Steps To Sell A Call Option

The purpose for this post is to reach an audience of people who want to know the steps to sell a call option in the options market. If this is you, I provide step by step below to get you on your way. The post below is a complement to this post. Personally, I trade covered call options rather than naked call options, as the latter is very risky if you don’t have the stock to cover. I obtain the stock position as a result of a secured put option I sold being exercised. Although executing the trade is the same, if you are just starting out, stick to what is safe.

The example I provide is on the E*TRADE trade platform, but the steps should be similar on any other trading platform you find.

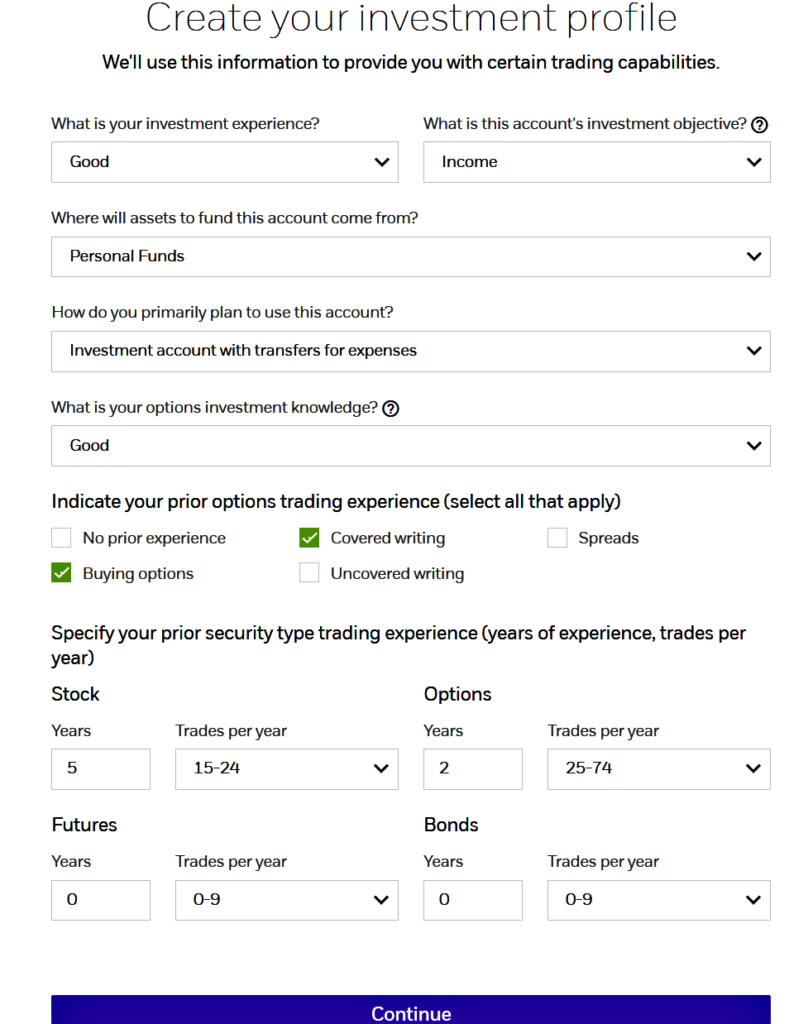

Step #1

Open Individual brokerage account with E*TRADE. Preferably with a margin account, so you don’t have to go back later to switch if you feel the need to have one. On this section, be truthful so as to allow to be saved from yourself.

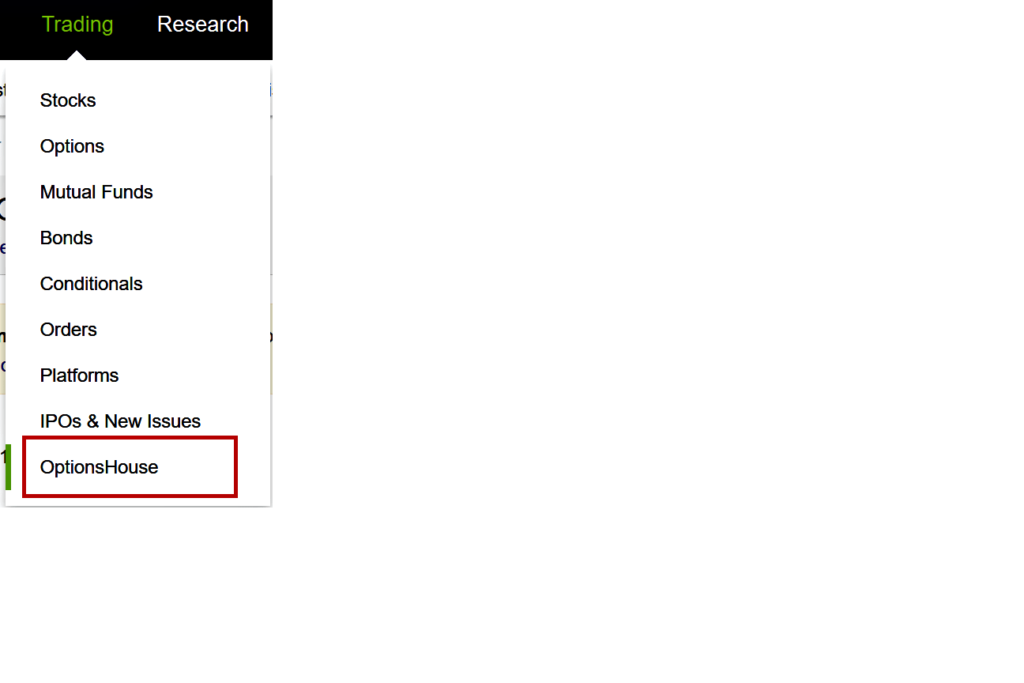

Step #2

Under Trading, select Options House and the following window should appear.

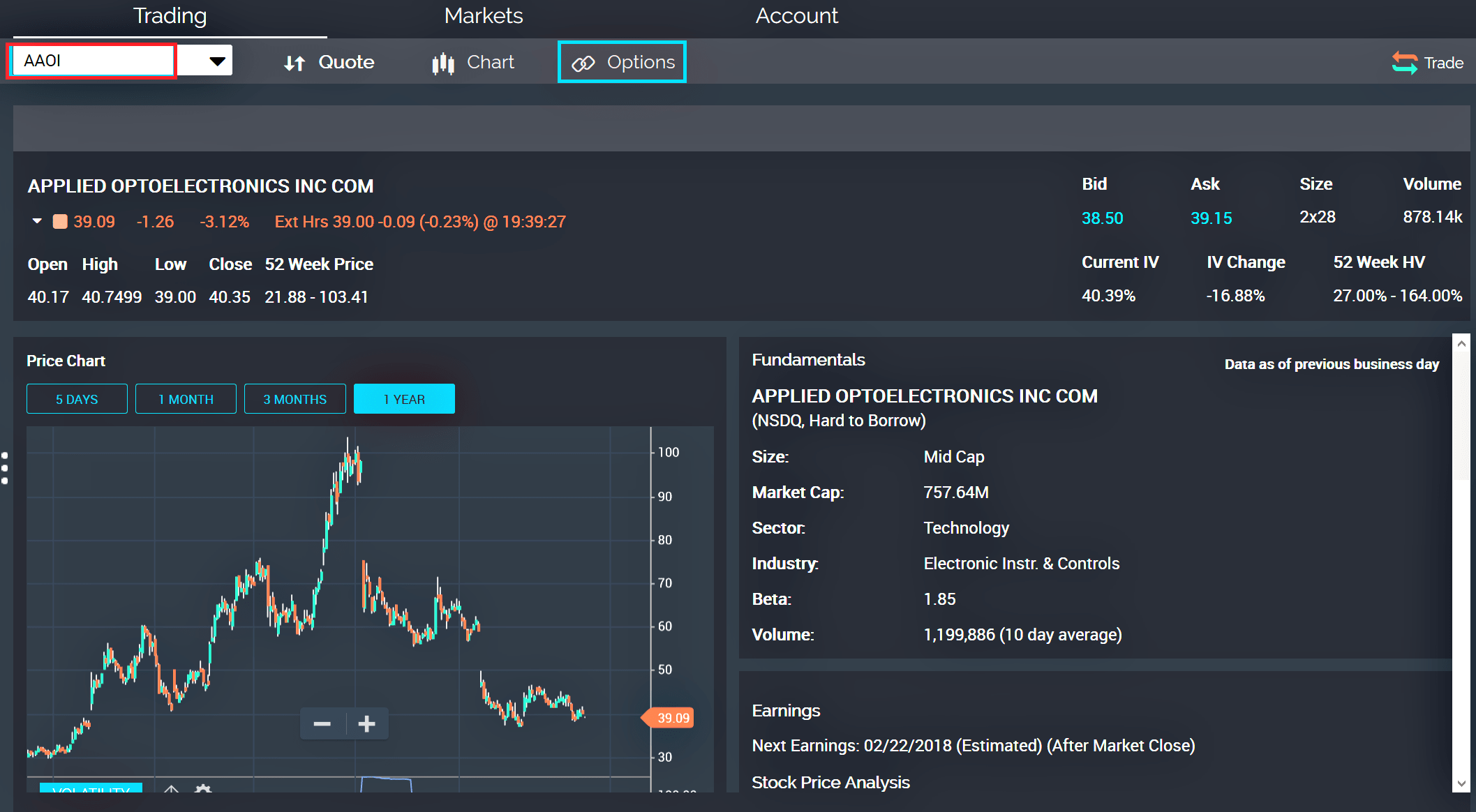

Step #3

In the box outlined in red, enter the ticker symbol or company name you intend to sell call option for. In further examples, I use AAOI stocks as you can purchase 100 shares for under $5000. Then select the Options Chain outlined in blue.

Step #4

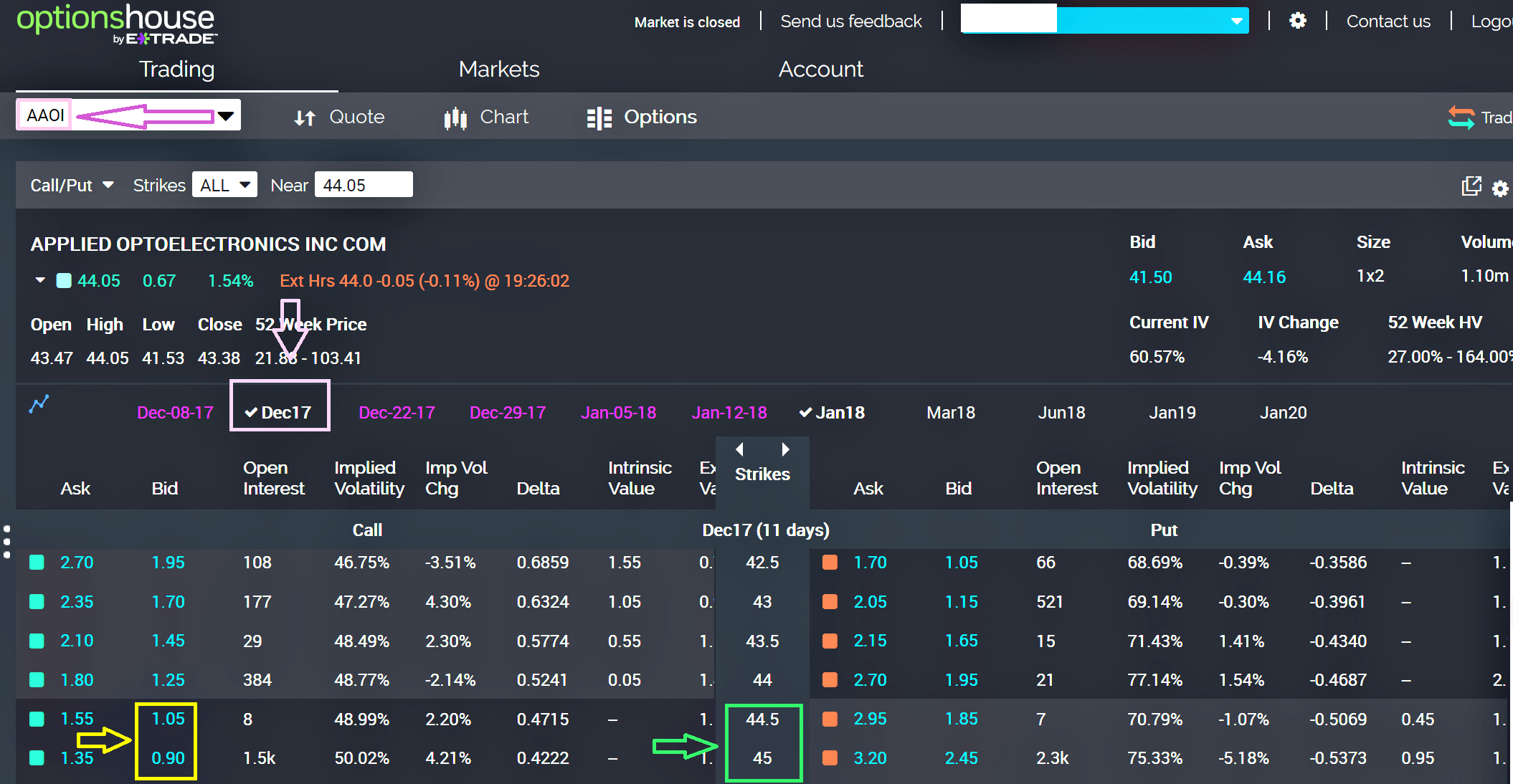

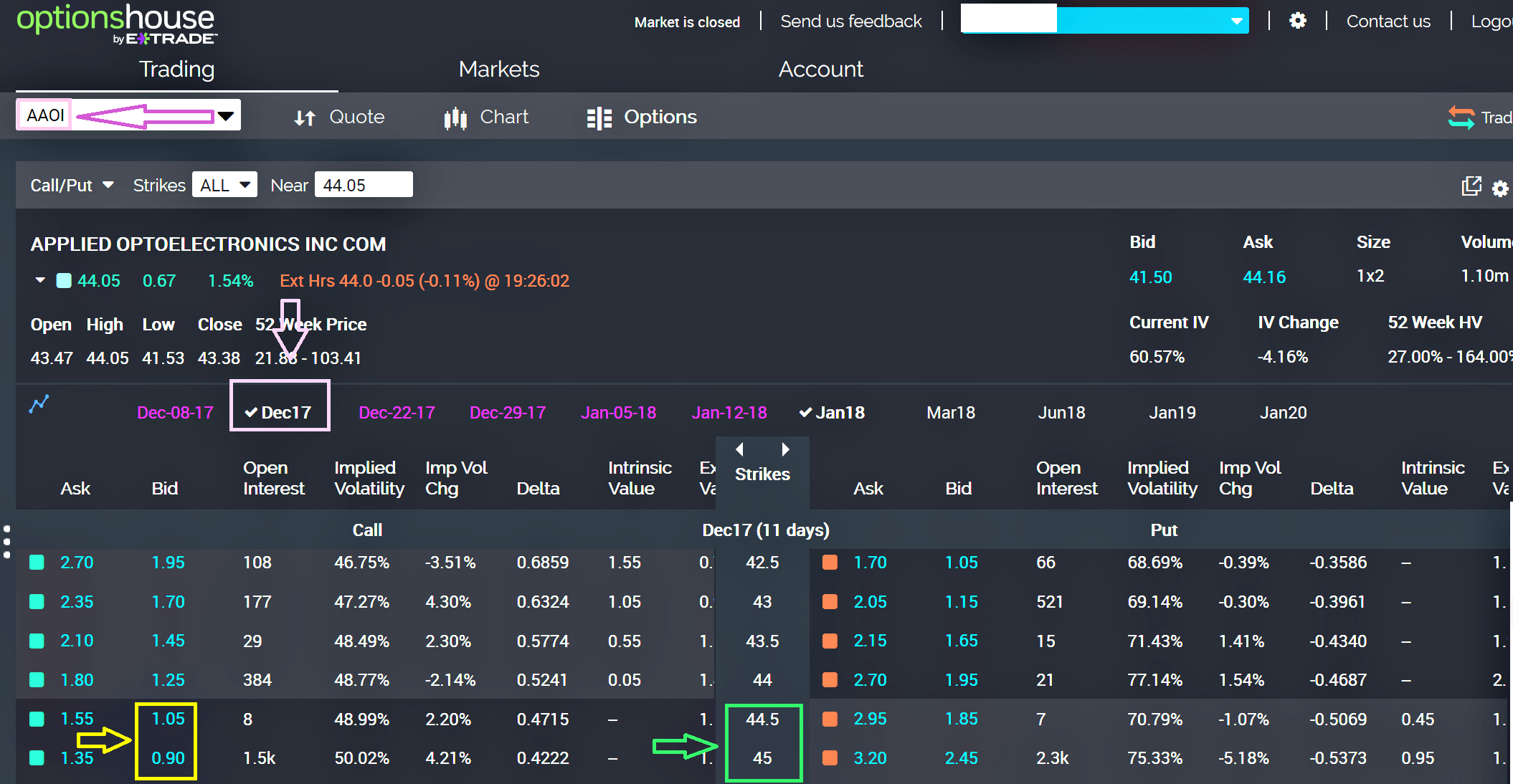

You will see a window as follows which is referred to as options chain. I have outlined in different colors the items you need to sell a call option.

- Outlined and arrow in purple is the ticker symbol AAOI

- Outlined and arrow in pink is the month in which the option will expire. These are monthly options which expire every third Friday of each month

Step #5

Next, select a strike price one or two positions out of the money

- Outlined and arrow in green is the strike price(s). I usually trade one to two strikes out of the money (the strike you choose is entirely up to your preference; however, you can see the bid profit potential goes down the further out your strike price is from the underlying stock’s current price). We will be only looking at items to the left of the Strikes column in the middle

Step #6

Outlined and arrow in yellow is the bid(s). This is the premium (credit) that a call option seller (that is you) receives. If sold at either of the two strike price(s) below of $44.5 or $45 (outlined in green), you would receive $105($1.05 x 100) or $90(¢0.90 x 100). One options contract always consist of 100 shares of the underlying stock. In this case, AAOI. Take for example the strike $44.5, if we sold this option, we are obligated to sell AAOI at $44.50 per share.

If the stock price is at or above $44.5 anytime before the Dec17 expiration and the buyer of the option we sold wishes to exercise his option, we would have the stock called away at $44.50 per share of 100 shares. If we don’t have the stock on hand, we would need to purchase it at current market price and provider to the buyer. That strike was the agreed upon strike price.

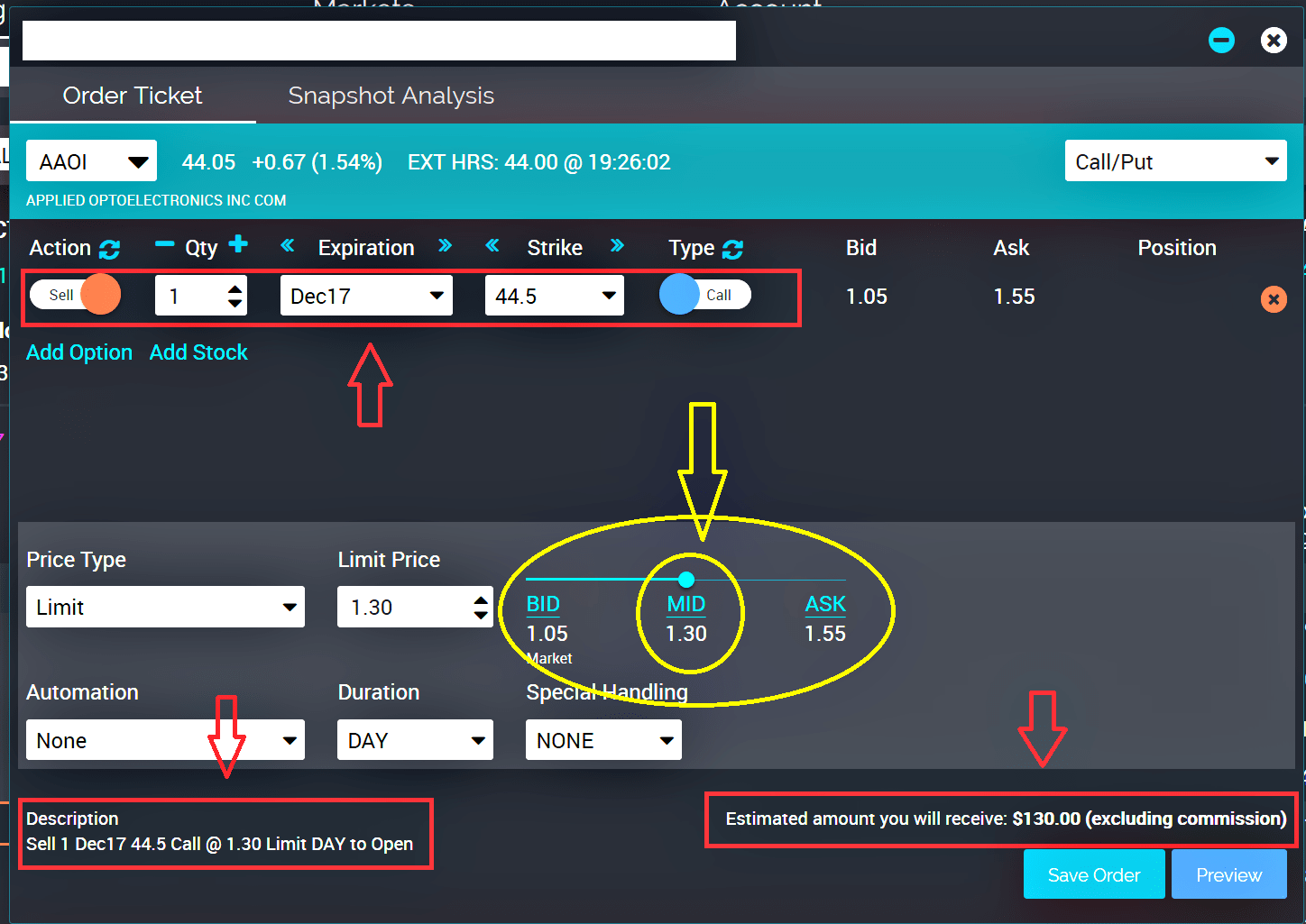

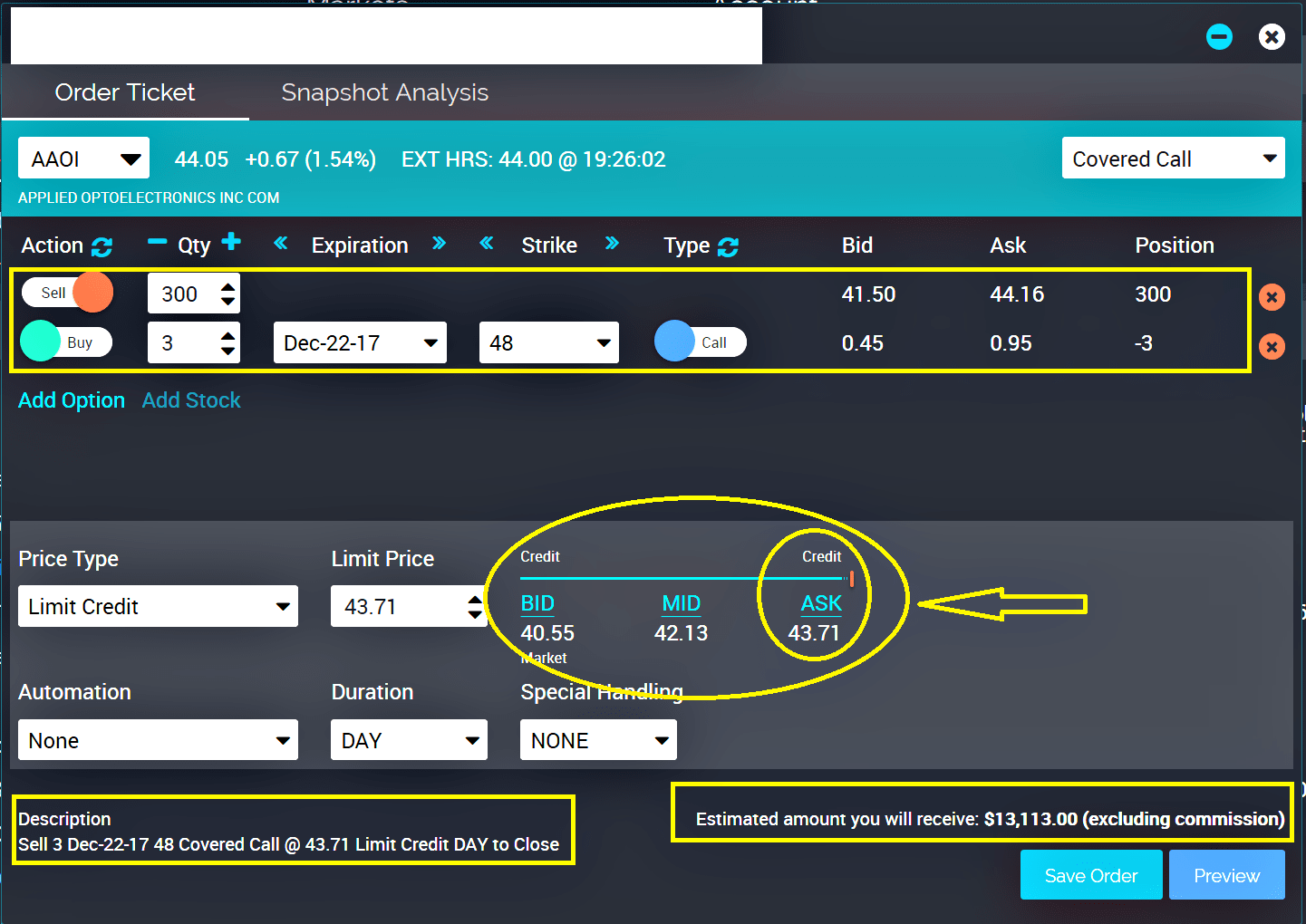

- Click on one of the bid outlined and arrow in yellow, and a pop up order ticket comes up shown below. Examine the specifics of the order. The action, quantity, expiration, strike, and type. I usually select a limit order at the midpoint between bid and ask. The order ticket shows description of the order and estimated credit you will receive from the trade(excluding commissions)

Step #7

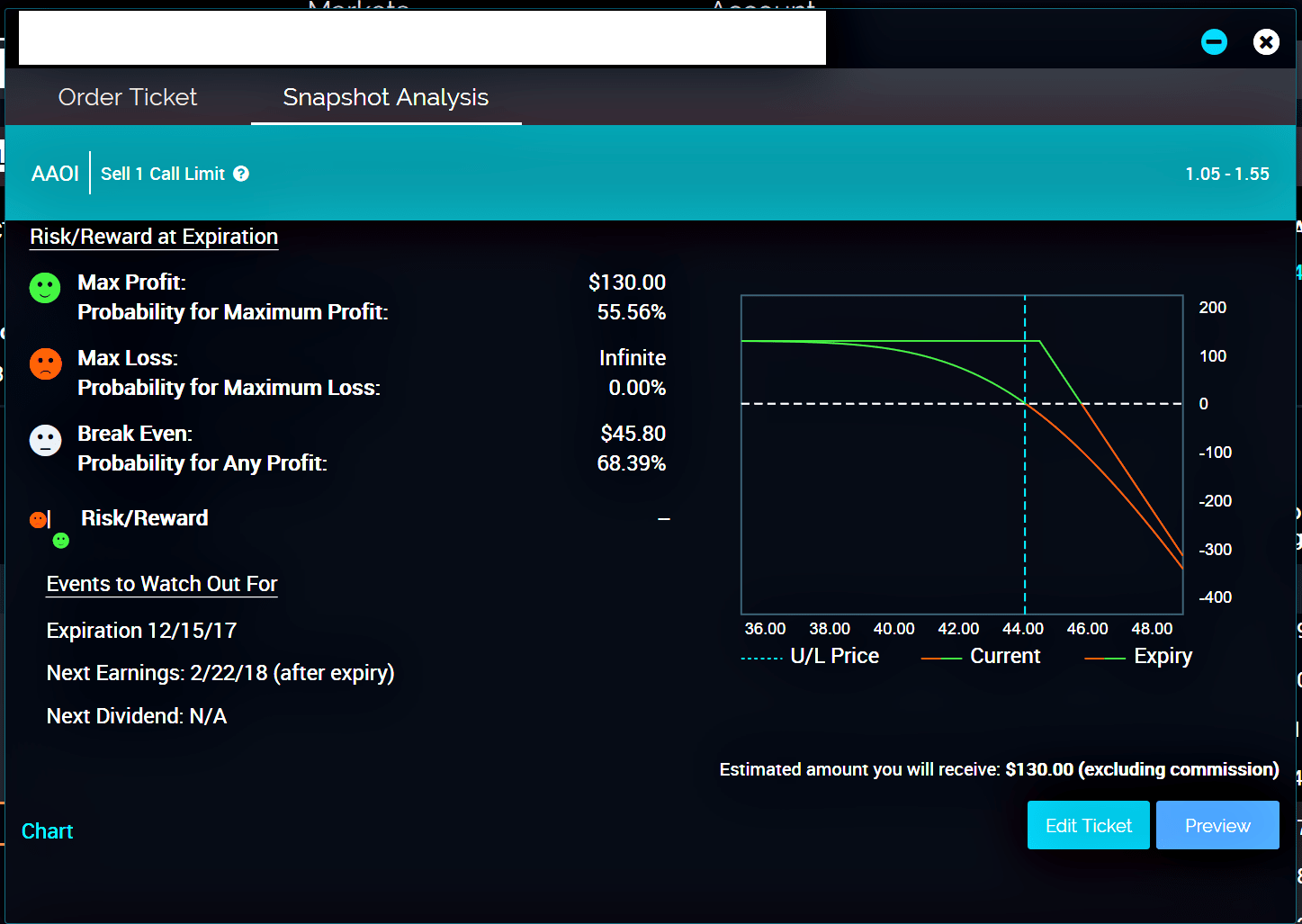

If you click on the Snapshot Analysis tab next to Order Ticket, it gives a breakdown of probability and profit/loss for the trade. Max Loss is infinite assuming the stock goes up in price to undetermined point. If you owe the shares beforehand, this point is mute because you will not need to go to market to purchase the stock if price rises above your strike.

Step #8

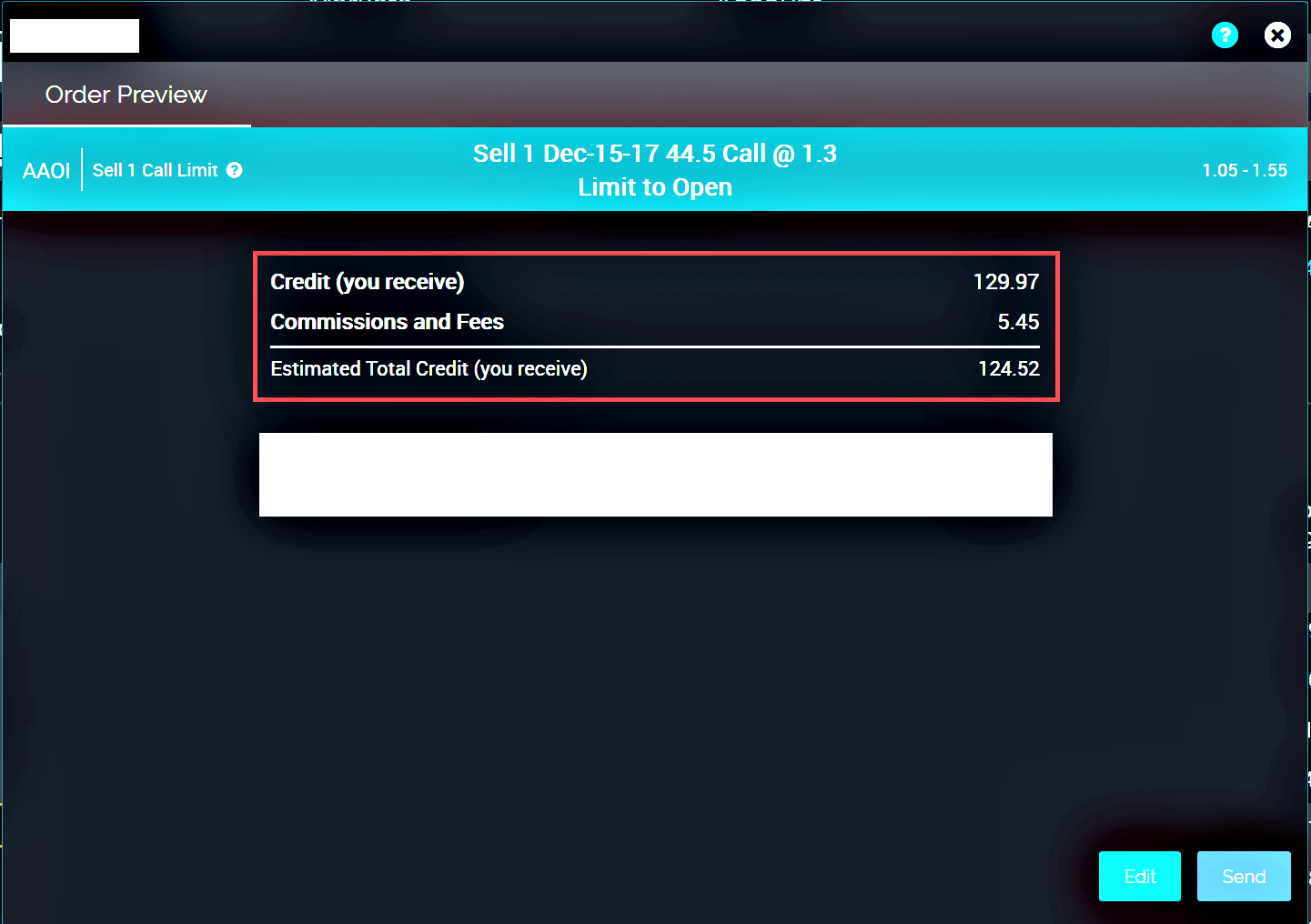

If you click Preview, it shows you credit you receive minus commissions of $124.52. Then, click Send and the trade will get executed and should show as filled.

Step #9

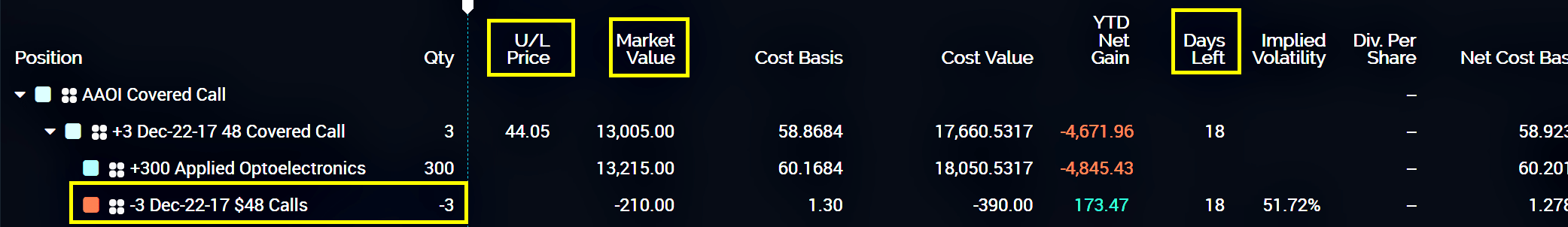

Once filled, it will appear under your Positions tab. This is monthly option, where now that the trade is in you can sit back and monitor the position.

Note: This shows as Qty 3, but disregard because I wanted to demonstrate what it would appear like if you sold 1 call. Also, the stock position has current market value below my cost value, but my call option is making money. This is possible scenario you can be in where you must manage position back to positive. This is done by selling winning covered call options to reduce cost basis and/or in conjunction with corresponding stock value appreciation.

Step #10

I will only outline 3 possible outcomes as to not overwhelm you at this moment. 1.) Close the position early, 2.) option expires worthless, 3.) prepare to have the stock call away.

Close the Position Early

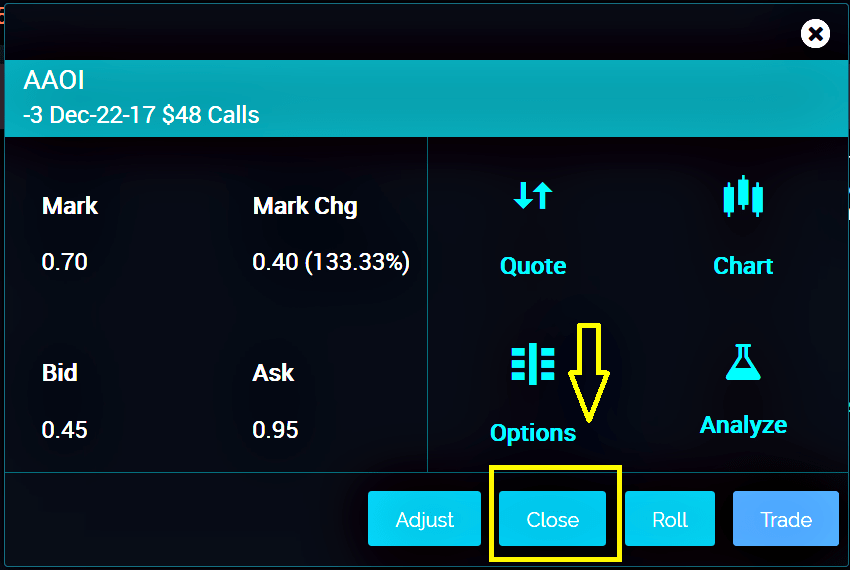

In the above image from Step #9, if the market value -210.00 were to decrease in value down to say -20, you should consider to close the position. This implies a movement in the price of the underlying stock that the value of option to market is only $20. Since I collected $390 (the cost value), I could pocket a sure profit of $370 (excluding commission) now instead of waiting for the options expiration for that additional $20. If we clicked on the position, the following box comes up. We click the close.

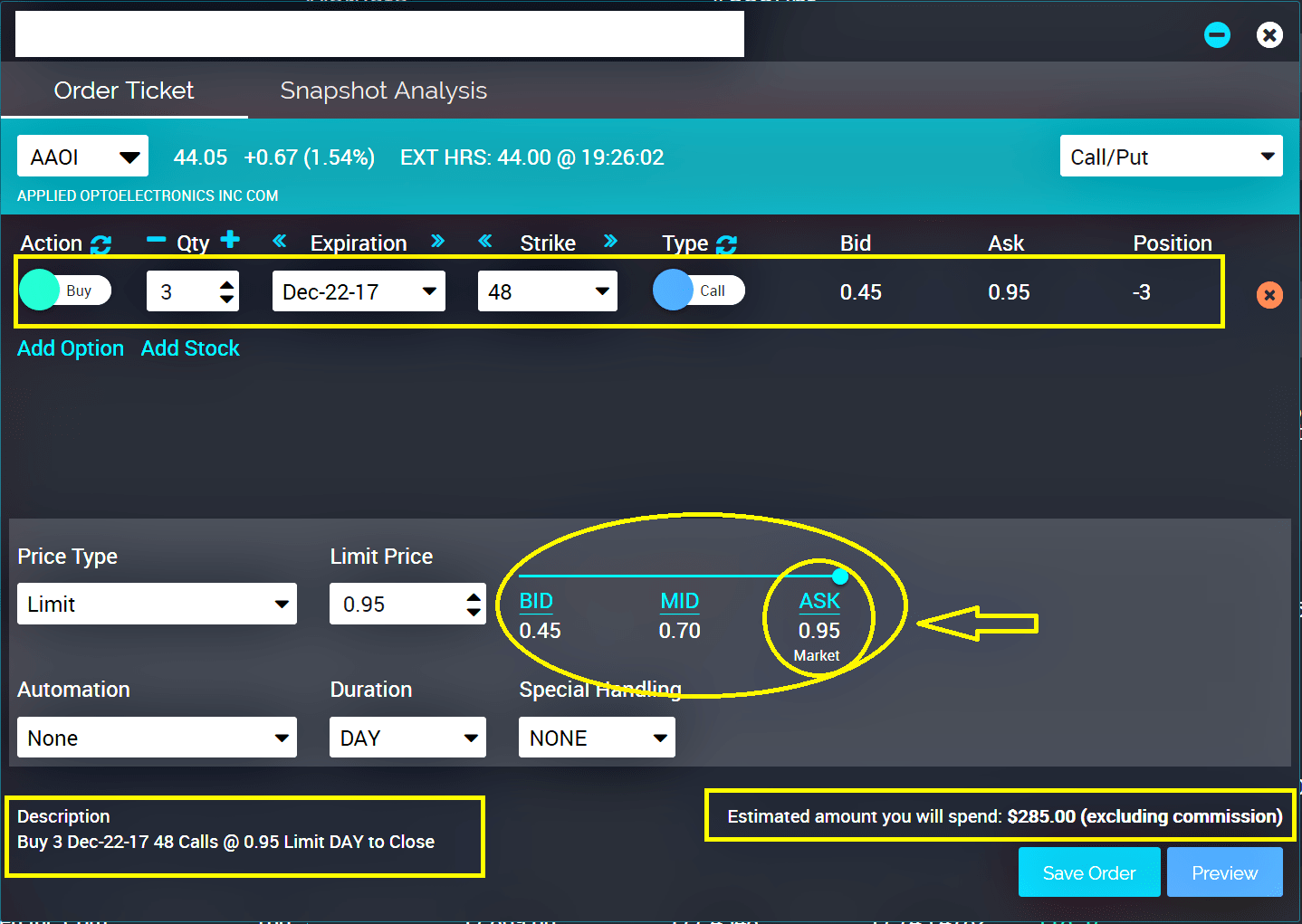

Then, we basically go in reverse of Step # 6. We buy back the option we sold at the strike we selected.

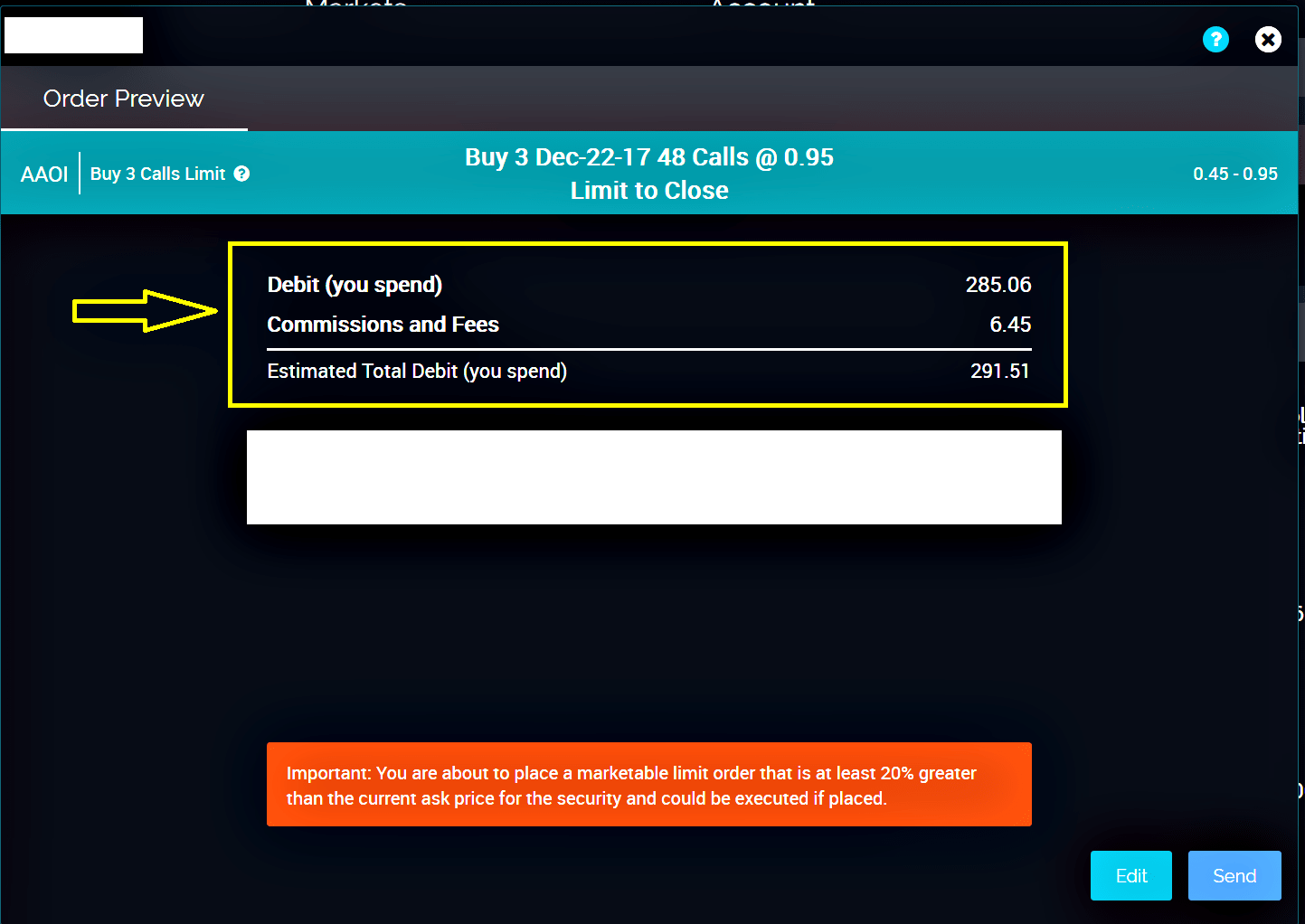

However, this time we have to pay the ask. This winds up being a debit from us $95(per contract), if we were to close early. Our net would still be $105 (excluding commissions) ($390 – $285), if close early with current numbers.

Normally, you would just close the option outlined in yellow in step #9. However, by clicking on the covered call level, you can close both simultaneously.

Option Expires Worthless

If the options expiration comes, of Dec17, and the buyer has taken no action between the time we sold the option because the strike price is not $44.5o or above, we need not take any action. The option we sold expires worthless. If a covered call was done, we retain our stock because we don’t need to sell the stock. We can then repeat the process from Step #3.

Prepare to Have Stock Called Away

If the options expiration comes, of Dec17, and the buyer has taken action to exercise on the option because the strike price is $44.50 or above. We need to be prepared to sell the stock at $44.50 a share for $4450. If a covered call was done, we give up our stock because we agreed to sell the stock at that strike. It is a covered call because we have the stock to exchange on hand; otherwise, we would have to buy from the stock market at current price. Having the stock called away, we would get cash and we would switch to strategy of doing secured put. This strategy is covered in the below blog post.

Things to Note

With the premium(credit) you received, you can reinvest, let it sit in your account or transfer out of your brokerage account. Regardless, of the 3 outcomes from Step #10, all or some of the premium remains yours. It is considered a short term gain, so taxes will need to be paid to Uncle Sam at your marginal tax rate when you report you taxes.

In Closing

These are the steps to take to sell a call option for a premium in the options market. This can be done continually to generate a steady stream of income without much money to outlay. I hope this helps you take that leap to get started trading options.

More Options Blog Post for your reading enjoyment

- Make Money Trading Monthly Options Series – October 2017

- Make Money Trading Monthly Options Series – September 2017

- Make Money Trading Monthly Options Series – August 2017

- Make Money Trading Options, $3370 This Month

- You Have Options

December 22, 2017 @ 12:27 pm

This is killing me and I half already knew this info. I’m a lil slow sometimes

February 4, 2018 @ 10:18 pm

Just take your time and give it time to absorb into your mind. It can be a lot to get your mind around especially if you are not use to these concepts.