Make Money Trading Monthly Options

This post is a continuation series about how to make money trading monthly options. I share here what my trades are for this and previous month’s. Also, I also discuss how much money I have made or loss and how I am managing positions. Previous post haven’t really delved into my psychology behind trades and why which choices were made. If you are curious, I cover this more below. It may be helpful for you that are on the fence about can you do this yourself as well. Nonetheless, what has become apparent to me is that our economic survival may hinge on knowing other ways to generate income besides a job. A working knowledge and experience of how to trade options can help you tremendously today and in future.

One Year Ago

A year ago in March, I took a chance at an opportunity to generate some more cash flow for my household. The chance I took was with options trading and that my knowledge to that point was sufficient to do well. Before that time, I really wasn’t that familiar with options trading at all. I learned the basics and understand better what I could do as I went along. I still don’t know and understand everything there is to know about options trading. However, I continue to educate myself as I go. Don’t close the door on this as an opportunity you could be taking too because you don’t think you can do. Below are last 2 month’s post and previous positions taken by date:

Making Money Trading Monthly Options Series – August 2017

Make Money Trading Options, $3370 This Month

Previous Month’s Positions

Legend

- Gray – Highlighted gray implies a position in repair due to stock price being below original strike price I purchased the stock at. Yet, I am still able to collect premium from covered call position

- Green – Highlighted green implies a position which I made some or all the money I intended to make

- Red – Highlighted red implies a position which I loss money

Covered Call

- 8/21 Sold 2 ACIA SEP17 45 Call @ $1.35

- 8/21 Sold 1 AAOI SEP17 65 Call @ $2.10

- 8/21 Sold 5 TWLO SEP17 30 Call @ $1.09

Long Stock

- 8/21 Sold 100 GDX @ $23.00

- 8/21 Bought 100 AAOI @ $85.00

Call

- None this month

Secured Put

- 8/21 Sold 1 LRCX SEP17 157.50 Put @ $4.60

- 8/21 Sold 1 NTES SEP17 272.5o Put @ $6.89

- 8/23 Sold 1 NTNX SEP17 22.50 Put @ $2.20

Previous Positions Analysis

Last month, I wasn’t quite as busy making trades as the previous month. I was largely managing positions that are in repair. I try to collect the highest premiums I can on those positions in repair without having to roll them out because the stock price has appreciated too quickly. Despite being repaired, I still successfully collected premium on these positions from a covered call. Those positions highlighted in gray are being repaired and will continue into this month’s positions. TWLO and ACIA are showing bullish as they break above some resistance lines. Something interesting happened with NTES that I explain below.

AAOI has started to rebound from the $58.98 last month to $63.80. I will be repairing this position until I get back to my cost basis or better. Below, in this month’s positions, you can see that I felt AAOI was so attractively valued that I sold 2 Oct17 $55 strike Put.

In addition, the positions highlighted in green were winners. This means they expired out of the money or was sold at profit. GDX was sold for profit after called away at $23 a share. LRCX option expired worthless as it closed way above the $157.50 strike. I keep the premiums from the trade no matter what. However if the price of the stock at expiration is at the strike price, I can be put the stock or have the stock called away.

This Month’s Positions

Here are the trades I entered for this month which are either a continuation of, a new, or a closed position. Options will expire on the 3rd Friday in October, unless I close early, roll up, roll out, or roll up and out of a position(s). Furthermore, I use the position taken in companies by their stock ticker symbol, i.e. ACIA. If you want to know who these companies are, here’s the part you need to do a little research:

Long Stock

- 9/18 Bought 100 NTES @ $272.50

- 9/18 Sold 100 NTES @ $290.03

- 9/18 Bought 100 NTNX @ $22.50

Covered Call

- 9/18 Sold 2 ACIA Oct17 50 Call @ $0.75

- 9/18 Sold 1 AAOI Oct17 65 Call @ $2.30

- 9/18 Sold 5 TWLO Oct17 32.50 Call @ $0.75

- 9/18 Sold 1 NTNX Oct17 22.50 Call @ $0.97

Secured Put

- 9/18 Sold 2 AAOI Oct17 55 Put @ $3.80

- 9/18 Sold 1 NTES Oct17 272.5o Put @ $3.20

- 9/20 Sold 1 MU Oct17 34.50 Put @ $1.11

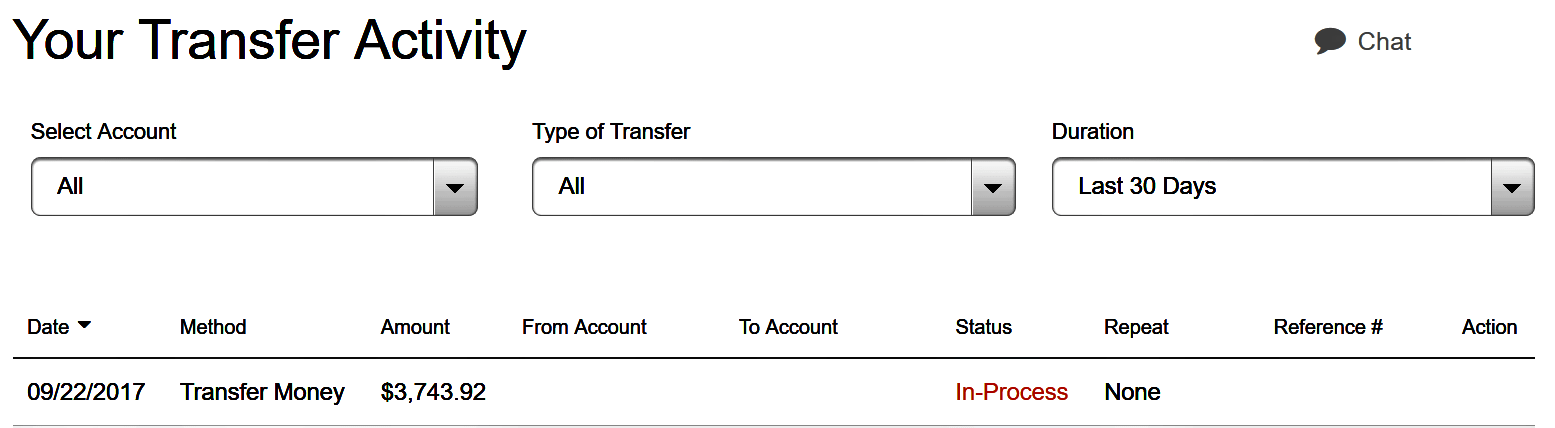

I was able to make money trading monthly options this month of $3743+ with these positions.

My Trade Psychology

I am still largely putting on options trades in stocks with earnings growth, good fundamentals, and relatively low P/E in comparison with its peers and broader market. On Monday, I was assigned NTES, which is one such stock. It ran up from the $272.50 strike I bought it at to $290.03. I then sold it that day and then put on the exact same position as last month. That was quick profit which I am glad I took that day, because it is back down to $271.61 as of writing this post.

I think the stock(s) in repair can recover because they are relatively cheap, but I’ll just have to be patient. Despite that, I still have had several positions win, and those positions were taken in stocks with very attractive P/E ratio and growth prospects. They were within historical P/E ratio range of stocks between 10 – 20. As a result, these were stocks I was much more comfortable taking ownership in because the P/E ratio was not rich.

The current positions I chose for this month is inline with that thinking to have stocks with P/E ratios under 20. For example, MU has P/E of 16, NTES has P/E of 18.81, and AAOI has P/E of 15.12. I am positioning myself to be more risk off in positions I take without being out of the market. Even with that being the case, I still make a fair amount of premium on these positions.

In Closing

Finally, updates of trades I’m positioned in and how they have been working for me can be found here each month. These are currently the positions I’m working for options trades and I am doing pretty well, with hopes that a few of my positions, namely TWLO, AAOI, and ACIA, rebound slowly to what I originally paid for them, but in the meantime, I’ll sit back and collect premiums while I wait and continue to decrease my actual cost basis in these stocks.

Weekly Roundup of Blog Post for 9/25/2017 - 9/29/2017 - The World Of Os

October 1, 2017 @ 5:24 pm

[…] Make Money Trading Monthly Options Series – September 2017 AAdvantage Aviator Red Limited Time Credit Card OfferStart Here […]