How To Book Cruise With Points

In the blog post, “One Cruise Within Sight”, I wrote we were close and now, as of July 13th, it’s official that one of the two vacation cruises goal has been reached as laid out in the blog, “Lofty 500,000 Points Goal for 2 Vacation Cruises”. What’s left to do is booking a flight, which as of writing this, is still too far off in the future to do so. Then it’s smooth sailing along Europe’s Western Mediterranean coastal cities for our first time to this continent.

What’s uncommon but becoming more common for us is how we are going to get there for practically no additional money out of pocket which weren’t having to spend anyway. Through maximizing award travel techniques that I have learned from travel bloggers and pod-casters of the world all this has become possible. This is our second big trip achieved entirely through award travel as the first was a 7 day vacation in Hawaii and now it’s going to be 9 day cruise in Europe.

I am astonished and proud because not only are we getting the opportunity to see and experience the world like we desire, but also knowing the fact that we haven’t gone into debt to do so. In other words, though we used credit cards to get award travel rewards, we did not carry balances at the end of each month through this process. I know a lot of people may not believe that is true, but it is absolutely true! I cannot stress enough that it is possible and can and should be done without going into debt.

How We Booked Cruise

Let me explain how we booked the cruise, as this blog post is the first I’ve seen discuss award travel being used for cruises; although, I am not stating it’s not been done before, but it will be the first known to me of anyone speaking of it in the award travel world.

My wife’s credit, was a big factor in making this trip happen because as I discuss and thoroughly detailed in the aforementioned post, “One Cruise Within Sight”, she was largely responsible for the points accumulation as I was tapped out from applying because of Chase’s 5/24 rule (no more than 5 credit cards from any other bank, including select Chase cards, which show on your credit report for the last two years). The seventeen credit cards I signed up for last year put my credit on the sideline. This was for the end of last year and beginning of this year I couldn’t do anything. During that time, some fabulous offers from Chase were up for grabs. They offered the Sapphire Reserve 100,000 Ultimate Rewards (UR) and the Business Ink Preferred 80,000 UR for $4,000 and $5,000 spend, respectively, in 3 months. My wife was approved for both credit cards.

Transfer Or Combine UR Points

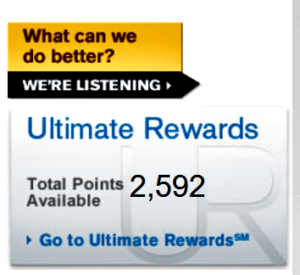

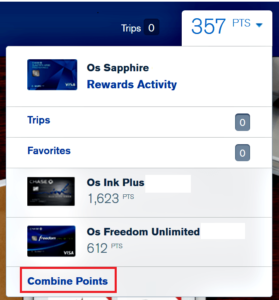

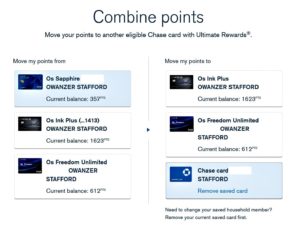

Chase has a feature in Ultimate Rewards where you can transfer/combine UR points into your own account(s) or that of another household member. In addition, UR points have different valuations depending on the type of card it is. My wife has the Sapphire Reserve card where each UR point is valued at their highest value of ¢0.015. The Sapphire Preferred has the next highest value of ¢0.0125. Those two cards are Chase premium credit cards. There is also non-premium Chase Freedom and Freedom Unlimited were the value is ¢0.01. So, once we have achieved the points needed, we transferred those points to my wife’s Sapphire Reserve account. The steps show this below.

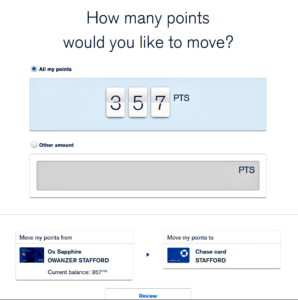

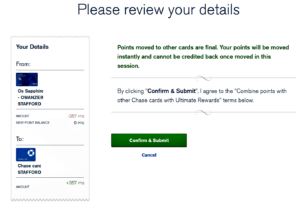

Steps To Combine Points

- Login to your Chase Account and find Go to Ultimate Rewards

- Select the card you want to transfer/combine points from

- Move the points from one account to another or from your account to another member of your household

- Enter the how many points you want moved

- Review and confirm the transfer. It should show in the other account instantaneously.

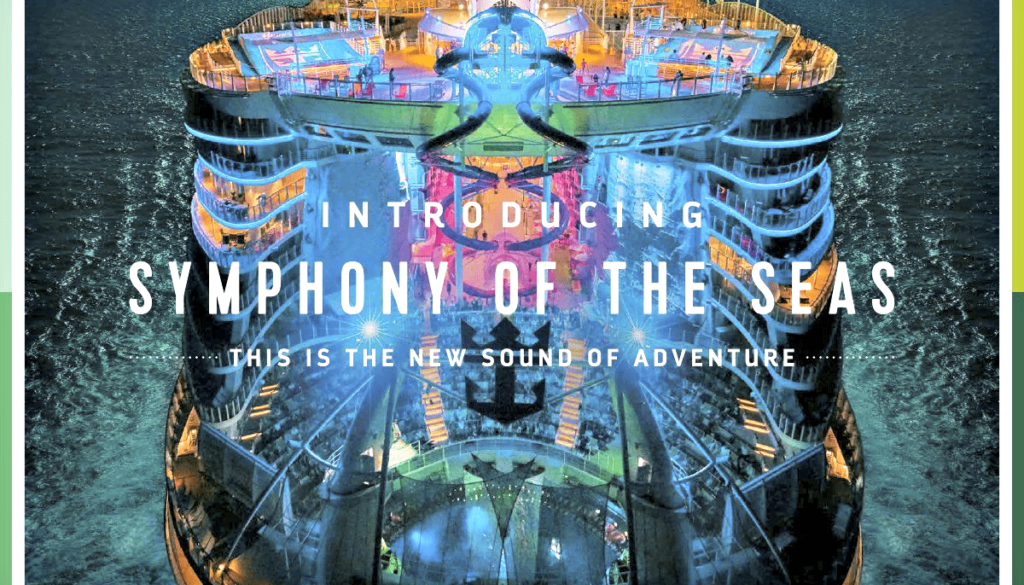

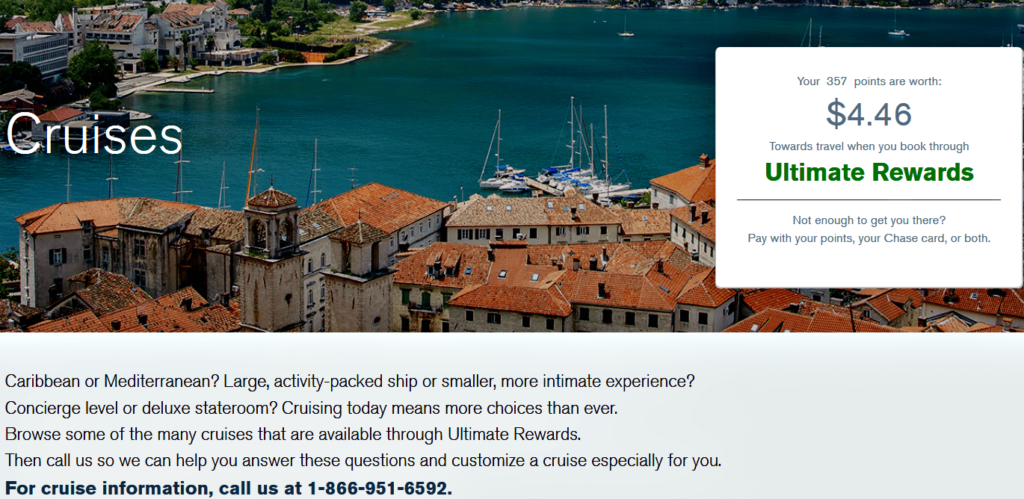

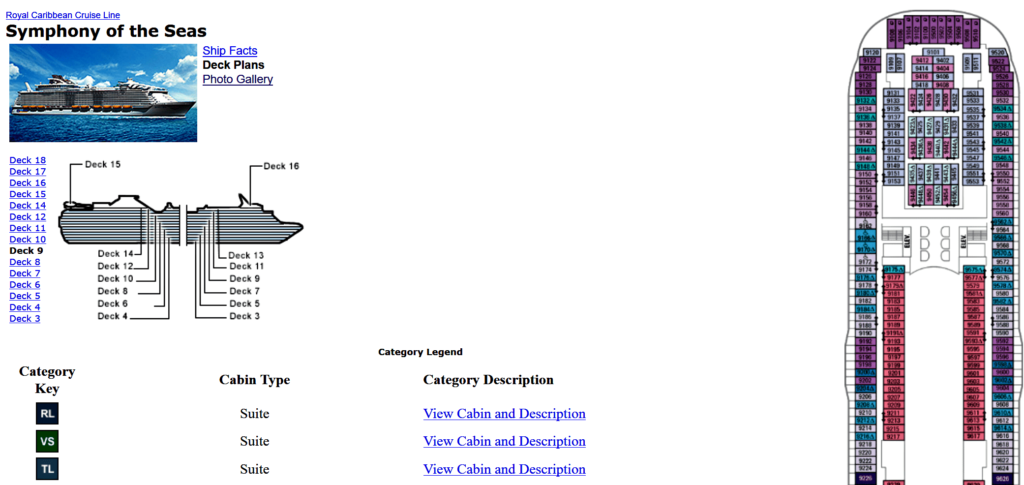

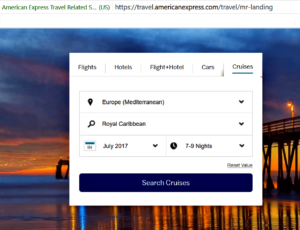

Next, my wife and I conference on the phone and then contacted Chase under the Ultimate Rewards -> Explore -> Cruises -> Cruise Information Number  and we told the representative the cruise and the dates we were looking to book and that we wanted to do so with our points. This cruise was not listed on Chase’s website, but I was able to pull up detailed information on American Express Membership Rewards website for the ships deck plan

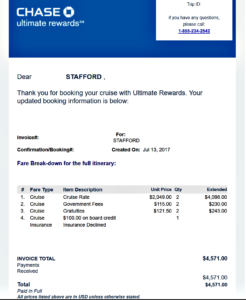

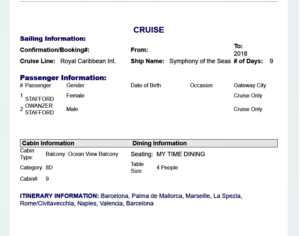

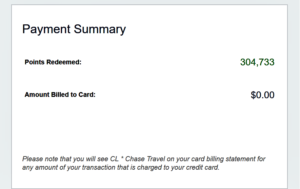

and we told the representative the cruise and the dates we were looking to book and that we wanted to do so with our points. This cruise was not listed on Chase’s website, but I was able to pull up detailed information on American Express Membership Rewards website for the ships deck plan  in order to visually see of the available rooms where they were located on the ship and select the one we thought best for us. We booked the entire cost of the cruise, including taxes and gratuities, for a 9th floor Ocean View balcony on Royal Caribbean’s newest ship, Symphony of the Seas, for 9 days departing from Barcelona for 304,733 UR points, retail cost $4,571.

in order to visually see of the available rooms where they were located on the ship and select the one we thought best for us. We booked the entire cost of the cruise, including taxes and gratuities, for a 9th floor Ocean View balcony on Royal Caribbean’s newest ship, Symphony of the Seas, for 9 days departing from Barcelona for 304,733 UR points, retail cost $4,571.

The Only Downer

The only downer was that it took awhile to actually book the cruise because we were awaiting bonuses to post. The price went up as I discussed it might do from time passing when I originally wrote the first post where it was retailed at $3,334, not including taxes and gratuities. Nonetheless, I am ecstatic about the result as this trip was booked entirely with Ultimate Rewards points from Chase. All it took was ordinary spending, some of which was strategically done on these and other credit cards from Chase.

Nothing to hard, maybe a little work for you to do, but you can save paying $4,571 for a cruise. I am sure it will be packed with great new experiences, and I think it’s worth the work needed to achieve it. My wife would tell you that that $4,571 savings will not be lost on me. I will save it towards our long term investments. As for the flight still to be booked, I have points accumulated to cover that cost for two people.

Is Cruise In Your Future?

If you have travel in mind in the future, particularly a cruise, direct your attention to two transferable currencies; namely, Chase Ultimate Rewards and/or American Express Membership Rewards (MR). I recommend these two because they currently offer the highest signup bonuses for available credit cards that can be used for cruises, but as mentioned in aforementioned blog, “One Cruise Within Sight”, American Express has some drawback because you cannot pool points. However, the end result still can be achieved through slightly different process which I will lay out below.

Note: I have not experienced doing this process, but I spoke with American Express representative that books the cruises. Using our cruise above as hypothetical question, she said how to book cruise with points can be achieved.

Chase Ultimate Rewards Strategy

This cruise cost 304,733 UR points for 2 people. The below strategy shows how a couple can achieve that by each signing up for

- Chase Sapphire Reserve – 50,000 UR points bonus after $4,000 spend in 3 months. $450 annual fee; however, $300 travel credit (can be used for flight)

- Chase Sapphire Preferred – 50,000 UR points bonus after $4,000 spend in 3 months. Annual fee waived first year, then $95 annual fee

- Chase Freedom Unlimited – $150 bonus after $500 spend in 3 months. (Cashback can be converted to UR points) No annual fee.

- Chase Freedom – $150 bonus after $500 spend in 3 months. (Cashback can be converted to UR points) No annual fee.

- Chase Ink Preferred – 80,000 UR points bonus after $5,000 spend in 3 months. $95 annual fee (substitute in this card if you have a business)

For both, this accumulates to 200,000+ UR points and $600 cash( 600 ÷ ¢0.01 = 60,000 UR points), which can worth more than ¢0.01 when transferred to Ultimate Rewards account linked to Sapphire Reserve. This strategy can help you hit a 262,000+ UR mark and this can all be done at your own pace. An additional 3K – 4K of spend will put you at the mark point-wise needed. I lay out how to direct your spending using the strategy in the blog, “How to Meet Credit Card Minimum Spend on Chase Sapphire Preferred”. Remember this is an example of points needed for our cruise but can vary for you. So mix and match as appropriate to your circumstances.

American Express Membership Rewards Strategy

The points cost for this cruise using MR would be significantly higher at 457,100 ($4571 ÷ ¢0.01) for 2 people. The reason is because MR points are typically valued at ¢0.01 per point for travel redemption like this. So, the below strategy is geared more to those who own businesses because of more access to American Express higher signup bonuses credit cards. Below shows how a couple can achieve that by each signing up for

- American Express Platinum Card – 60,000 MR points bonus after $5,000 spend in 3 months. $550 annual fee; however, $200 statement credit for airline incidentals (only for one selected airline)

- American Express Premier Rewards Gold Card – 25,000 UR points bonus after $2,000 spend in 3 months. $100 statement credit for airline incidentals (only for one selected airline). Annual fee waived first year, then $195

- American Express Everyday Preferred Card – 20,000 MR points bonus after $1,000 spend in 3 months. $95 annual fee

- American Express Business Gold Rewards Card – 50,000 MR points bonus after $5,000 spend in 3 months. Annual fee waived first year, then $175

- American Express Business Platinum Card – 50,000 MR points bonus after $10,000 spend in 3 months. $450 annual fee; however, $200 statement credit for airline incidentals (only for one selected airline)

For both, this accumulates to 410,000+ MR points. An additional 3K – 4K of spend will put you at the mark point-wise needed to book entirely with points. The booking process for Membership Rewards would be similar to Ultimate Rewards, except you would go to your Membership Rewards account and call the number for cruise booking.

Steps To Book Cruise with Membership Reward

- Login to Membership Rewards account

- Call to speak with representative about booking

As mentioned above, American Express seems to follow the process, as I understand it, to allow you to pay for cruise in increments. For example, if you wished to book cruise entirely with points, the rep said, they would run one account’s MR points. They would then need to wait 72 hours and then run the other person’s MR account. Any remaining balance that is left over can be paid with a credit card that day or within allotted time-frame.

In Closing

Anytime you can pay for travel with award travel, I think it is pretty fantastic. I lay out the case above how we accomplished the goal to book cruise entirely with points. Every case might not be like ours, but even if you just offset any cost of travel like this too is an goal to be striven for. The payoff will be tremendous because if done like I said above you’ll save money and have memorable experiences.