Crucifying My Credit Score

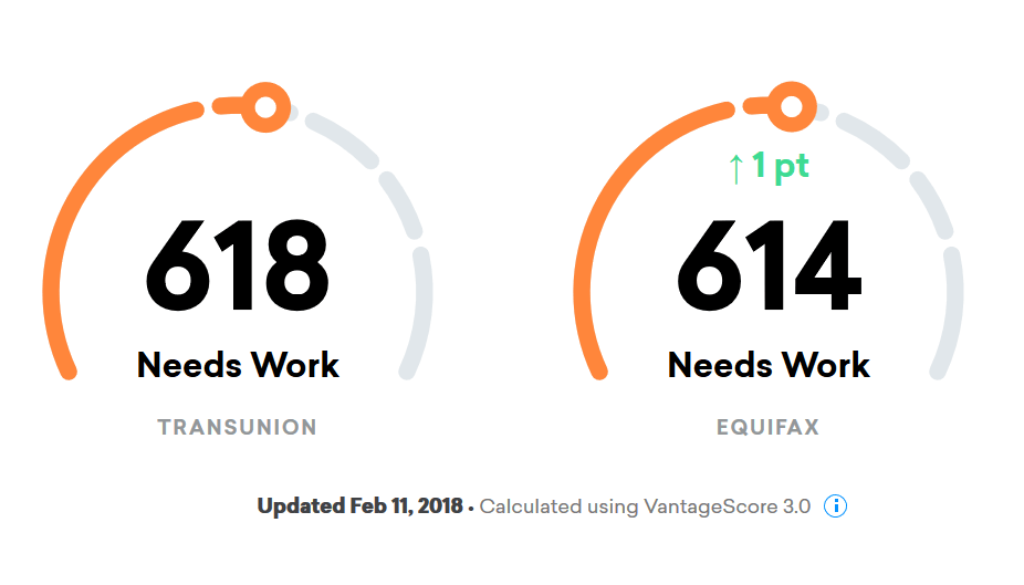

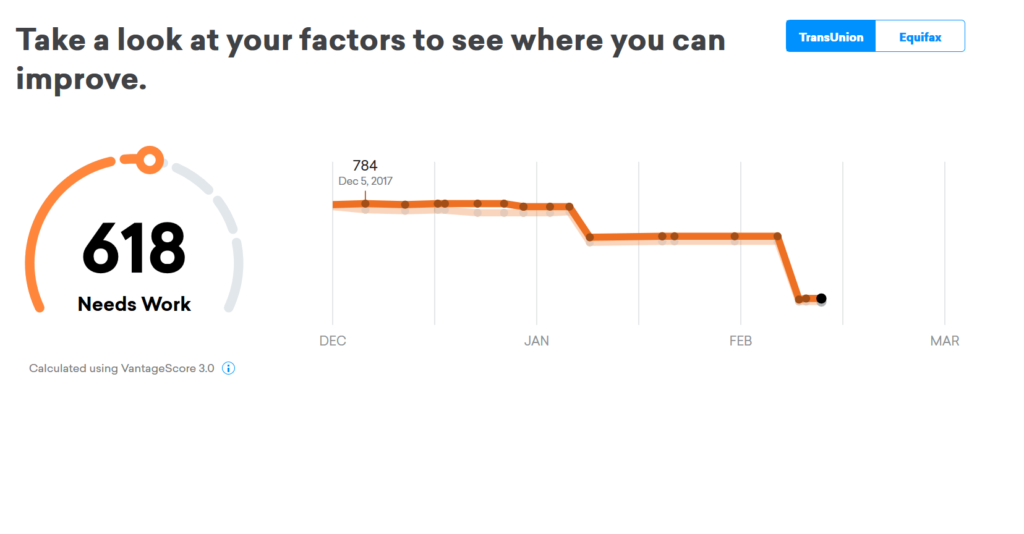

On TheWorldofOs.com blog, I write about what’s going on in my world as it concerns the core topics of my website. As of late, on the topic of Personal Finance, I’ve deliberately been crucifying my credit score. It feels a bit like this because, in the realm of personal finance, this sort of sacred metric that supposedly embodies our credit worthiness, I’ve willingly desecrated. I’ve sacrificed this symbol for something else that clearly matters more to me. What matters more to me you ask? Income, Income, Income!

Easy Money

I have had a good score  before this; thus, my access to the Federal Reserve’s/banks easy money policy. This comes in the form of a balance transfer promotional offers for 0% APR for some specified period of time. See 2 good post I written on the topic below:

before this; thus, my access to the Federal Reserve’s/banks easy money policy. This comes in the form of a balance transfer promotional offers for 0% APR for some specified period of time. See 2 good post I written on the topic below:

Evaluating Chase Balance Transfer Check Strategy

Deciphering Balance Transfer Offers

Every reader may not be in the position to do this, nor should they necessarily. I assessed my own personal situation and thought, “why not take advantage of the opportunity to arbitrage this easy money”. The only debt I had in my name were mortgages and revolving credit balances which I pay off entirely each month.

Mechanism for Arbitrage

Therefore, I could deposit those balance transfer checks directly into my checking account. I can then use this asset to generate more money than the cost to borrow. I do that by trading options in the stock market. Although other assets could potentially be used, due to the duration of the offer and the liquidity of stocks/ETFs, I chose this as mechanism for arbitrage.

I’m of the opinion that if you know how to trade options and you have a lump sum of cash, that cash you start with should pretty much stay intact. You may have positions down from time to time, but all in all it’s pretty close to whole. What better way to test my hypothesis? Can you keep your core investment intact as you generate income for lifestyle without running out of money?

I assume I’ll be able to extract the amount I borrowed from balance transfer from my options account to payoff the credit card balance once the term of the promotion ends. If I have done well in the management of positions taken and the stock market doesn’t throw a wicked curveball, I believe it can be done.

Status or Substance?

On the one hand, you feel proud that you have a credit score that grants you access to better financial terms when you intend to finance something. However, what if nothing is on the horizon that you need to finance long term? No house, car, or other consumer goods that can be paid off entirely from your monthly income? Unluckily for me, I started taking on balance transfer offers, although I intend to buy a rental house early this year per my goal. This may or may not effect me because a lender is privy to my entire financial statement. So, they will see the debt, but I also can show additional income. However, I’m not yet clear how this will be viewed.

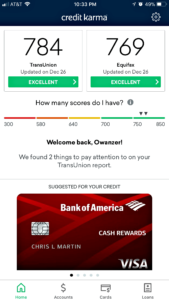

The one fallback I have for having a bad credit score for the moment is my wife has a good 720+ credit score and she can be added as buyer to contract in order to improve the terms.

If I had none of that going on, what purpose does a great credit score serve? But seems like I feel, even if I do what does it matter? This is the approach from which I came to the conclusion that I am OK crucifying my credit score for a short period of time. I would rather the real additional income I could earn over a status symbol.

Credit Scores Recover

From experience, as fast as my score went down, I know it can rebound once the balance are paid back. This occurred for my wife who was an authorized user on a credit card I did my first balance transfer on. Her credit score got hit 50 points! Once she was removed as authorized user on the card, her score went back up 50 points when the lender reported the next month. I know this will be similar for me. So, what do I stand to gain from crucifying my credit score? On 10K, doing options trades, I can earn a range of $250-$500 per month. After I deduct the minimum payment of 1% (about $100 on 10K balance) due on the balance each month and short term gains taxes, the difference is discretionary income.

So, what do I stand to gain from crucifying my credit score? On 10K, doing options trades, I can earn a range of $250-$500 per month. After I deduct the minimum payment of 1% (about $100 on 10K balance) due on the balance each month and short term gains taxes, the difference is discretionary income.

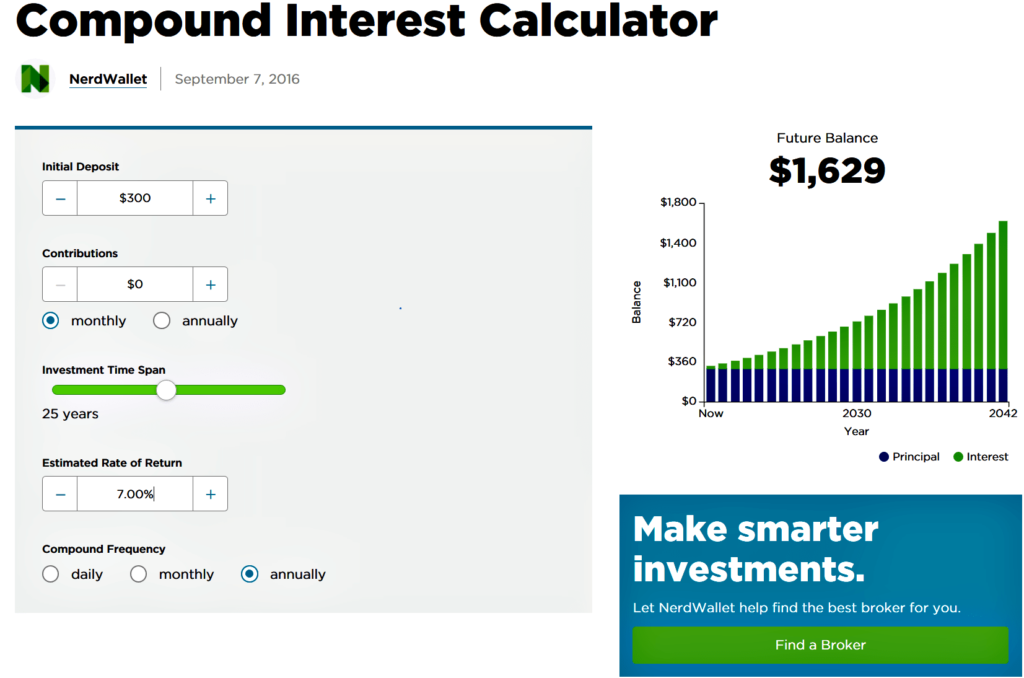

Personally, I make it a point to invest no less than 10% of this amount in my long term portfolio. My long term portfolio is invested in brokerage or Roth IRA accounts on platforms like Motif Investing and Loyal3=>FolioFirst where I can buy fractional shares.

There is risk that I could lose my investment in the stock market. That is certainly the case and I’m aware of that. However, I believe this is less likely due to what stocks I select for this purpose. I don’t think Apple, Amgen, Applied Materials, or Stamps is going to $0 in the next year or even 5 years. In addition, I do have some reserves on hand.

Arbitraged Income Compounding

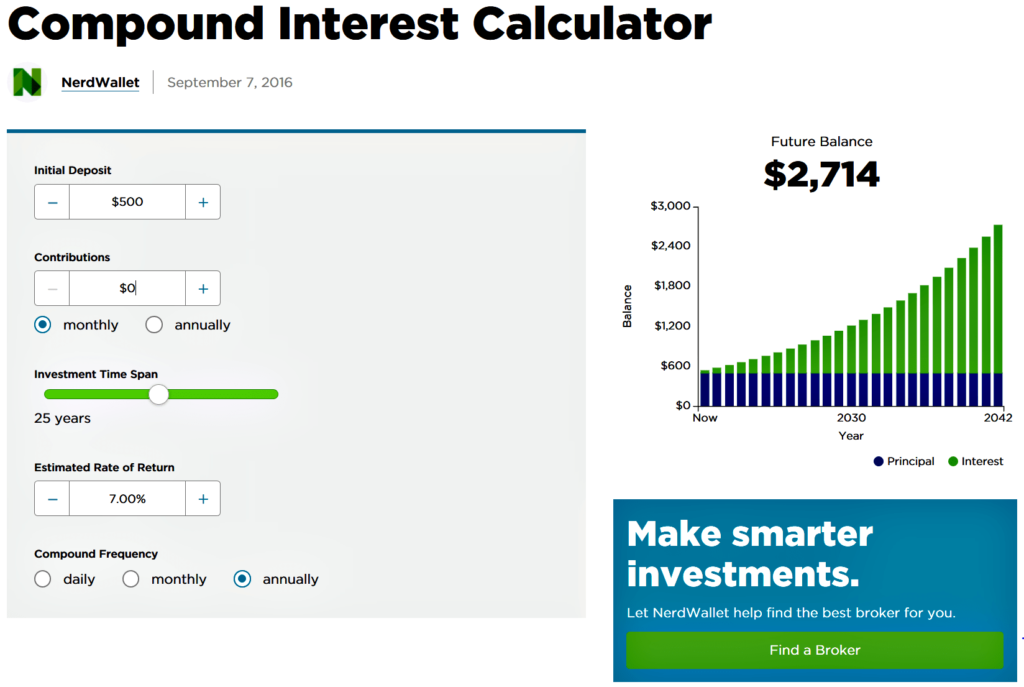

Let’s assume during the time-frame of the promo, I set aside additional $300 ($25 × 12) on the low end and $500 ($50 × 12) on upper end when setting aside 10%. The compounding on each amount after 25 years is below:

$300 compounded over 25 years

$500 compounded over 25 years

Of course, I could invest more than the 10% and compound even more; however, life is to be lived, so I might very well spend some of the discretionary income on fine dining, entertainment, travel, or other consumer goods that enrich our lives.

I realize this is against the grain of normal financial speak, but I’m a middle class individual seeking greater possibility of obtaining financial independence sooner rather than later in life. So, every little bit can help as I put more money to work for us. In addition, I’m giving proof to the idea that there is a way to not run out of money in retirement that no one of normal financial speak is talking about.

In Closing

I have drawn on an occasion when I feel crucifying my credit score is certainly OK. It’s when I can make more money. When I can make more income for me and my family with manageable risk, I’m going to do that. Also, I am likely to continue to do so as long as this is available. However, let me be clear, Os is not saying you should crucify your credit score using balance transfers, especially if it’s to buy consumer goods, No! Peter Schiff embodies the spirit of what I’m saying in this post in the below audio snippet. Have a listen.

Schiff, Peter. “Stocks and Bonds Do Dangerous Dance – Ep. 327.” Audio blog post. The Peter Schiff Show. iTunes, 8 Feb. 2018.