially higher net profit margins

- taxed as short term capital gains

Rental Real Estate

- cash flow from rental real estate more fixed from month to month

- less liquidity versus trading options

- somewhat less profit margin

- potentially tax free income

- maintenance cost

What I wished to discuss in this post is the range of cash flow you could potentially earn each month from trading options in the stock market. This will depend on:

- amount of money you have to invest

- using monthly options

- using cash secured put/covered call options strategies

I’ll breakdown some examples by the amount you have to invest. There are not many $500+ stocks/ETFs. Therefore, you may be adding multiple option contracts of the same stock/ETF or have various combinations of different stock/ETF positions. That choice is entirely up to you based upon the amount of money you have to invest.

1 options contract consist of 100 shares of the underlying stock/ETF of your choosing. Also, monthly options expire every third Friday of the month. The Bid amount × 100 is what you are credited for selling an option. For example, as of writing this, Apple (AAPL) is $175.50 per share. If you were to sell a put option with Bid 2.50 for AAPL stock at the 175.50 strike, you would be credited $250 (2.50 × 100). If exercised, you would pay $17,550 ($175.50 × 100 shares).

Trading Options Basics

If you don’t know what the hell I’m talking about, here are some previous blog post to help get you up and running as for the basics in selling put/call using cash secured put and covered call strategy.

Trading Options Secured Put and Covered Call

Trading Options Secured Put and Covered Call Cont’d

Less Than $5000 Investment

Note: The stocks listed here are not recommendations. They are listed for illustration purposes and any credits to you (excludes taxes, commissions, and fees).

Sell Cash Secured Put

Selling the March18 expiration for NTNX at the 32.50 strike for 1.05 (1.05 × 100) Bid would mean a credit to you for $105 .

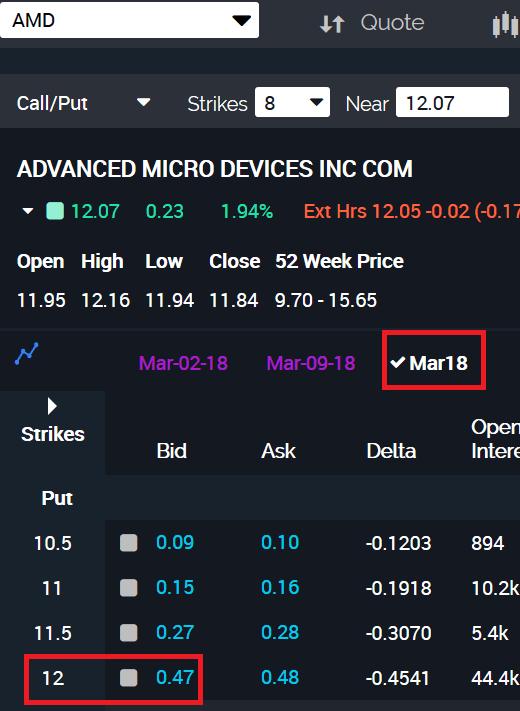

Selling the March18 expiration for AMD at the 12 strike for 0.47 Bid would mean a credit to you for $47.

Sell Covered Call

Selling the March18 expiration for NTNX at the 37.5 strike for 1.45 Bid would mean a credit to you for $145.

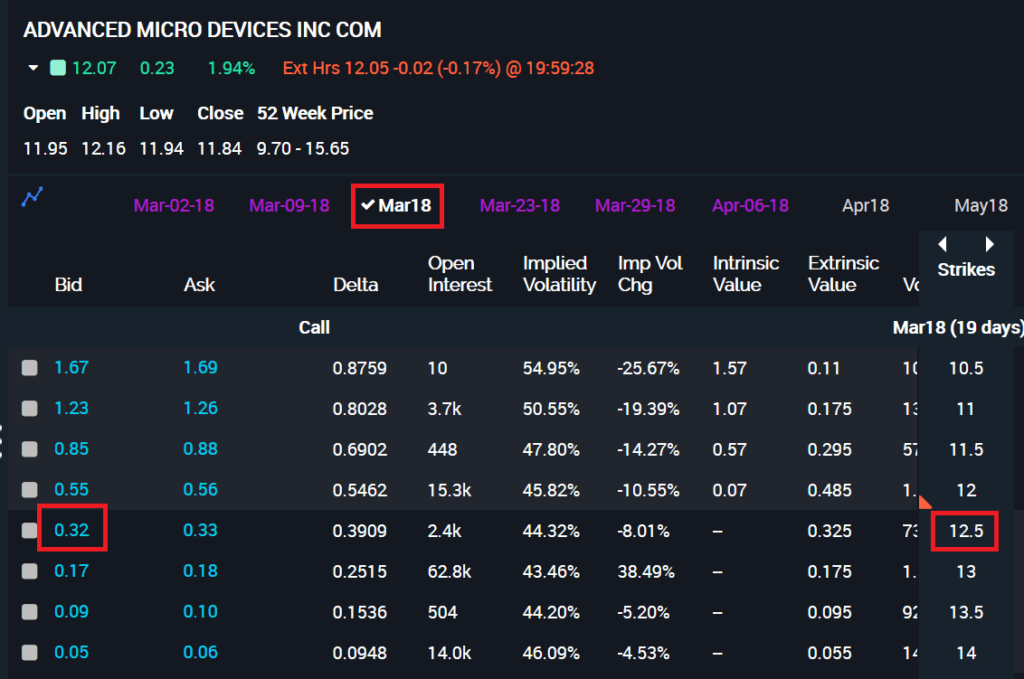

Selling the March18 expiration for AMD at the 12.50 strike for 0.32 Bid would mean a credit to you for $32.

So, in the above, if you sold 1 put for NTNX and AMD, you would collect $152. If your put options finished in the money, you could sell 1 call for NTNX and AMD and collect $177. For this example, you would still be selling the Mar18 expiration. Therefore, if you are on the put or call side of the options trade you stand to make money. This process can be rinsed and repeated each month. Going from cash to stock and from stock back to cash.

$5000 – $25,000 Investment

Sell Cash Secured Put

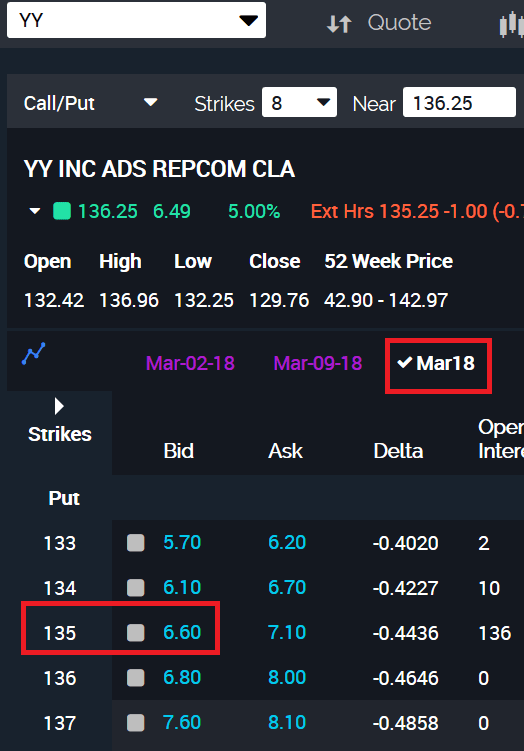

Selling the March18 expiration for YY at the 135 strike for 6.60 Bid would mean a credit to you for $660.

Selling the March18 expiration for NVDA at the 242.50 strike for 6.20 Bid would mean a credit to you for $620.

Sell Covered Call

Selling the March18 expiration for YY at the 138 strike for 6.40 Bid would mean a credit to you for $640.

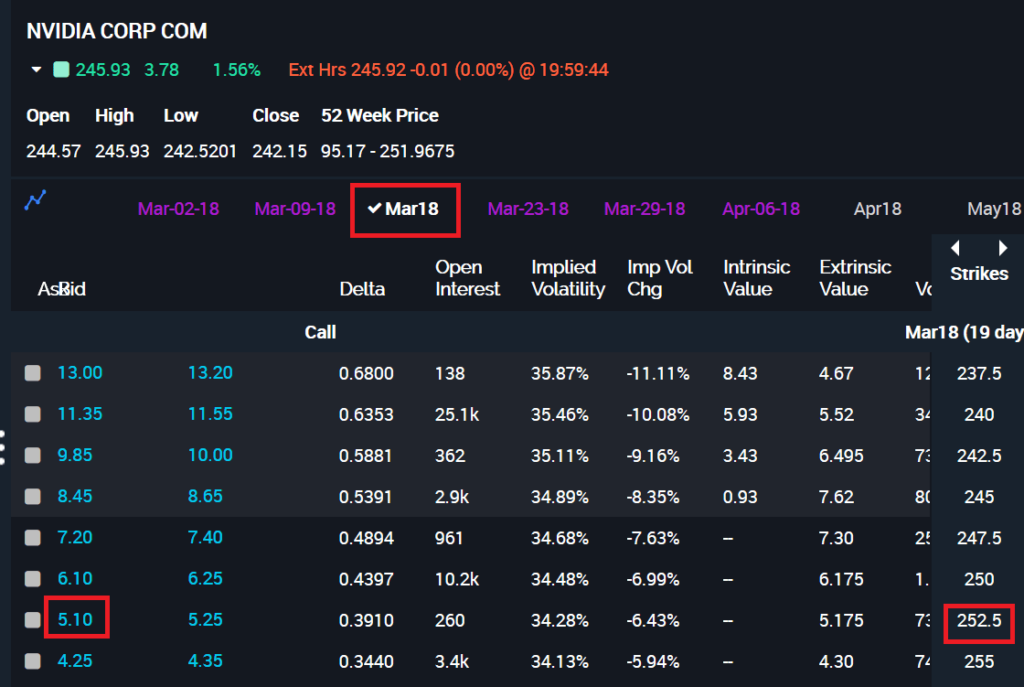

Selling the March18 expiration for NVDA at the 252.50 strike for 5.10 Bid would mean a credit to you for $510.

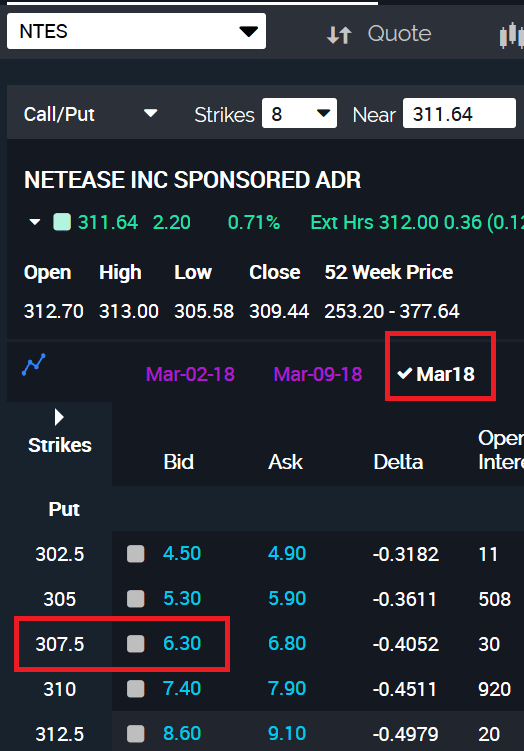

$25,000 – $50,000 Investment

Sell Cash Secured Put

Selling the March18 expiration for NTES at the 307.50 strike for 6.30 Bid would mean a credit to you for $630.

Selling the March18 expiration for AVGO at the 250 strike for 6.70 Bid would mean a credit to you for $670.

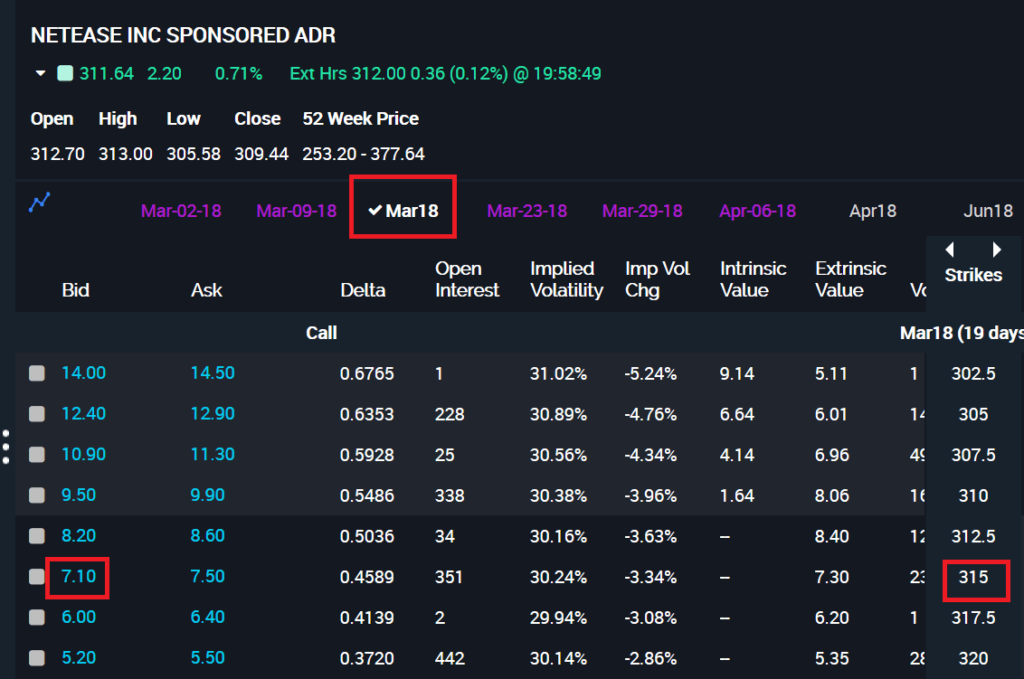

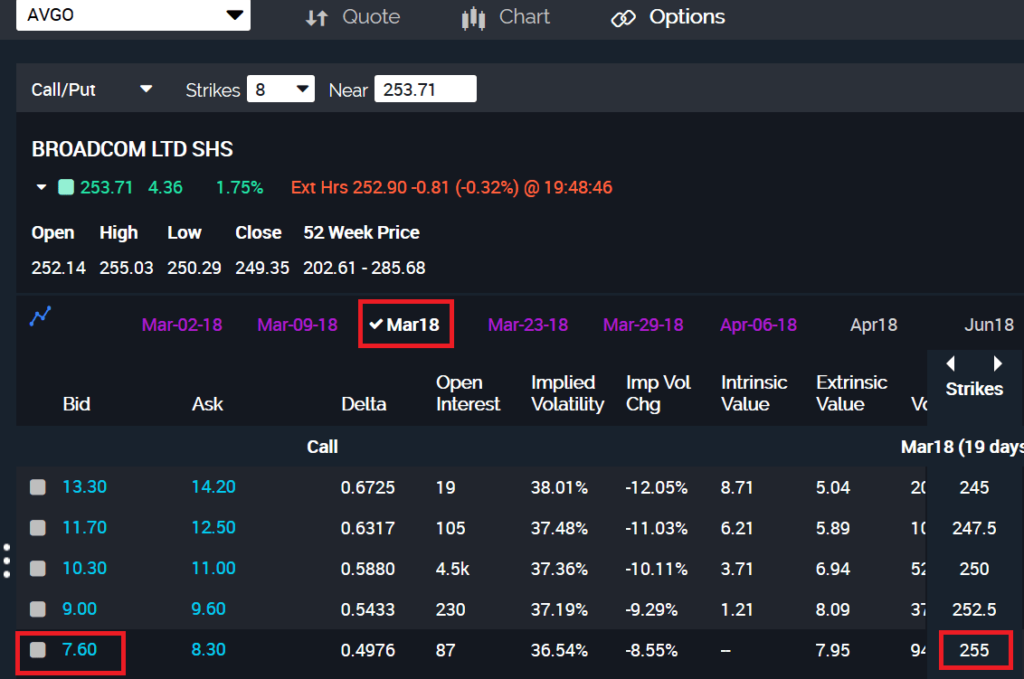

Sell Covered Call

Selling the March18 expiration for NTES at the 315 strike for 7.10 Bid would mean a credit to you for $710.

Selling the March18 expiration for AVGO at the 255 strike for 7.60 Bid would mean a credit to you for $760.

In Summary

I demonstrated above from call/put side of the options chain, you definitely can generate cash flow from trading options in the stock market. The amount you have to invest largely dictates how much cash flow. Much like receiving rent from real estate, you can receive cash credit from option trades each month. Yes, those cash credits you receive can be deposited into a bank account and spent for a burger at Burger King!