Flying To Europe with Points/Miles For A Cruise

In a previous post, “How To Book Cruise with Points”, I detail how I booked a cruise for my wife and I to Europe with Chase Ultimate Rewards points alone. Now, the time has come when I have to book the flight for this trip. Similar to cruise, I am going to be flying to Europe with points/miles for a cruise. We have amassed points/miles needed through strategic use of credit cards that were providing big signup bonuses. It is a pretty long trip and we have saved a lot of points for just this purpose. Ultimately, our supreme goal is to redeem the points we have accumulated for experiences we might not have had otherwise. We can redeem points/miles for aspirational travel in style and comfort and pay little or no money out of my pocket for this privilege.

Tracking Prices

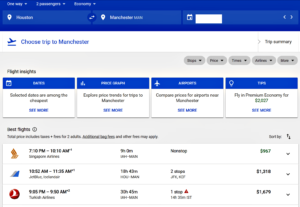

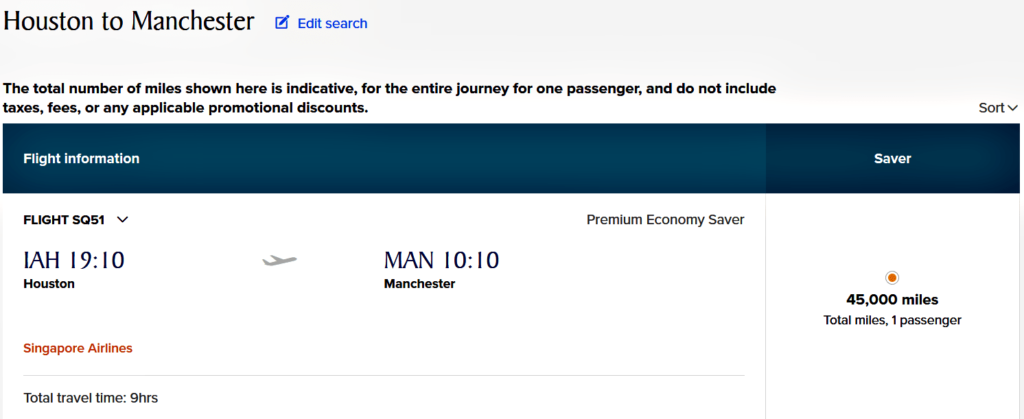

On Google Flights, I have been tracking business class flights price particularly for Singapore Airlines.  They have a 9 hour nonstop flight from Houston to Manchester. During my research on other travel blogs, the Points Guy list it as 1 on the 10 best business class awards to Europe. I want to experience that and since we live in Houston, that was right up my ally. Although Manchester, GB is not my final destination, I thought to use this opportunity to either train/fly for a brief visit to London, GB. Then fly via British Airways to Paris, FR. Since these cities are more inland from our cruise departure site in Barcelona, we would not have been able to experience otherwise.

They have a 9 hour nonstop flight from Houston to Manchester. During my research on other travel blogs, the Points Guy list it as 1 on the 10 best business class awards to Europe. I want to experience that and since we live in Houston, that was right up my ally. Although Manchester, GB is not my final destination, I thought to use this opportunity to either train/fly for a brief visit to London, GB. Then fly via British Airways to Paris, FR. Since these cities are more inland from our cruise departure site in Barcelona, we would not have been able to experience otherwise.  Even if for the briefest time, I think it’s well worth it to at least get a glimpse and feel for these places. Then we can see if it’s some place we want to explore further at later time. Finally, we’ll fly in from Paris to our cruise departure in Barcelona, ES via Air France or Vueling. I have British Airways Avios miles to cover for these short hop trips going to our destination.

Even if for the briefest time, I think it’s well worth it to at least get a glimpse and feel for these places. Then we can see if it’s some place we want to explore further at later time. Finally, we’ll fly in from Paris to our cruise departure in Barcelona, ES via Air France or Vueling. I have British Airways Avios miles to cover for these short hop trips going to our destination.

Positioning Points

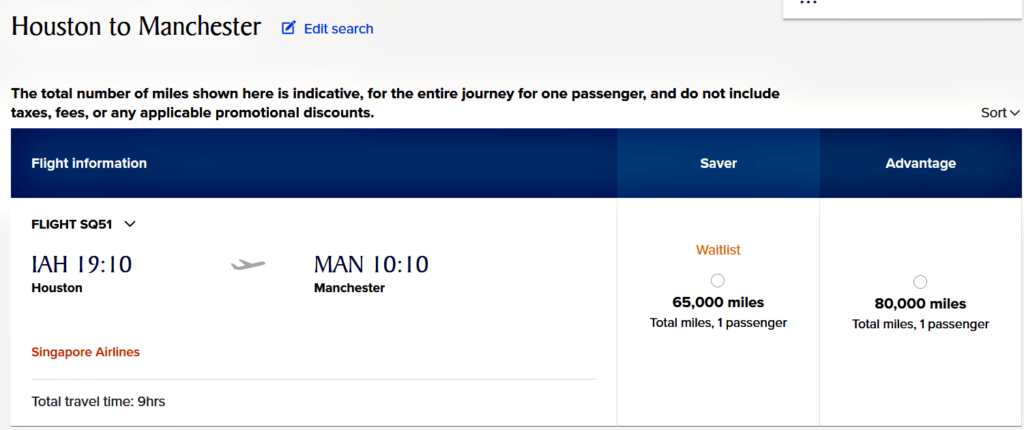

I didn’t have all the points needed to book the one-way from Houston to Manchester in my Krisflyer account. At the time, I only had 56,000 Krisflyer miles. When I cancelled the Citi Prestige Thank You Rewards (TY) credit card, I transferred TY points bonus (50,000 TY points for $3,000 spend in 3 months) I received to Singapore Krisflyer miles. These points are approaching expiration, so I not only intend to use, I must use so that I don’t lose out on the opportunity to redeem for travel.

In addition, I needed to make some additional points transfers from Chase Ultimate Rewards (UR) and American Express Membership Rewards (MR). Chase and American Express also have points which are transferable to select loyalty programs. For Chase, Citi, and American Express, Singapore Airlines loyalty program was included. So, I have started to move points into my Singapore Airlines Krisflyer account to book the one way from Houston to Manchester in business class for 2 people. It requires 65,000 points per person for 130,000 Krisflyer miles total.

Using Transferable Points To Get The Job Done

Chase UR benefits are really flexible because they allow you to combine points. So, I combined my wife’s 21,000 UR into my Chase Ultimate Rewards account. I had 42,000 UR points myself. I then transferred these to my Krisflyer account. Since I was still a little short, I had MR which I could also use to get us to 130,000 Krisflyer miles. Therefore, I transferred 11,000 MR to my Krisflyer account.

Current Krisflyer miles balance => 56,000 Krisflyer miles

Transfer from Chase Ultimate Rewards => Singapore Krisflyer 63,000 UR points

Transfer from AMEX Membership Rewards => Singapore Krisflyer 11,000 MR points

This gives me the total I need, but with Singapore Airlines Krisflyer point transfers aren’t reflected immediately. It can take up to 2 business days. Once this is done, I’ll book all the outbound travel legs from Houston => Manchester => London => Paris => Barcelona.

The Retail Cost

Let’s talk the retail cost for this one-way trip on business class. Or you can always consider economy. The point I want to emphasize is if you don’t use or can’t use an award travel strategy, but you will still travel, you lose a tremendous asset which is your cash. Over time, if you continue to give up your assets, you get poorer. On TheWorldOfOs.com, though I hit you with travel and leisure topics, it’s often intertwined with personal finance and investment implications. Two other topics discussed on TheWorldOfOs.com.

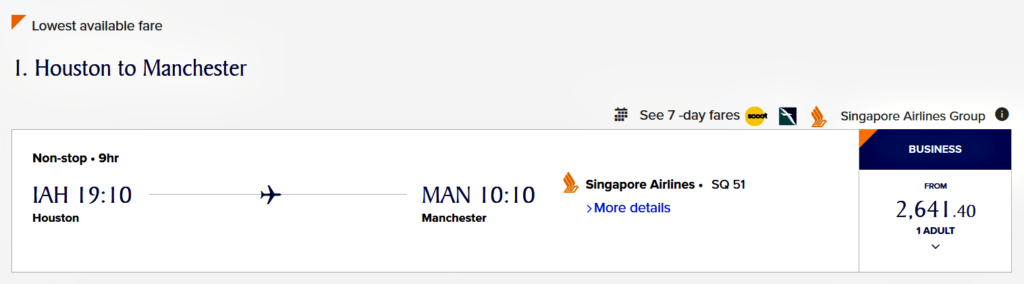

Being able to travel and see the world is fantastic pleasure and experience. However, if you are always doing it at the expense of your savings and investment, you might not be able to do a lot more of it in the future. Take my trip for example, the retail cost for one-way business class is $2,641.40 per person. That’s $5,282.80 for two people. That’s a lot of money.

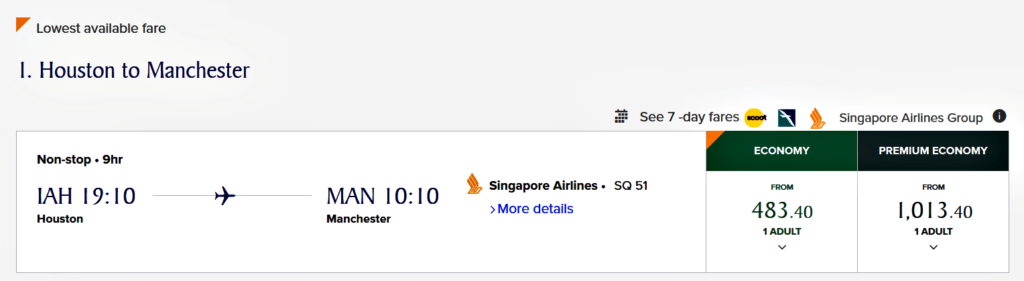

Even if you say, I’ll just go economy, the retail cost for one-way is $483.40 per person and $966.80 for a couple. The retail cost of our cruise was $4,571. Now, couple that with the flight on the low end at $5,537 and on the high end at $9,853.80. No matter how you slice it, that’s real money that whether you use debt to finance or saved cash, it’s money gone. You can never leverage that money again for any other purpose.

The retail cost of our cruise was $4,571. Now, couple that with the flight on the low end at $5,537 and on the high end at $9,853.80. No matter how you slice it, that’s real money that whether you use debt to finance or saved cash, it’s money gone. You can never leverage that money again for any other purpose.

This Gives Reason To…

All the more reason to either fix your credit if it’s messed up or educate yourself on blogs like mine or other travel blogs on how you can take advantage of award travel opportunities. The latter will do 2 things for you:

- allow you to retain your cash for savings and investment

- require you to determine how much points you need and if/where to transfer them for travel

Doesn’t this make sense that you should be aiming and positioning yourself to do this? You do know that maximizing award travel is not a crime, right? So, why shy away!

For my trip, business class required 65,000 Krisflyer miles per person.

For economy, it’s 45,000 Krisflyer miles per person.

Non-Typical Travel Blogger

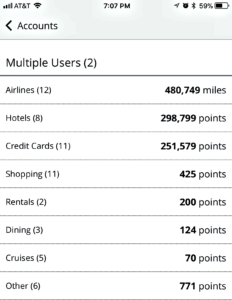

My wife and I probably don’t travel as much as typical travel bloggers because we are employees with full-time J-O-B-S. Thus, we have fixed amount of vacation and holiday each year. Despite that, we usually can take about 2-3 trips per year. For us, that’s pretty good. The 9 night European cruise on Royal Caribbean is a big trip for us. Although it has depleted some of our points/miles, the picture to the right shows we still  have sufficient left over for quick domestic travel or towards future travel. I did not discuss the return flight, but it will be a lot more direct. I assume it will be approximately another 130,000 miles. If we deduct that from the 470,299, it still leaves us with 340,299 miles or 338,059 credit card points that are transferable to airline loyalty programs that we can use to achieve the desired result.

have sufficient left over for quick domestic travel or towards future travel. I did not discuss the return flight, but it will be a lot more direct. I assume it will be approximately another 130,000 miles. If we deduct that from the 470,299, it still leaves us with 340,299 miles or 338,059 credit card points that are transferable to airline loyalty programs that we can use to achieve the desired result.

Replenishing Points/Miles

There is a process that as we are depleting points/miles for travel we are taking, we are also strategically looking for and applying for credit card offers from banks offering huge signup bonuses. Take for example, this year I have signed up for 3 new credit cards. They are as follows:

- American Express Platinum Card for Schwab – 60,000 MR after $5,000 spend in first 3 months. $550 annual fee

- American Express Gold Delta Skymiles Card – 60,000 miles + $50 statement credit after making Delta purchase in first 3 months. $3,000 spend in 3 months. Annual fee waived 1st year, then $95

- Bank of America – 50,000 premium rewards after $3,000 spend in 90 days. $95 annual fee

I intend for my wife to sign up for the following cards:

- American Express Starwood Preferred Guest Business – 35,000 Starpoints after $7,000 spend in first 3 months. Annual fee waived 1st year, then $95

- American Express Starwood Preferred Guest Personal – 25,000 Starpoints after $3,000 spend in first 3 months. Annual fee waived 1st year, then $95

- American Express Hilton Honors Business – 100,000K. 75,000 after $3,000 spend in first 3 months plus 25,000 additional after $1,000 spend in first 6 months. $95 annual fee

Next, we are maximizing the existing reward bonuses on select credit cards through spending each month. For example, the below Chase credit card earns 2X points when used on travel and dining at restaurants.

Another example, the below American Express credit card earns one of the highest reward value per dollar spent at ¢0.024. Typically points and miles are worth about ¢0.01 per dollar spent.

American Express Starwood Preferred Guest Business

I personally use an app called Walla.by which helps me chose the best card I have in my wallet to maximize rewards when I’m planning to make a purchase. In the near future, I will write a post on this service.

Finally, I ask readers of my blog that are spurred to action by the information I am presenting to sign-up using my promotional links. I list them in my post or on my affiliates and referrals page.

In Closing

I am sharing some of the details I’m going through as I plan on flying to Europe with points/miles. It gives me tremendous pride that I’m going to be simply transferring points/miles for this trip instead of my cash. I hope this serves as the motivation you need to spur you to fix your credit and/or educate yourself on this. That way we are both keeping more of our assets and enjoying fantastic trips around the world.

I would appreciate you sign up for credits offers with the links below if you are revving to get started. However, it you are unsure and have questions, leave a comment below and I’ll reach out to try and answer your questions/concerns.

AMEX Starwood Preferred Guest Business

AMEX Business Gold Rewards Card

AMEX Gold Delta Skymiles Business Card

March 7, 2018 @ 8:13 am

Hello ,

I saw your tweets and thought I will check your website. Have to say it looks very good!

I’m also interested in this topic and have recently started my journey as young entrepreneur.

I’m also looking for the ways on how to promote my website. I have tried AdSense and Facebok Ads, however it is getting very expensive. Was thinking about starting using analytics. Do you recommend it?

Can you recommend something what works best for you?

I also want to improve SEO of my website. Would appreciate, if you can have a quick look at my website and give me an advice what I should improve: http://janzac.com/

(Recently I have added a new page about FutureNet and the way how users can make money on this social networking portal.)

I have subscribed to your newsletter. 🙂

Hope to hear from you soon.

P.S.

Maybe I will add link to your website on my website and you will add link to my website on your website? It will improve SEO of our websites, right? What do you think?

Regards

Jan Zac

March 10, 2018 @ 9:24 pm

Hi Jan, I checked out your website and truthfully, I should be asking you for a few pointers. I see you at least have reader feedback through comments. However, you sound new to this much like myself. I like a lot of your video content. I plan to start moving in that direction myself. I still have a full-time job, so this is more a piece at a time thing. I think your website has a good feel and flow.

I did setup Google Analytics to monitor web traffic to my site https://www.google.com/analytics/analytics/#?modal_active=none.

I use https://dlvrit.com/ to push my content to social media sites.

I use the tool Yoast SEO on WordPress and following the guidance it provides for ensure I have good SEO

Yes, perhaps we can add some backlinks