In $7,000 of Unexpected Debt, Evaluating My Options

TheWorldOfOs.com is about what is going on in its author’s (Owanzer stafford) world. So, I’ll be transparent around personal finance in saying it’s not all roses all the time nor am I living in a bubble. I’m not speaking down from on high. No, I’m talking about my middle class experience in real time. That I depict as I maneuver through life. If you’re not über rich, you’re likely to be or have been in a debt circumstance with similar options I put in context below. I’m in $7,000 of unexpected debt, evaluating my available options on how I’m going pay it off. The take away is that when you find yourself in this situation, be sure and layout your available options. Then based on that evaluation, choose the best option to dig yourself out from beneath debt.

How Did I Get Here?

So, how did I get in the debt? I think 2 things I can attribute it to:

- An investment I made to acquire a new rental property

- Underestimating the home improvement cost of new rental property

I don’t want to infer that every decision to invest will wind you up in debt. Long-term, this still is a very good decision. However, if I had done a better job to find a property more move-in ready, given the fact I was putting 20% down, it would not have opened the door for me to underestimate the home improvement cost. That was the mistake I made. Due to the devastation caused by Hurricane Harvey in Houston, the cost for labor was much more due to supply and demand forces. I was now at its mercy.

Even after liquidating emergency funds, I’m $7,000 short. That is a combination of final payment to the general contractor and small repairs needed at 2 of my other rentals. I have no discretionary income, either emergency savings or incoming cash-flow, to cover this unexpected debt in it’s entirety when it’s due. For me, I’ll need to few months to pay it off and access to credit will allow me do so.

“Credit” Backdrop

There is debt situation worse than this where there isn’t a “credit” backdrop. As my wife frames it, this debt means your lights get turned out, or your water gets turned off, or you can’t get any food. How many of us are in this situation? As opposed to I’m in debt, and I still go and buy a shirt at Ross with a credit card. I’m in the latter debt situation.

I’ve had to make tough choices and sacrifices throughout my life just to have access to a credit backdrop.

Yes, my debt situation is a little different from being that dire, but certainly not because of privilege. Before me, it was my parents choices and sacrifices. Then, I’ve had to make tough choices and sacrifices throughout my life just to have access to a “credit” backdrop. Yet, I still wind up in a situation where I have to make 1 or all of the decisions below:

- borrow the money either through personal loan or credit

- sell assets (maybe at most inopportune times) to raise money to cover

- lose something (wealth, possessions, credit score, and possibly life)

If that access is maxed out and/or misused, how quickly can that backdrop disappear? I have sources of liquidity, in investment accounts, that I can use which I don’t want to. Being in this situation lets me know that I haven’t arrived.

This is an issue poor and middle class people are constantly facing in life and 1 or more of the aforementioned decisions have to be made. The more of these situations we have, the more we are chipping away at our wealth, health, security, and freedom. These are also the decisions that can mean the difference between us moving ahead, staying above water, or losing ground.

Evaluating Debt Payoff Decisions

I’m a little stressed from this too because I hadn’t been in this position in awhile. In addition, I hate that I’m faced with the decisions above. I know I don’t have $7,000 just lying around and even if I did it pains me to have to come off that. But what can I do? I’ve been thinking about that and I know it could be worst. I’m going to have gazelle like intensity in paying off, so I won’t be in this debt for long. Let’s talk about my evaluation, in conjunction to, 3 aforementioned decisions and what I’m not going to do and why.

I’m not going to sell assets

I think I can be out of this debt in 12 months with discretionary income from my salary, positive cashflow from rent, and options trading premiums going towards paying it off. So, because of the short duration, I’m not going to sell assets that have potential for appreciation and compounding.

- lose something (wealth,

possessions, credit score)

I have no intention to be corrupt like say “45” and have contractors do work and not pay for it and say sue me. There will be no lien against my property nor judgment against me to further crucify my credit score. So, my contractor and his workers will get paid in full and on time. I will lose a bit of wealth which if I didn’t underestimate would have gone to my long term portfolio in my custom built motifs, Os Own What You Love and Os ETF 87/13 Allocation.

- borrow the money either through personal loan or credit

I plan to borrow and put the money owed on a credit card for the points/miles potential. The question is should I or will I leave it there? Here I’m considering the interest rate I’ll need to pay on that $7,000 balance.

Options Available to Me

My credit score is kind of low now because of my balance transfer strategy. So, a personal loan may not be a good option. I’ll still check to compare the terms to my other options which are:

- leave on credit card

- do a balance transfer

- use a policy loan against the cash value of my whole life insurance policy

The latter is an option you may not have heard of and may not be available to you. However, it may be; thus it’s on the table as well for consideration.

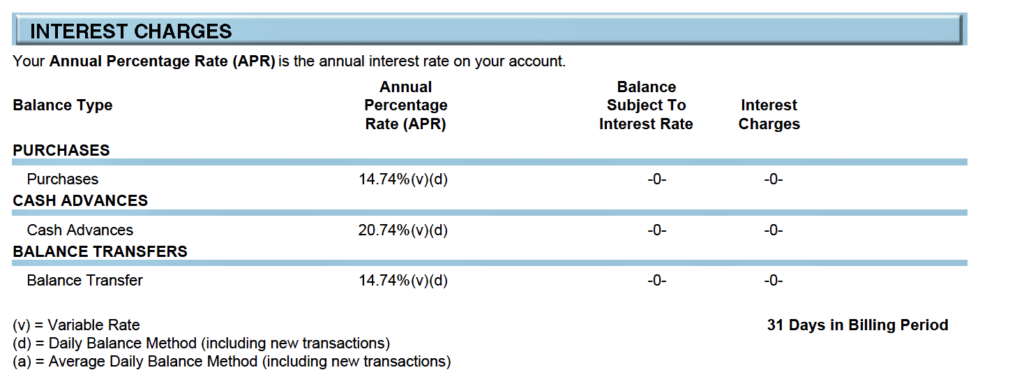

If I choose to leave on a credit card, it’ll be a business card with the lowest interest rate. Currently, the Chase Ink Cash is the business credit card I have in my possession with the lowest APR. I would then track the interest I pay, because I can deduct on my taxes as it’s from a business expense to improve my rental property. In addition, some lenders like Chase, American Express, and Citi don’t report business credit card balances to the 3 credit bureaus. So, this won’t further impact my credit score.

Chase Ink Cash Lowest APR

I recently received a balance transfer offer from Barclays on AAdvantage Aviator Red World Elite MasterCard. It’s 0% promotional APR through August 1, 2019 with a 3% transfer fee. That’s 15 months where I wouldn’t need to pay interest on the balance while I payoff. This is looking like a good option.

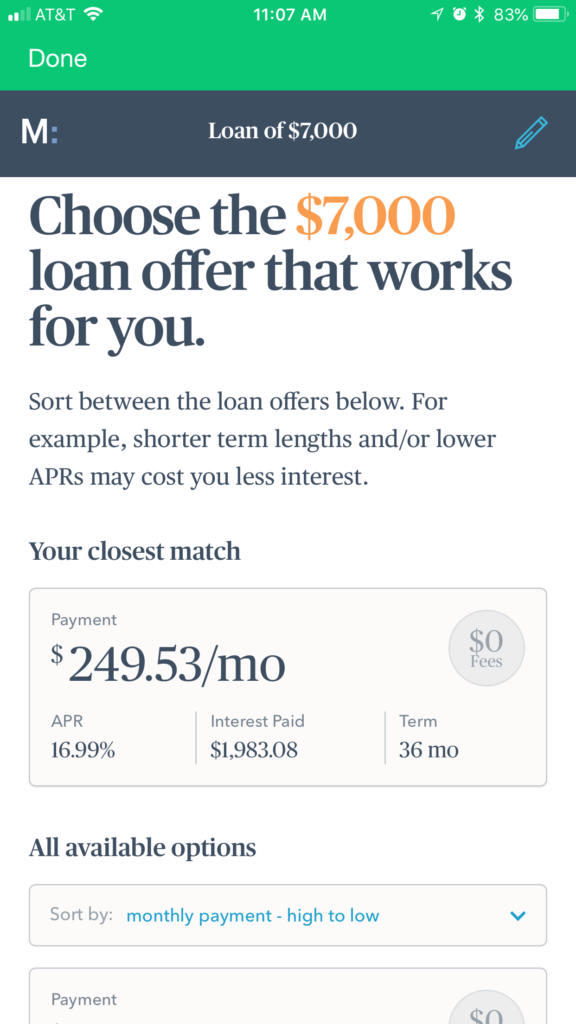

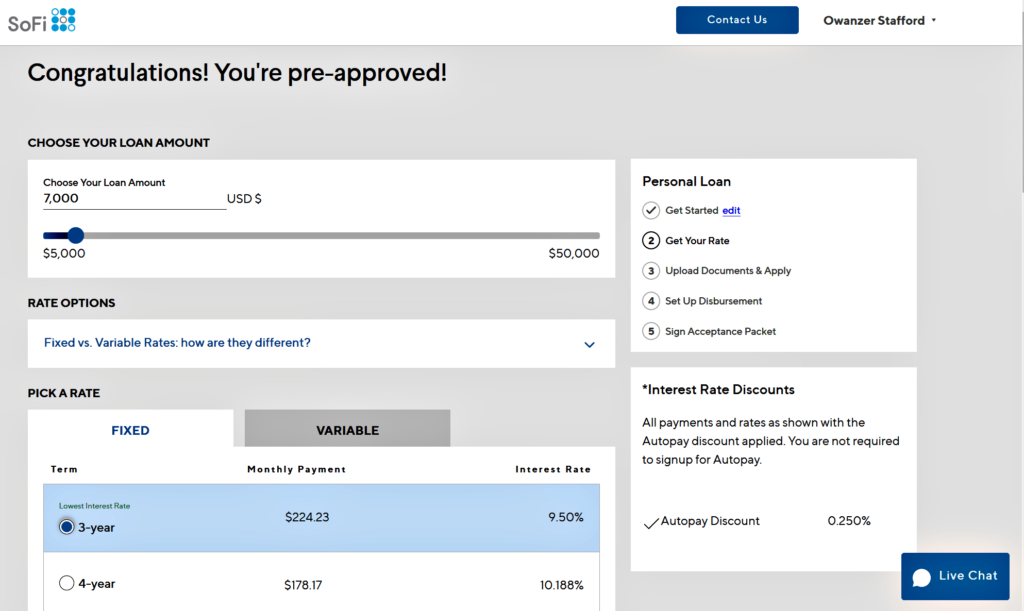

If I do policy loan, I have the greatest flexibility as far as terms and interest rate. I get 5% interest rate and duration of loan is totally up to me. With this option, I’m not beholden only to the terms of what the bank gives to me. Below are the terms I received from Marcus by Goldman Sachs and Sofi:

Marcus by Goldman Sachs Offer Terms

Sofi Personal Loan Offer Terms

When you are without many financial options because of bad or no credit, others make the terms for you. I’m not liking the personal loan option from these 2 lenders.

Conclusion

I’m in debt and I’m aware of how I got there and how I’m going get out of it. I’ve evaluated options available. My best option is the balance transfer option where I’ll pay $466 over next 15 months. I’m just glad I have decent options I can easily bounce back from but I know some people have to do all 3 decisions because it’s so bad they are behind. That is a tight position to be in. I hope information shared here helps your thought process in evaluating your available options and choosing best one to get from beneath debt.

June 19, 2018 @ 8:23 am

Great blog here! Also your web site oads uup fast!

Whatt web hoat are you using? Can I get your

affiliate link to your host? I wish my site loiaded up ass quickly as

yours lol http://passingthequill.com/node/29

June 30, 2018 @ 8:42 pm

Thanks, it’s appreciated. I use Bluehost.com. Here is my affiliate link. Hope this helps. https://www.bluehost.com/track/theworldofos/

I also compress images using https://imagecompressor.com/